Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 22, 2015 12:40:53 GMT -5

I think this is filed under the, "no shit Sherlock" category?  I seem to remember someone around here talking about fantasy Island a lot at one time. Well there you have it, China is on a collision course to learning how reality works.  |

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Apr 22, 2015 17:25:52 GMT -5

Yep, it looks like China has lost their Balancing pole on that tight-rope. I wonder how the US Company's that do Business with them will come out, let alone the Countries that do?

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 23, 2015 19:52:39 GMT -5

It will be interesting to watch it all unfold, that is for sure - talk about a banking panic starting in the east.... What makes me laugh right now is reading these stories about how these defaults are a good thing.. Yes, China opening the short selling market while simultaneously letting state owned firms and massive real estate companies default is a good thing alright..  |

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Apr 24, 2015 15:50:46 GMT -5

It's easier for them to write off their debt on company's than for them to do it for themselves.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 27, 2015 12:06:26 GMT -5

I hear ya. That's what they think anyway. The idea that there is an easy way out of this is the funny part to watch.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 28, 2015 11:56:21 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 1, 2015 18:58:41 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 10, 2015 11:36:50 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 13, 2015 21:23:08 GMT -5

Keep spending those reserves! Keep cutting those rates!  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 18, 2015 10:06:22 GMT -5

It's safe to say that western banks know just how bad the situation in China is. The western media publications are trying to spin that the real estate market has bottomed in China, not unlike they did in 2008. The reality of the situation... As we know from the data in the last post, housing inventory actually GREW by 24% over the last year. If fact, we know from the data that the only way for the backlog to clear up is if all construction stops. We know from common sense that if all construction stops, the economy falls off a cliff. So in the classic, "catch 22" situation - to keep their property market growing they are forced to make riskier loans, with less down, and start relying on complex financial tools to try and mask the seriousness of the debt levels that is already choking off growth. In other words, the story is the same as on the "Meltdown" documentary that I watched last night about the first half of the global housing bust. Funny thing is, I don't think the film makers knew they were making the first of a two part doc.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 28, 2015 8:47:33 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 1, 2015 23:54:55 GMT -5

Gee, I wonder why the sovereign fund has pulled money from the banks in China?  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 5, 2015 0:17:09 GMT -5

China is literally just one giant leveraged mess..  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 15, 2015 9:26:27 GMT -5

Forget the escalation in the Ukraine over the last 48 hours. Forget that the I.S. is about to open a new front in central asia. Forget Greece. This is - by far - the biggest news that has emerged over the last couple of days...  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 29, 2015 10:19:02 GMT -5

Greece? How about the "housing market is stabilizing". If fact, it's getting so strong we have to lower interest rates because our stock market is popping.  So in other words, the CPC is a dog chasing its own tail trying to spin their way out of a debt and liquidity trap..  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 1, 2015 2:11:13 GMT -5

So in other words, the CPC is a dog chasing its own tail trying to spin their way out of a debt and liquidity trap..  Better question, what is in their control??.. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 3, 2015 11:44:25 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 4, 2015 15:41:36 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 5, 2015 17:21:08 GMT -5

I'm pretty sure something very disruptive was going on in Europe's banking system at this time as well...

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 6, 2015 14:02:13 GMT -5

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 6, 2015 16:08:17 GMT -5

, ,

WHAT MORE CAN YOU SAY: THEIR MARKETS HAVE LOST 30% THIS YEARS. NATION AL TRADERS TRADE ON THE LAST WORK OF THE NATIONAL CHINESE PRESS NOT PE OR PEG!!!!

FLOW5 AND I Talked about how under capitalized the Banks were. Again it is a house of cards and un-used homes.

Thank-you for par exultant thinking and data: God Bless you and yours, Bruce aka BiMetalAuPt  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 7, 2015 2:13:45 GMT -5

Déjà vu, eh  ? Maybe it's because I'm young, but I just can't believe how the mistakes of the past... ah well, opportunity for the contrarian and all that.. Thank you for the kind words. Ditto. Talk about trading? Or the end of the slow motion plane crash... Over 20% of listed China stocks now in trading halt. It's truly amazing to watch these commies try to stop the inevitable.. Next thing they will be arresting stock traders and individual investors as a "matter of national security".. The special unit in charge of arrests - the Plunge Protection Team.   |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 8, 2015 0:09:13 GMT -5

We have now broken a record for China.. The next step, the entire market will be halted?? China companies rush to suspend their shares; 40% of all stocks now in haltOh and I wonder what people that wanted to sell their homes when the market "was" in trouble will be thinking now that the market has "stabilized"? Oh ya, sell!! Further proof that systemic issues are too big for ANY TYPE of intervention, even when the whole thing unfolds in slow motion.  |

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Jul 9, 2015 0:57:21 GMT -5

The people of China want to be capitalist but the Ruling Party are What? That's the Reason why they are in the mess they are in now. It just can't work.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 10, 2015 0:12:37 GMT -5

That's exactly it. The fact is that communism has never worked - anywhere. China is the next on that list and it's fitting because even MAO knew Communism was never a long term plan, lol... I do love how in a nation of 290 million traders - most of which are small retail clients - they think having companies billions in the market to create a 10% jump in 2 days is not going to do anything but create a larger exodus when 30 or 40 million traders recover some of their losses.  I mean, the money people have lost on margin in the last three weeks must just be staggering!  |

|

resolution

Junior Associate

Joined: Dec 20, 2010 13:09:56 GMT -5

Posts: 7,273  Mini-Profile Name Color: 305b2b

Mini-Profile Name Color: 305b2b

|

Post by resolution on Jul 10, 2015 9:00:40 GMT -5

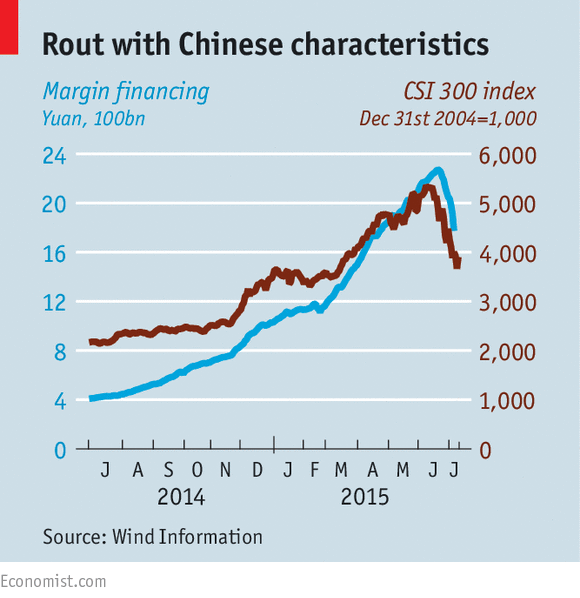

Looks like an awful lot of margin financing. It's really ramped up this year. I would hate to be the little guy that thought the government was guaranteeing the market and borrowed to invest a few months ago. Longer term investors look ok since they are still up 75% for the year.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 10, 2015 11:53:12 GMT -5

The thing about China's market is that it's not old enough for their to have been any long term investors yet. 85% of "investors" in China are small retail clients, they don't have a financial industry like we do in the west. The market still has yet to hit 2007 highs, so essentially every investor in China has gotten screwed. Then there is this..  The idea that because the the market has "recovered" the last two days with CPC essentially locking it down and dumping cash into half the market is pure lunacy - new car sales today is the reality. Their banking system is completely broken and compared to the size of their economy now, the trillions in reserves is nothing but a drop in the black hole of debt that is the Chinese economy. Stay  because their way out is the global conflict that is right in the path of China's new silk road they have to create to save themselves over the long term.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 10, 2015 11:59:28 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 11, 2015 20:50:46 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 17, 2015 23:32:00 GMT -5

The only piece of fiction this week bigger than China's GDP number... Wait, China's GDP number this week was the biggest work of fiction of the last five years - at least..  |

|