tractor

Senior Member

Joined: Jan 4, 2011 15:19:30 GMT -5

Posts: 3,499

|

Post by tractor on Jun 22, 2023 9:43:36 GMT -5

I'm sure we covered this as some point, but as my son will be launching soon on his first full time, post graduate job we had a discussion last night about the benefits of a 401k vs. Roth contributions.

He is starting from ground zero, early 20's, no employer match. What would the collective group recommend he start building retirement income in? 401k, Roth, or a 50/50 split?

|

|

ArchietheDragon

Junior Associate

Joined: Jul 7, 2014 14:29:23 GMT -5

Posts: 6,380

|

Post by ArchietheDragon on Jun 22, 2023 9:47:08 GMT -5

Roth

|

|

Tiny

Senior Associate

Joined: Dec 29, 2010 21:22:34 GMT -5

Posts: 13,508

|

Post by Tiny on Jun 22, 2023 10:03:19 GMT -5

My first thought is ROTH. But really it depends on his current income and his projected income path. If he's single and earning 80K per year I think the advice is different than if he's single and earning 50K per year.

I'm not using real numbers - I'm not good at math.

But really, I think it depends on his income (how much of it will be in a higher tax bracket).

I don't know how to explain this but say if he will have 5K (or less) of his income spilling over into the next tax bracket - he might be better off putting that 5K into his 401K and then the "savings" from that into a Roth PLUS anything else he can put into the ROTH. That's kind of the gist of it - put enough into a 401K so that any money going to a Roth is taxed not at the highest amount.

If his salary is 60K - 10% to retirement is 6K. I'm not sure how that plays out with taxes on his income.

I think the current advice is to save 15% of gross income for retirement.

(There's also the issue of an EF. IF your son has a first line of defense cash EF, he could put additional EF money into his Roth. I kind of did this - I split my Emergency Fund into two parts - a couple of months of income in Cash and then the "I'm building to 6 months EF" went into my Roth (and stayed as cash in my Roth). I figured I could always re-allocate the money inside my Roth at a later date. I wasn't maxing my Roth - but was going with the "If you don't fill the space in your Roth you loose that space." At some point I kept 10K as "cash" in my roth and everything else got invested. I never needed to touch this money. )

|

|

myrrh

Established Member

Joined: Apr 12, 2011 22:55:14 GMT -5

Posts: 478

|

Post by myrrh on Jun 22, 2023 10:15:39 GMT -5

This is one of those unknowable answers because none of us know what tax bracket he will be in when he retires. So we can use today's tax brackets as a proxy and say most definitely Roth if income is below the 12% bracket (currently $44,725), most definitely traditional if income is above the 24% bracket ($182,100) and a toss up in between. If his income is on the border, he could get below a bracket by contributing to a traditional to that point and add the rest to Roth.

As far as IRA vs 401k, it kind of depends on how good the fund choices and fees are in the 401k.

|

|

Tiny

Senior Associate

Joined: Dec 29, 2010 21:22:34 GMT -5

Posts: 13,508

|

Post by Tiny on Jun 22, 2023 10:18:48 GMT -5

This is one of those unknowable answers because none of us know what tax bracket he will be in when he retires. So we can use today's tax brackets as a proxy and say most definitely Roth if income is below the 12% bracket (currently $44,725), most definitely traditional if income is above the 24% bracket ($182,100) and a toss up in between. If his income is on the border, he could get below a bracket by contributing to a traditional to that point and add the rest to Roth. As far as IRA vs 401k, it kind of depends on how good the fund choices and fees are in the 401k.  For 2023 I found this on the IRS webpage: 35% for incomes over $231,250 ($462,500 for married couples filing jointly); 32% for incomes over $182,100 ($364,200 for married couples filing jointly); 24% for incomes over $95,375 ($190,750 for married couples filing jointly); 22% for incomes over $44,725 ($89,450 for married couples filing jointly); 12% for incomes over $11,000 ($22,000 for married couples filing jointly). |

|

jerseygirl

Junior Associate

Joined: May 13, 2018 7:43:08 GMT -5

Posts: 5,398

|

Post by jerseygirl on Jun 22, 2023 10:19:33 GMT -5

Does anyone think taxes will be lower even 20 years in the future?

We bought into the idea that we’d have a lower tax rate on retirement- nope! Now our RMDs push us into fairly high tax rate

|

|

tractor

Senior Member

Joined: Jan 4, 2011 15:19:30 GMT -5

Posts: 3,499

|

Post by tractor on Jun 22, 2023 10:23:44 GMT -5

To fill in a data point I missed. He is very single and starting salary will by $60k.

Thanks for the info so far!

|

|

thyme4change

Community Leader

Joined: Dec 26, 2010 13:54:08 GMT -5

Posts: 40,884

|

Post by thyme4change on Jun 22, 2023 10:25:45 GMT -5

Does anyone think taxes will be lower even 20 years in the future? We bought into the idea that we’d have a lower tax rate on retirement- nope! Now our RMDs push us into fairly high tax rate Roth wasn’t available until we were over the income max - and I feel the same way as you. We were told our income and taxes would be lower in retirement. I highly doubt that will happen with me. I would have been much better off paying taxes when I was making 50k. That said, I wish I had more of a mix, so I could adjust and minimize - but alas, what I have is what I have. |

|

Tiny

Senior Associate

Joined: Dec 29, 2010 21:22:34 GMT -5

Posts: 13,508

|

Post by Tiny on Jun 22, 2023 10:47:18 GMT -5

Does anyone think taxes will be lower even 20 years in the future? We bought into the idea that we’d have a lower tax rate on retirement- nope! Now our RMDs push us into fairly high tax rate This is not a critic or judgement of jerseygirl. I don't know her situation. This does illustrate that "retirement income" can be as financially complicated as all the working years of "saving money as tax efficiently as possible". As you approach your retirement - you need to start thinking about the ins and outs of accessing your retirement money so you can do so in the most tax efficient way. (my oldest sibling lamented that he didn't realize he should have started using his tax differed money and/or been doing Roth Conversions as soon as possible... the changes to the starting age for RMDs helped him out by giving him a couple more years to convert money to a Roth (which helps a lot because his kids will be receiving inheritance money from his tax advantaged accounts at a time when they will hitting the highest incomes of their careers.) I'm probably not saying all of that right... The gist of it is - it's not a set it and forget it kind of thing. You need to keep reviewing and planning. In my real life - the people who started getting a handle on their "retirement" income/money in their mid to late 50's expressed less regret or angst about their actual retirement than those who assumed they had to work until 65 and didn't pay attention to their retirement until they hit 64 or 65. Some of the early planners realized they could retire at 62 or 63 versus having to work until their FRA as they assumed they would OR that they had some flexibility with employment, they could pursue other interests). Some of the late planners realized they could have retired (or done things differently) in the years leading up to their current age. |

|

teen persuasion

Senior Member

Joined: Dec 20, 2010 21:58:49 GMT -5

Posts: 4,201

|

Post by teen persuasion on Jun 22, 2023 10:55:02 GMT -5

To fill in a data point I missed. He is very single and starting salary will by $60k. Thanks for the info so far! How much can he afford to contribute? If he can max the Roth 401k, great. If he can't, then contributing to traditional will give him more to contribute (the tax savings). Don't forget state tax, too. How much is his income expected to increase as he gets more experience? Higher income in the future would imply more need to use traditional then to reduce taxes in a higher bracket (compared to now). So he might want to lean to frontloading Roth accounts as much as possible now, shifting to traditional later. His marginal tax rate now, vs at withdrawal in retirement, is the guidepost. Predicting the future is tricky, though. A general rule of thumb might be: federal tax bracket 12% and under use Roth, over 12% use enough traditional to get down to the 12% threshold and Roth for the remainder. Above 22% all traditional for the tax break. Unless you expect pension income in retirement, or have >$1m in traditional ALREADY - then use Roth, because you've already filled the lower brackets in retirement! |

|

teen persuasion

Senior Member

Joined: Dec 20, 2010 21:58:49 GMT -5

Posts: 4,201

|

Post by teen persuasion on Jun 22, 2023 11:06:42 GMT -5

I like this investment order list, to help you figure out where to put your next $$ when saving. Emergency fund is first, then capture any match (none here), pay down high rate debts, HSA if appropriate, an IRA (because fees are under your control; work plans can be expensive), finally back to 401k/etc. and some more ideas on how to decide Roth vs traditional. |

|

Deleted

Joined: Nov 24, 2024 20:10:31 GMT -5

Posts: 0

|

Post by Deleted on Jun 22, 2023 11:20:13 GMT -5

My daughter, who has an internship this summer, asked me this question when she started. Since she is only doing the internship in this taxable year, I told her to open a Roth. My thinking was that this was a temporary job and she would be lucky to clear 10K for the whole summer, so a pretty low tax bracket and she wouldn't have to move the money once this job ends.

|

|

haapai

Junior Associate

Character

Joined: Dec 20, 2010 20:40:06 GMT -5

Posts: 6,009

|

Post by haapai on Jun 22, 2023 12:09:24 GMT -5

To fill in a data point I missed. He is very single and starting salary will by $60k. Thanks for the info so far! That's helpful but we really need the details of how much of his health insurance he's paying for and whether he has access to an HSA. Also it sounds like he just started this job, so his gross income in 2023 will be far short of $60K this year.

Contributing $6500 to a Roth IRA this year might get him to 15% percent for retirement.

In future years, he'll probably have to be putting more away, somewhere, and I don't know enough about his paycheck to say whether that should be a traditional or a Roth 401(k). He's probably not nearly as close to the 22% federal bracket as it seems.

|

|

haapai

Junior Associate

Character

Joined: Dec 20, 2010 20:40:06 GMT -5

Posts: 6,009

|

Post by haapai on Jun 22, 2023 12:17:53 GMT -5

I think that it is important in this discussion to distinguish between Roth IRAs, which have some sweet non-retirement options (they can double as EFs and can be used to accumulate some of a house down payment) and Roth 401(k)s which do not have similar features and may be fee-riddled monstrosities that you are stuck with until you separate from an employer.

|

|

tractor

Senior Member

Joined: Jan 4, 2011 15:19:30 GMT -5

Posts: 3,499

|

Post by tractor on Jun 22, 2023 13:02:35 GMT -5

He will have no HSA, his health insurance will cost $14/month with a $2000/deductible. He's also double covered until he turns 26 under my plan.

In a perfect world, his income will continue to increase (freshly minted engineer), and he has a large inheritance coming from his grandmother, plus whatever I don't spend from my estate.

He can't max out his 401k as he does have rent, student loan payments, and a few other expenses to deal with. He's comfortable with 10% going into some kind of retirement account.

Keep the advise coming, I'm learning as well.

|

|

myrrh

Established Member

Joined: Apr 12, 2011 22:55:14 GMT -5

Posts: 478

|

Post by myrrh on Jun 22, 2023 13:23:55 GMT -5

FTR, I've always contributed the max to a Roth IRA and then any remaining money I could afford (which was usually none in my first decade of working) went to my 457 (gov 401k equivalent). The 457 gets a lot more than the Roth nowadays because I make more, so the amounts in each account are close to equal even though I've been contributing to the Roth a lot longer. I figure this will give me additional flexibility in controlling my income in retirement.

|

|

teen persuasion

Senior Member

Joined: Dec 20, 2010 21:58:49 GMT -5

Posts: 4,201

|

Post by teen persuasion on Jun 22, 2023 13:25:31 GMT -5

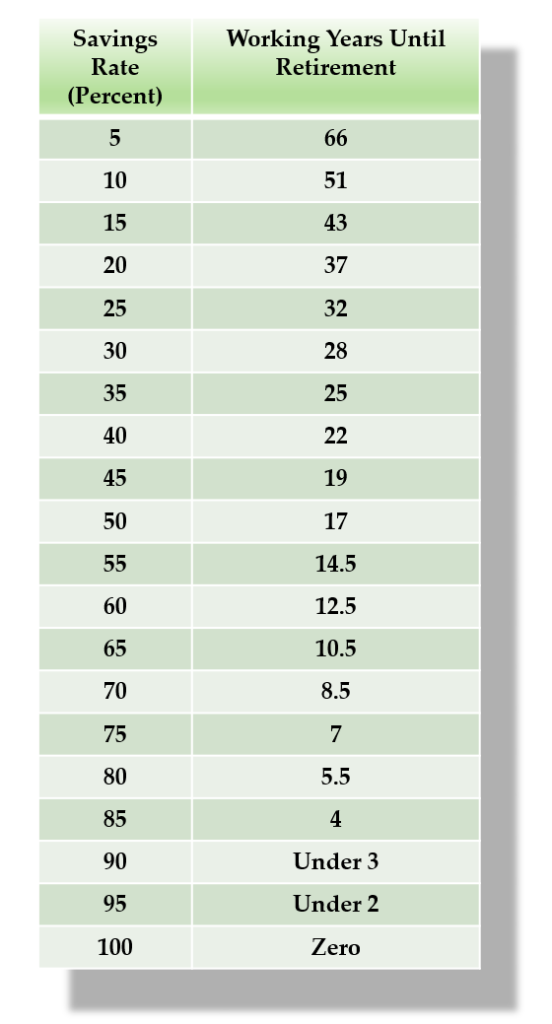

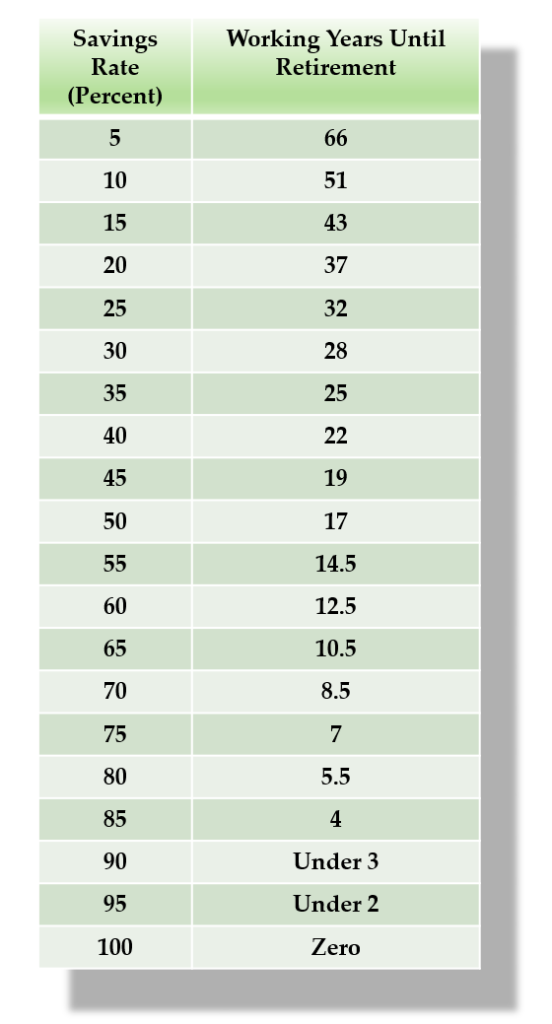

Only 10% into retirement (especially when he's young w/o dependents) is not nearly enough! The Shockingly Simple Math Behind Early Retirement has a great chart comparing retirement contribution rates and working years until retirement. At 10% its 51 working years to reach retirement! Double it to 20% and it drops to 37 years. Or 25% is 32 years...  |

|

myrrh

Established Member

Joined: Apr 12, 2011 22:55:14 GMT -5

Posts: 478

|

Post by myrrh on Jun 22, 2023 13:40:20 GMT -5

Well, one would hope funding the emergency fund and paying off student loans will only take a few years so retirement savings can be pumped up as those expenses go away.

Also I'm jealous of his health insurance costs. My supposedly good state employee health insurance isn't nearly as cheap.

|

|

souldoubt

Senior Member

Joined: Jan 4, 2011 11:57:14 GMT -5

Posts: 2,758

|

Post by souldoubt on Jun 22, 2023 16:41:21 GMT -5

I always liked the advice of multiple posters on here that said 401K for full employer match, max Roth IRA, max 401K and anything left to taxable. I started a Roth IRA when I was 18 and my only regret is that I didn't put more in when I was younger. Since your sons employer doesn't match the 401K I would say go Roth IRA and if he decides he wants to contribute more than 10% and maxes out his Roth IRA put anything extra into the 401K.

|

|

haapai

Junior Associate

Character

Joined: Dec 20, 2010 20:40:06 GMT -5

Posts: 6,009

|

Post by haapai on Jun 22, 2023 16:49:45 GMT -5

He will have no HSA, his health insurance will cost $14/month with a $2000/deductible. He's also double covered until he turns 26 under my plan. In a perfect world, his income will continue to increase (freshly minted engineer), and he has a large inheritance coming from his grandmother, plus whatever I don't spend from my estate. He can't max out his 401k as he does have rent, student loan payments, and a few other expenses to deal with. He's comfortable with 10% going into some kind of retirement account. Keep the advise coming, I'm learning as well. Dang! I did not expect this. He's a lot closer to the 22% federal bracket than I expected. I thought that health insurance and HSA contributions would put him two to six grand below the 22% bracket in 2024 before any inflation adjustments hit.

This is interesting and unexpected. I also had not foreseen large or largish inheritances landing on him. I really don't know how to advise. Maybe he should pay for better advice? Maybe you should pay for better advice for him? I do not know, and I do not think that you should tell me, how large the inheritances that will likely land on him will be and what form they will take.

|

|

|

|

Post by The Walk of the Penguin Mich on Jun 22, 2023 17:55:17 GMT -5

Why not do both? Max out his Roth and contribute to his 401k. There might come a time where he will no longer be able to contribute to a Roth, and will need the tax advantage of the 401k. There might be a time where he will receive an employer match.

This way, the door opens in both directions.

|

|

teen persuasion

Senior Member

Joined: Dec 20, 2010 21:58:49 GMT -5

Posts: 4,201

|

Post by teen persuasion on Jun 22, 2023 21:07:41 GMT -5

Why not do both? Max out his Roth and contribute to his 401k. There might come a time where he will no longer be able to contribute to a Roth, and will need the tax advantage of the 401k. There might be a time where he will receive an employer match. This way, the door opens in both directions. OK, this is not directed at Mich, but it hits a pet peeve of mine: using "Roth" to refer to Roth IRA, and 401k as the "other" option. IRAs and 401ks can each have traditional and Roth options. That's 4 options total, not 2. I was reading the OP as should one contribute to Roth or (unnamed = traditional) 401k? I guess that's another question - does his 401k have a Roth option, too? What's the vesting schedule? What are the fees, and what are the expense ratios on the funds? But, yeah do both. Roth IRA has a smaller max at $6500. Can act as a secondary emergency fund in a pinch before a real emergency fund is filled. 401k for additional savings, but more restrictive (good and bad - too easy access could permit early raiding). For IRAs, prefer Roth over traditional, especially if his income will grow appreciably in the future to the point he exceeds the income to contribute directly to a Roth IRA. As long as he has nothing in a traditional IRA, he can do a backdoor Roth IRA. Keep any/all traditional in a 401k, and don't rollover to an IRA when leaving an employer, to keep the backdoor Roth IRA option open. |

|

Rukh O'Rorke

Senior Associate

Joined: Jul 4, 2016 13:31:15 GMT -5

Posts: 10,339

|

Post by Rukh O'Rorke on Jun 22, 2023 21:43:48 GMT -5

Only 10% into retirement (especially when he's young w/o dependents) is not nearly enough! The Shockingly Simple Math Behind Early Retirement has a great chart comparing retirement contribution rates and working years until retirement. At 10% its 51 working years to reach retirement! Double it to 20% and it drops to 37 years. Or 25% is 32 years...  I think this is assuming level expenses throughout... 100% 0 years? |

|

Rukh O'Rorke

Senior Associate

Joined: Jul 4, 2016 13:31:15 GMT -5

Posts: 10,339

|

Post by Rukh O'Rorke on Jun 22, 2023 21:47:37 GMT -5

with no match, def go Roth IRA.

many 401k have rather sucky choices, and higher expense rates. With a Roth IRA you can be in complete control of your investment vehicles.

|

|

teen persuasion

Senior Member

Joined: Dec 20, 2010 21:58:49 GMT -5

Posts: 4,201

|

Post by teen persuasion on Jun 22, 2023 22:00:41 GMT -5

If you can save 100%, someone is paying all your expenses (or you have no expenses  ) - you don't need to wait to retire, presumably.  If you read the linked blogpost, that table is just another version of this:  You don't need absolutely level expenses for it to roughly work. It's meant to be a guideline as to how long it takes to reach FIRE from zero, depending on your saving rate. |

|

Cookies Galore

Senior Associate

I don't need no instructions to know how to rock

Joined: Dec 19, 2010 18:08:13 GMT -5

Posts: 10,926

Member is Online

|

Post by Cookies Galore on Jun 23, 2023 12:50:34 GMT -5

Why no match? Just not yet this early with the company? Stingy company? They fund something else in place of a match? I have a 403(b) with no match but that's because I have a defined benefit pension 100% funded by my employer.

For someone who regularly visits a financial message board, I'm not obsessive about how I'm funding my retirement. I'm doing what I'm doing and retirement is going to happen no matter what. I throw money in the 403 (incrementally increasing my contribution with every annual pay raise), throw money at my Roth IRA, throw money in my general life is happening now savings, and admire my annual pension statements. If he fund a Roth IRA and throw some bones at a 401k, I'd save my brain space and just do it easy. Even if he can't fully fund a Roth or a 401k, money put into retirement IS money put into retirement.

I think we tend to forget that a lot of young people hear "you gotta max or else you'll die penniless" and don't bother saving until they start making more because it's stressful and demoralizing to not be able to throw all your money at future you now, when they should be hearing "whatever you can save now is good."

|

|

phil5185

Junior Associate

Joined: Dec 26, 2010 15:45:49 GMT -5

Posts: 6,412

|

Post by phil5185 on Jun 23, 2023 14:59:39 GMT -5

If he invests 10%/yr ($9000/yr) at 11%/yr - and if the $9000 adjusts upward at 3%/yr due to salary increases, he will have about $1.75 M in 30 yrs. Probably not enough in Y2053.

If he invests 15% he should have about $2.63 M in 2053 - probably a better target? ( I was a 'freshly minted engineer' in 1963, I seem to recall investing 17%/yr ( that was probably an IRS limit at the time.) But most projections are highly dependent on world cultural events, wars, US societal shifts, Wash DC reactions, and market reactions. And luck - eg, the SP500 Index rose 18%/yr for 18 years, money was doubling about every 4 years.

As for Roth or IRA - not much difference. If you assign $10k to invest, with Roth you will pay the 20% tax upfront leaving $8000 to invest. With IRA the whole $10,000 gets invested - but when you cash it out (RMDs, etc) you will pay the 20% tax. And whether the tax will be higher or lower in 30 years is unknowable.

In the 1960's and 70's there were about a dozen tax brackets - I hit the 70% bracket a couple times - and the deductions were everywhere, credit card interest, mortgage interest, car loan interest, tools, calculators, etc. Then in about 1987 the dozens of tax brackets was reduced to 2 - 15% and 28% - and the array of deductions was replaced by the standard deduction. An overall tax cut for most people. (Much of the high taxes during the 50's and 60's were to pay WW2 reparations}

|

|

giramomma

Distinguished Associate

Joined: Feb 3, 2011 11:25:27 GMT -5

Posts: 22,334

|

Post by giramomma on Jun 23, 2023 18:27:25 GMT -5

We started a ROTH IRA for my son when he was 16/17. The grands were still giving him 529 money, he made at least 3k a year at his job. We repurposed the 529 money for a ROTH when it was clear he had more than enough for tech school.

We'll tell him to continue on with a Roth at least for a little while. We also have 529 money we have to roll over to a Roth.

|

|

tractor

Senior Member

Joined: Jan 4, 2011 15:19:30 GMT -5

Posts: 3,499

|

Post by tractor on Jun 23, 2023 19:29:38 GMT -5

Why no match? Just not yet this early with the company? Stingy company? They fund something else in place of a match? I have a 403(b) with no match but that's because I have a defined benefit pension 100% funded by my employer. For someone who regularly visits a financial message board, I'm not obsessive about how I'm funding my retirement. I'm doing what I'm doing and retirement is going to happen no matter what. I throw money in the 403 (incrementally increasing my contribution with every annual pay raise), throw money at my Roth IRA, throw money in my general life is happening now savings, and admire my annual pension statements. If he fund a Roth IRA and throw some bones at a 401k, I'd save my brain space and just do it easy. Even if he can't fully fund a Roth or a 401k, money put into retirement IS money put into retirement. I think we tend to forget that a lot of young people hear "you gotta max or else you'll die penniless" and don't bother saving until they start making more because it's stressful and demoralizing to not be able to throw all your money at future you now, when they should be hearing "whatever you can save now is good." I can't speak for the company...but they do mention "at the discretion of the board" they might make additional contributions on an annual basis. This is code for profit sharing, with no commitment for a set percentage. I guess it's the way they want to do things, so I told him not to plan on any match. Maybe they will put a percent of his salary in every year (?), I have no idea. Time will tell. If he finds out things suck more than he imagines, he'll have to explore other options. |

|

saveinla

Junior Associate

Joined: Dec 19, 2010 2:00:29 GMT -5

Posts: 5,299

|

Post by saveinla on Jun 23, 2023 20:49:01 GMT -5

If the company does well the match will be higher than the norm.

|

|