|

|

Post by vl on Mar 17, 2011 6:04:44 GMT -5

So what did Bernanke's market pump cost all of us on Tuesday? We were just south of 300 points off on the Dow when the Fed starting printing up more fake dollars to drive the final down to 139 by the closing bell. ALL of that evaporated yesterday and you can rest assured more is on the way as hoarders of our currency continue to decay.

It's ONLY been about oil and remarkably, two unrelated events are killing that greed off at the root. The continuing Japanese disaster will sap cash from long term gambles like bonds. So if your broker says "buy" punch him in the eye for the lie because you would be buying HIS way out! Count on all foreigners to be liquidating interests to amass cash. Way until they're done and the damage has gone its course to know the bottom.

The Middle East has hoarded our dollar so mightily that it has curtailed- flow. Do you know what currency is without flow? Sense-less paper. Likely, the influx of old currency in a fiat and manipulated economy that isn't really global, will do the same thing that Tsunami did... wash over pre-occurring carnage and leave nothing much to recover.

UNCLE SAM WANTS YOU... now, not later, alligator. Redirect to your own backyard and get those unemployed back working so tax revenues recover ahead of economics. YOU lose if we can't. The rest of us just start up a new currency unit.

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Mar 17, 2011 6:26:57 GMT -5

V.L., How about risk!!!! Lighten bonds and buy small caps.. Greatest bang for the USD..        You heard me say this before..Like Aug 2010.. Open buy at tye time on the Russell 2000...It is all about M2!!! I may be ahead on the russell but QQQQ look interesting. Just a thought, Bruce Attachments:GDP vs M2.gif.jpg (11.28 KB)

|

|

|

|

Post by frankq on Mar 17, 2011 6:50:59 GMT -5

bimetal,

I agree. Small to mid caps are looking good.

|

|

Deleted

Joined: Nov 26, 2024 3:06:30 GMT -5

Posts: 0

|

Post by Deleted on Mar 17, 2011 7:11:55 GMT -5

I had opened a short-term bond fund late last year for rebalancing in my retirement portfolio. Selling a little equity here/there on the rise.

There was also a bump in bonds with recent stock drop. It looks like some rebalancing is in order from bonds to equity. I'm still going w/equity income over small/mid.

|

|

Deleted

Joined: Nov 26, 2024 3:06:30 GMT -5

Posts: 0

|

Post by Deleted on Mar 17, 2011 7:17:55 GMT -5

My primary commercial RE client, like many other public companies, has a large cash holding. A list of potential property buys is very exiting to see - we are predicting the hoarders will be spending their cash soon to lock in bargains.

I would think other industries are similar.

|

|

Deleted

Joined: Nov 26, 2024 3:06:30 GMT -5

Posts: 0

|

Post by Deleted on Mar 17, 2011 7:28:04 GMT -5

My company is global - and we have large corporate calls to hear what goes on in our other business units. I am completely US domestic - so it is interesting to hear from colleagues in SA, EU, and Asia-Pac.

Development is very strong in - India & China. Those areas are the source of current & projected growth.

I have heard nothing about "masses" liquidating assets from the folks dialing-in from outside the US.

|

|

blackliver

Junior Member

Joined: Jan 1, 2011 10:42:20 GMT -5

Posts: 191

|

Post by blackliver on Mar 17, 2011 7:52:37 GMT -5

have some K Frank, should see 300 by cocktail hour.

|

|

|

|

Post by frankq on Mar 17, 2011 14:03:15 GMT -5

Back in after a little rebalancing. Lets move it up!

|

|

|

|

Post by vl on Mar 17, 2011 14:11:37 GMT -5

How about risk!!!! Lighten bonds and buy small caps.. Greatest bang for the USD.. Read more: notmsnmoney.proboards.com/index.cgi?board=moneytalk&action=display&thread=4892#ixzz1GsuzqatQI'm not opposed there at all... depending on WHAT your Small Cap actually does. I'm sure TM was making that point too. Frank... well... okay. The point is that a natural disaster calls for cash and the current over-blown market has it overly occupied in businesses that cannot afford to liquidate to give it up. There will absolutely be a backlash from Japan and it will spread into Chinese commercial business. That said, certain Small Caps are capable of a fall back to non-import reliance. The majority haven't got a clue how to do it without collapsing mid-transition. Today's "up" is a complete and utter farce. It would be nice if the felonious financiers hit the road and cleaned the markets up for usefulness but don't hold your breath waiting for it. I have always squinted when you spew those acronyms, BiMetal... I look at real things like- the hundreds of thousands of abandoned homes in Nevada and how an exhausted Lake Mead impacts what remains. I look at an ignorant claim that Jobless Claims are down while actual jobs and job creation with family sustaining incomes is stagnant to non-existent. I measure how many court cases there are and how much lawyers take out a system that has emergency financial managers armed with axes hacking away at the wrong pariah sapping all those taxes. As I said before... you have no clue whether your bonds CAN actually pay out. You have less of a clue whether ANY funds can pay you your profits in legitimate CASH. The game has Quadrillions in play but only $60-70 Trillion in actual tangible currency. That's a mighty big round of Musical Chairs and LOTS of people not only won't get seated, they won't be in the room when the music stops. |

|

|

|

Post by mikec on Mar 17, 2011 16:14:37 GMT -5

Down is always real..... Up is always a farce..... Never changes.....  |

|

|

|

Post by frankq on Mar 17, 2011 17:08:15 GMT -5

Down is always real..... Up is always a farce..... Never changes.....  Yeah, I'm still waiting for Dow 2000 ...... |

|

|

|

Post by itstippy on Mar 17, 2011 18:14:42 GMT -5

You "realists" had better turn on the evening news:

* Obama reassures the Nation that we are not in danger of nuclear fallout from Japan, and that our domestic reactors are safe.

* Geithner uses his credibility with Congress to urge raising the debt limit.

* Congress pledges to do "what's right for America".

* That Yum guy from National Association of Realtors says housing is about to turn the corner.

We are so doomed. Whatever those guys say is the kiss of death. A giant radioactive cloud will likely float over from Japan and engulf our own reactors, causing them to explode. Congress will lower the debt limit in an attempt to "do what's right for America". What few remaining active housing construction sites exist in America will be engulfed by a giant radioactive cloud from both Japan and the US.

Ya gotta watch the news, guys, and act accordingly.

|

|

|

|

Post by vl on Mar 17, 2011 19:54:05 GMT -5

The fact that we have these issues and leaders need to reassure the public but haven't generated tangible results is the REAL issue. How ironic that a clique terminated who they determined to be-- incompetent, yet have failed to pull the economy out of the muck but have managed to rack up the single largest waste of money- making it debt we can't repay-- in history.

|

|

kman

Initiate Member

Joined: Oct 8, 2011 20:43:42 GMT -5

Posts: 83

|

Post by kman on Mar 17, 2011 20:41:38 GMT -5

We can't repay ...what? ....more government fake numbers?...V_L, you worry too much.

|

|

|

|

Post by mikec on Mar 18, 2011 10:19:07 GMT -5

|

|

Deleted

Joined: Nov 26, 2024 3:06:30 GMT -5

Posts: 0

|

Post by Deleted on Mar 18, 2011 11:10:46 GMT -5

V_L lets suppose the China doesn't want to get repaid in dollars...lets suppose that with rice, cotton, wheat and grain shortages due to floods that wiped out their crops and farmland they want to be paid in soft commodities. Lets suppose that with farmers planting an additional 12 million acres this year(which is the reason why you can't find fertilizer, tractors are through the roof and irrigation infrastructure is in short supply) lets say we do that. Now its not about the dollar or debt..... its about needs and who has abundance...we own the furture...with an unlimited, renewable supply of food  This countries assets aren't just the dollars that it sells. Excellent post Frank. |

|

|

|

Post by sangria on Mar 18, 2011 13:26:09 GMT -5

"The game has Quadrillions in play but only $60-70 Trillion in actual tangible currency. That's a mighty big round of Musical Chairs and LOTS of people not only won't get seated, they won't be in the room when the music stops."

Good point.

|

|

|

|

Post by sangria on Mar 18, 2011 14:13:02 GMT -5

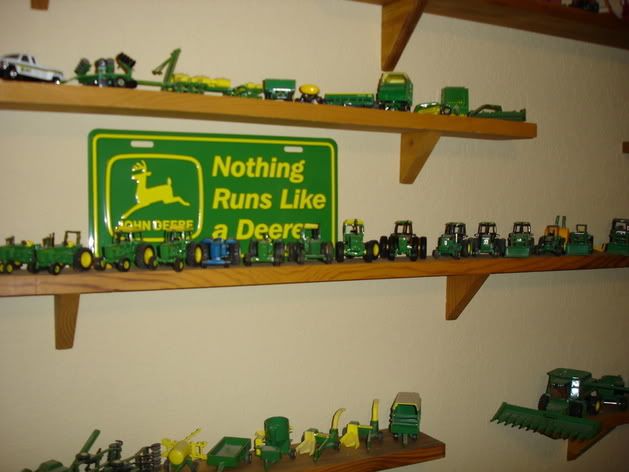

I found some more tractors!  |

|

|

|

Post by Steady As She Goes on Mar 18, 2011 14:14:55 GMT -5

"A giant radioactive cloud will likely float over from Japan and engulf our own reactors, causing them to explode" You can beam me up now Scotty. I have found very little intellegent life here.... Is there room for 2 more on the transporter pad? I think the wife and I will join you and Scotty. |

|

|

|

Post by Steady As She Goes on Mar 18, 2011 14:17:33 GMT -5

sangria ... that looks like my nephews room a couple of years ago. He also had a John Deere ceiling fan and his carpet looked like a freshly plowed field. (I was surprised he never planted it.)

|

|

|

|

Post by frankq on Mar 18, 2011 15:11:59 GMT -5

Now FTI. That's just not fair! You just can't whip out a rational response like that!

|

|

|

|

Post by frankq on Mar 18, 2011 15:36:22 GMT -5

We can't repay ...what? ....more government fake numbers?...V_L, you worry too much. Now..now...kman. Everyone knows that THEIR government number aren't fake, just ours..... |

|

|

|

Post by sangria on Mar 18, 2011 15:57:38 GMT -5

Steady As She Goes: Couple of years back, I was in Branson, Missouri. They have a John Deere toy store there that could bankrupt a person. My wife took my credit card. I bought one toy tractor, that was all the cash I had.

|

|

|

|

Post by Steady As She Goes on Mar 18, 2011 16:36:33 GMT -5

Steady As She Goes: Couple of years back, I was in Branson, Missouri. They have a John Deere toy store there that could bankrupt a person. My wife took my credit card. I bought one toy tractor, that was all the cash I had. Smart wife !!!!!!!! ;D |

|

|

|

Post by itstippy on Mar 20, 2011 15:50:46 GMT -5

Some thoughts on "Market Gamblers". Most of us gamble in the market with our trading accounts. We study trends and balance sheets, try to pick likely winners, and place our bets. We're not much different from folks who place bets on sports or horse racing (the ones that are serious about it). Most of us are responsible, and we don't gamble with our eatin' money. Our trading accounts are a small percentage of our total net worth: if we "make a killing" our net worth goes up a bit; if we "lose our shirts" our net worth goes down a bit. The balance of our wealth is in less volatile vehicles (our homes, pensions, savings, bond funds, future earning power, etc.). We are the small, individual investors you hear about. We DO NOT drive the market's direction. The market's direction is driven by the Big Boys - huge funds - sovereign wealth funds, mutual funds, hedge funds, Central banks, etc. They trade giant blocks of stocks, baskets of mixed stocks, currencies, derivatives, debt obligations... They pay enormous salaries to people to manage these transactions. They invest wads of money in technical hardware and software. They are emotionless, basing their market-moving trades on data and skill (and perhaps just a tad of manipulation?). Which brings me to my point. I hate "analysis" like this drivel: "NEW YORK (Reuters) — Watch out for intraday swings because it's going to be wild. Cataclysmic events, including a nuclear disaster in Japan, uprisings in the Middle East and North Africa and the possibility of more currency market intervention will keep investors reacting to headlines. "This is an extremely news-driven market. Investors are on the edge, and they are reacting to every headline they see," said Randy Frederick, director of trading and derivatives at the Schwab Center for Financial Research in Austin, Texas. Many investors said the sudden increase in uncertainty had caused a corresponding rise in trading based on emotion rather than facts or fundamentals." www.msnbc.msn.com/id/42180200/ns/business-eye_on_the_economy/What a load of crap. As if the market-moving big guys are frantically buying and selling based on emotion, with no eye toward fundamentals. Whoever wrote this piece for Reuters has no idea how market direction is determined. They should remember the immortal words of CGT1: "News doesn't move markets - people do". |

|

|

|

Post by vl on Mar 21, 2011 13:36:39 GMT -5

"What a load of crap. As if the market-moving big guys are frantically buying and selling based on emotion, with no eye toward fundamentals. Whoever wrote this piece for Reuters has no idea how market direction is determined."

We can capture that same sentiment just falling Frank's comments. He continually acts like what he does is akin to rocket science as he posts the day on these boards! Basically, it's a button-pushing profession automated to a can't-lose situation until we become entirely insolvent. Wall Street and the whole Financial Sector is In It To Win It (for themselves) no matter who or what it destroys. We're so far away from being able to actually recover that we now make-up false targets just so there is SOME up and down movement. As far as "media"... somebody has to pay for it and we're all paying for it because they paid for it and took control. So much for freedom, freedom of speech, free enterprise... etc.

Do you know what we get when AT&T buys T-Mobile? Permanent layoffs, a larger oligarchy and one less variable keeping fees down.

|

|

usaone

Senior Member

Joined: Dec 21, 2010 9:10:23 GMT -5

Posts: 3,429

|

Post by usaone on Mar 21, 2011 13:47:49 GMT -5

V_L you always look for the positives, a ray of sunshine through the clouds.

|

|

decoy409

Junior Associate

Joined: Dec 27, 2010 11:17:19 GMT -5

Posts: 7,582

|

Post by decoy409 on Mar 21, 2011 13:51:21 GMT -5

V_L, nothing changes and the course remains the same. I could blurt and make calls and smell like a rose (that's dead but the perfume poured on it gives it smell) if I choose to support INSIDERS and corrupt actions by them. But as we all know by now DECOY409 does not support SHAM WoW. And that so called profit,I get a kick out of the Puppet News Crew exclaiming it. I find it most funny! And I laugh harder and harder as the few short weeks that have passed and the debt note index drops lower and lower. Unchartered water we are in and there is no better way to hold investor confidence as that CBO report stated than at 'ALL COSTS'  |

|

|

|

Post by sangria on Mar 21, 2011 14:08:07 GMT -5

Approval of the T-Mobile acquistion would be kind of a contradiction to the deregulation of Ma Bell.  Oh well, nobody called me for my opinion. I'm inclined to agree that Wall Street and the whole financial sector are in it to win, but still . . . . if they put out an offer to sell a security at an inflated price that is profitable for them . . . . some bonehead still has to come along and buy it. |

|

Driftr

Senior Member

Joined: Mar 10, 2011 13:08:15 GMT -5

Posts: 3,478

|

Post by Driftr on Mar 21, 2011 14:12:51 GMT -5

As an owner of VZ stock with a wife who loves her TMobile 3G phone, this acquisition is all kinds of bad for me. Actually, the VZ owner part might not end up being bad. Time'll tell on that one. Just hope they don't feel a need to go buy Sprint...

|

|