ModE98

Administrator

Start Investing admin

Joined: Dec 20, 2010 16:11:39 GMT -5

Posts: 4,441

|

Post by ModE98 on May 13, 2017 13:24:34 GMT -5

Added some shares of PSEC and WSR to my holdings of high dividend payers the other day as price looked right after coming down in the last few weeks. Believe they should be reasonably safe for now from further price decline.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 14, 2017 10:28:23 GMT -5

I have both Mod - PSEC & WSR., but sold half my PSEC at 9.19 per share. I really like WSR and I believe PSEC is still a safe bet, certainly like the dividend.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 14, 2017 10:32:55 GMT -5

I have an update on SBSI (Southside Bancshares. ) It seems they stuck one in on everyone. They raised their regular dividend then slipped in a DIVIDEND CUT for their Stock Dividend. It was cut from 5% to 2% - A 3% reduction - I don't think many people caught it. This was the first reduction since 1997 - They also state they are raising customer fees. I am selling after I qualify for the dividends - I cannot tolerate a company that is "Sneaky"  |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 17, 2017 9:34:35 GMT -5

I bought 300 more shares of Whitestone REIT today bringing my total share count to over 2000 shares. It was downgraded today with a price target of $10 per share. I do not agree with the downgrade and think it is a great income opportunity. I am taking a chance I know, but I actually believe that is a quality stock with a Dividend now at about 10.5% is a long term winner. Time will tell ..........................  |

|

ModE98

Administrator

Start Investing admin

Joined: Dec 20, 2010 16:11:39 GMT -5

Posts: 4,441

|

Post by ModE98 on May 17, 2017 10:48:23 GMT -5

Today's price seems attractive for WSR around the 10.80 to 10.90 range. Think you made a good choice. I hold 1K, not worried in the long run view. Things seem to run in cycles (up-down) over the years. As long as the dividend stays reasonably steady.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 17, 2017 13:40:28 GMT -5

Today's price seems attractive for WSR around the 10.80 to 10.90 range. Think you made a good choice. I hold 1K, not worried in the long run view. Things seem to run in cycles (up-down) over the years. As long as the dividend stays reasonably steady. This whole idea of declaring Retail and the shopping center owners dead is really mind boggling , people (investors) tend to overreact to things. But if they didn't overreact there would be great opportunities like this coming along. All one has to do is drive to the local shopping centers to experience the herds of people in them.  |

|

ModE98

Administrator

Start Investing admin

Joined: Dec 20, 2010 16:11:39 GMT -5

Posts: 4,441

|

Post by ModE98 on May 17, 2017 14:36:12 GMT -5

VA, There is only so much one would want to order on line. You cannot touch, feel, try out, unless one "shops". And it is good to get out of the house and visit a store every so often. I cannot see people just sitting at home for a lifetime glued to the chair in front of a computer. Perhaps some "downsizing" may be necessary for the BIG chains, but hey, they are not "dead" if they do things correctly. The active consumer will always be around. This may be only an adjustment phase as things are always changing over time. I think it is. So not to worry.

|

|

nlt

New Member

Joined: Mar 12, 2016 11:44:39 GMT -5

Posts: 28

|

Post by nlt on May 17, 2017 20:18:27 GMT -5

I was able to buy Realty Income today at a price I was comfortable with, will add more if it drops further. I sold all of my PSEC last week after earnings, but will definitely miss the dividend. I just didn't feel comfortable with it always having to be "watched". I want more SWAN's in my portfolio 😀

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 18, 2017 8:06:38 GMT -5

I was able to buy Realty Income today at a price I was comfortable with, will add more if it drops further. I sold all of my PSEC last week after earnings, but will definitely miss the dividend. I just didn't feel comfortable with it always having to be "watched". I want more SWAN's in my portfolio 😀 Yes, I bought some Realty Income the other day also. I have wanted it for some time but always felt it was too expensive. I still bought it a little earlier than I should have but what the heck, it should be a stock like you said that is a SWAN ( Sleep Well At Night) (For those readers that are not familiar with the term ! I also sold PSEC at $9.19 a share s few weeks ago (lucky timing) but I still own a small position in another portfolio. Lots of good deals on REITS right now for those that are brave enough - My suggestions: Apts, O, VTR, NNN, CCP, SPG, STOR, WSR. Stay away from : WPG; SRC |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 22, 2017 6:36:51 GMT -5

Mod - Looks like others are realizing the value of WSR !

|

|

ModE98

Administrator

Start Investing admin

Joined: Dec 20, 2010 16:11:39 GMT -5

Posts: 4,441

|

Post by ModE98 on May 22, 2017 10:12:20 GMT -5

VA...Yes, and I believe they will be amply rewarded in the next 1 to 3 years. Dividends and several points of growth. Nice return.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 31, 2017 9:45:59 GMT -5

As promised I am updating my trade on Bob Evans for the $7.50 per share special dividend.

I originally purchased the stock @ $10,138.71 for 150 shares. My goal was to hold it to qualify for the special dividend - I had to hold it through close of business on 30 May to qualify. So this morning I sold it. My sale price was : $10,401.00. So I received a net gain of $262.29. Not bad for a month. But... I also qualified for the "Special Dividend" of $7.50 a share which will be paid on 16 June. I will receive $1,125. Added to today's gain = ($1,387.29  ) Not bad for clicking a button a few times. |

|

ModE98

Administrator

Start Investing admin

Joined: Dec 20, 2010 16:11:39 GMT -5

Posts: 4,441

|

Post by ModE98 on May 31, 2017 13:29:35 GMT -5

Nice catch, VA.!

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on May 31, 2017 16:52:15 GMT -5

Thanks Mod, I wish I had doubled the investment. It's not often a company declares a $7.50 per share special dividend. I will certainly be on the look out for other opportunities. I know a lot of people buy into stocks just to qualify for a regular dividend and then they sell it after they qualify for it. I think I will try it more often but you certainly have to keep a close eye on things. |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 2, 2017 17:50:33 GMT -5

I like to keep 100% of my money invested in the stock market. I know some of you like to keep cash set aside for market drops. The only cash I have is when I sell out of a position or from the dividends I collect that are not on the DRIP program. ( I usually have most on drip, but some of the riskier stocks I like to collect the cash but I never let it sit around for very long because if its not invested it is not producing money.) Anyway I just read an article where it shows staying 100% in the market is the most productive way to invest. Here's a link if you care to read it for yourself: seekingalpha.com/article/4078363-keeping-cash-hand-staying-fully-invested-basic-math-help-decision |

|

Value Buy

Senior Associate

Joined: Dec 20, 2010 17:57:07 GMT -5

Posts: 18,680  Today's Mood: Getting better by the day!

Location: In the middle of enjoying retirement!

Favorite Drink: Zombie Dust from Three Floyd's brewery

Mini-Profile Name Color: e61975

Mini-Profile Text Color: 196ce6

Today's Mood: Getting better by the day!

Location: In the middle of enjoying retirement!

Favorite Drink: Zombie Dust from Three Floyd's brewery

Mini-Profile Name Color: e61975

Mini-Profile Text Color: 196ce6

|

Post by Value Buy on Jun 4, 2017 22:01:22 GMT -5

Today's price seems attractive for WSR around the 10.80 to 10.90 range. Think you made a good choice. I hold 1K, not worried in the long run view. Things seem to run in cycles (up-down) over the years. As long as the dividend stays reasonably steady. This whole idea of declaring Retail and the shopping center owners dead is really mind boggling , people (investors) tend to overreact to things. But if they didn't overreact there would be great opportunities like this coming along. All one has to do is drive to the local shopping centers to experience the herds of people in them.  I am beginning to think these real estate mall reits might be the next big implosion. There are just too many chain stores closing hundreds of locations at a time. The giant regional malls might be okay, but there will be hundreds of others that close up in the next decade. As Sears or Penney's close more anchor stores, it will lead to some mall fallout where they die the slow drip drip drip of fewer occupants, with fewer yearly sales in the units due to traffic drop off. |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 5, 2017 8:55:01 GMT -5

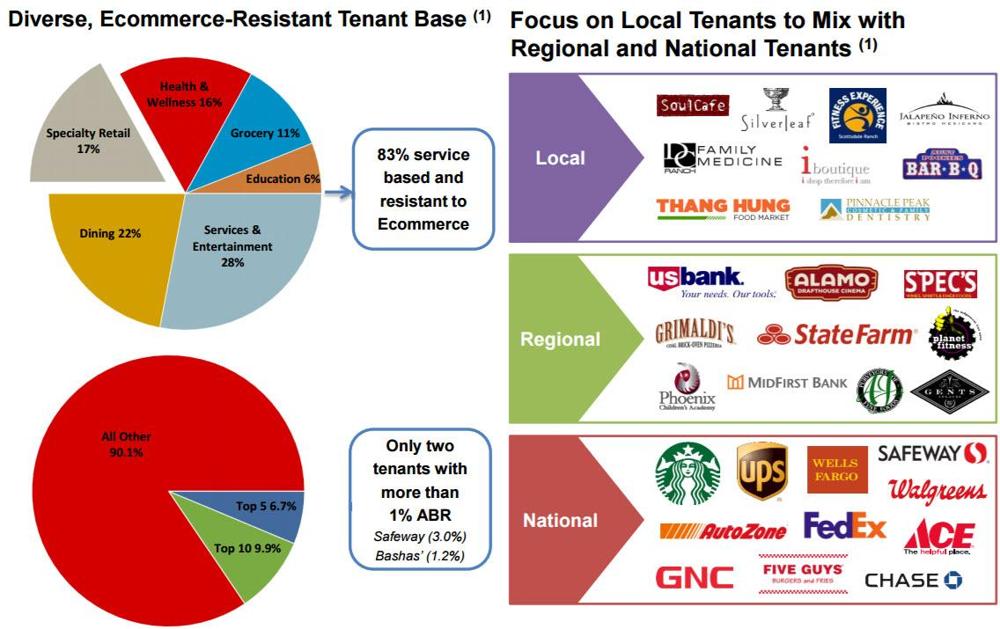

As a broad picture I believe you are absolutely correct Value Buy. You have to look at the Mall & Shopping Center owners individually. Tanger Outlet Malls for instance are booming with business. Next time you pass by one try and stop by and observe for yourself. Whitestone REIT (WSR) is very strategic also. It only acquires and develops upscale shopping centers in very affluent neighborhoods so in my opinion they will be doing very well in moving forward. The general gloomy outlook for retail right now is exactly what makes stocks like WSR a bargain. Am I taking a risk by bucking the trend ? Yes, but I believe it is a well calculated risk. I guess only time will tell. They have a great mix of tenants that are Local, Regional and National:  |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 12, 2017 9:14:20 GMT -5

The General Electric (GE) board of Directors has replaced Jeff Immelt with John Flannery as its new CEO !

Expect a Pop in the Stock Price !

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 13, 2017 14:53:37 GMT -5

I own GE but, I bought it in 2011 - @ a little over $17 a share. It has been okay but far from a great investment. I am hoping that it turns around and become the player it should be. I was unhappy because of Immelt's decision to sell off so many divisions and the investors got diddly squat out of it ! We owned those companies and got nothing for it. Even the Spin off - we would have to give up GE stock for it - Immelt was a crook like no other. The whole board of directors needs to be fired and start fresh.

I also think GE should be broken up into at least four companies : Aviation, Health, Industrial and Energy. Then the shareholders could see some value.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 13, 2017 17:17:01 GMT -5

John Flannery was the head of General Electrics Health Division so I am going to watch nervously as he attempts to bring GE back to glory again. Like I said above I would like to see them break up GE into four parts.

In the meantime - I will continue dripping shares as usual

|

|

Value Buy

Senior Associate

Joined: Dec 20, 2010 17:57:07 GMT -5

Posts: 18,680  Today's Mood: Getting better by the day!

Location: In the middle of enjoying retirement!

Favorite Drink: Zombie Dust from Three Floyd's brewery

Mini-Profile Name Color: e61975

Mini-Profile Text Color: 196ce6

Today's Mood: Getting better by the day!

Location: In the middle of enjoying retirement!

Favorite Drink: Zombie Dust from Three Floyd's brewery

Mini-Profile Name Color: e61975

Mini-Profile Text Color: 196ce6

|

Post by Value Buy on Jun 14, 2017 7:03:56 GMT -5

Just like wxyz dislikes Immelt I disliked Immelt almost from the beginning. I do not know whether Welch cooked the books or not before him, but performance under Immelt was horrible.

I too got out of the stock years ago and promised myself I would never look at GE until he was out. He still is not out! We have another six months for the stock to rise so he can cash out, what probably 100 million dollars worth of stock benefits? I am guessing, but we all know the drill.

Now we have a leader who ran an underperforming section of the company taking over. Not sure if it was his fault or not, but, I am not totally sure he is the guy who should have taken over........

I look for the stock to go up now so Immelt gets that golden parachute, but I will not buy any this year.

He sold NBC Universal for a song to Comcast. He got GE out of the financial sector at the bottom of that market for pennies on the dollar.

He cost shareholders tens of billions of dollars in value.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 14, 2017 7:31:02 GMT -5

I agree VB, Immelt offloaded tons of Divisions at below market value and had no consideration for shareholders. I personally believe it was a mistake to sell off all the financial segments at below market value and I believe GE would have bee much better off holding on to most of them. They were money makers and GE gave up a lot of revenue by dumping them. I would love to here what Jack Welch would have to say about how they gutted it.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 16, 2017 8:04:56 GMT -5

Three Dividend Increases:

Two Harbors - 4% (.25 - .26) Realty Income - .2% (.211 - .2115) W.P. Carey - .5% (.995 - 1.00)  |

|

Deleted

Joined: Nov 22, 2024 14:15:17 GMT -5

Posts: 0

|

Post by Deleted on Jun 30, 2017 11:24:19 GMT -5

Well it seems no one caught this:

June 28th, 2017 BAC announced a Quarterly Dividend of $0.12 Per Share; starting with the 3rd Quarter 2017 Dividend. According to the info on Bank Of America's Investor Website this represents a 60% increase to the Quarterly Dividend.

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jun 30, 2017 15:48:55 GMT -5

Well it seems no one caught this:

June 28th, 2017 BAC announced a Quarterly Dividend of $0.12 Per Share; starting with the 3rd Quarter 2017 Dividend. According to the info on Bank Of America's Investor Website this represents a 60% increase to the Quarterly Dividend.

Thanks, I missed that one ! |

|

Deleted

Joined: Nov 22, 2024 14:15:17 GMT -5

Posts: 0

|

Post by Deleted on Jul 3, 2017 21:39:43 GMT -5

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jul 15, 2017 7:16:25 GMT -5

Two recent dividend Increases:

Omega Healthcare Investors (OHI) - from .63 to .64 per quarter - Annually $ 2.56 per share National Retail Properties (NNN) - from .455 to .475 per quarter - Annually $1.90 per share. |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jul 15, 2017 7:25:28 GMT -5

I bought 300 more shares of Whitestone REIT today bringing my total share count to over 2000 shares. It was downgraded today with a price target of $10 per share. I do not agree with the downgrade and think it is a great income opportunity. I am taking a chance I know, but I actually believe that is a quality stock with a Dividend now at about 10.5% is a long term winner. Time will tell ..........................  Whitestone REIT is at $12.57 per share. Bought those 300 shares @ about 10.90 - = $500 profit but I am long term on this stock so will continue to hold. This is an example of how the market tends to over react and how you can pick up bargains on stocks if you watch them closely. It's the difference in collecting a 10.5% yield vs current yield of 9% on an investment. |

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jul 15, 2017 13:54:28 GMT -5

|

|

The Virginian

Senior Member

"Formal education makes you a living, self education makes you a fortune."

Joined: Dec 20, 2010 18:05:58 GMT -5

Posts: 3,629

Today's Mood: Cautiously Optimistic

Location: Somewhere between Virginia & Florida !

Favorite Drink: Something Wet & Cold

|

Post by The Virginian on Jul 17, 2017 6:14:07 GMT -5

Duke Energy Raises its Dividend 4.1 % !Duke Energy (DUK) has increased its Quarterly Dividend from .855 to .89 per share. It's annual dividend is now $3.56 per share.  |

|