bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 14, 2011 15:21:58 GMT -5

0.93811524990329 Certainty 1764.72890399046 one year upper target price $1764 per Troy Oz.. is wild.. but if all goes wrong with the ECB and debt refinancing of some 2 Trillion dollars for the European banks . It could be real bad.. Like 1931 and Baden-Kredit-Anstalt went insolvent.. despite efforts from Morgan, Rothschild family , Federal Reserve bank and Austria Federal Government. That was the real start of the Great Depression...not 1929 stock-market crash.. Just a thought, Bruce SID= Secularly insolvent Depression.. ie bank failure and m2 over supply over    done by central banks.. run away inflation.. reflected by gold prices... |

|

|

|

Post by lifewasgood on Apr 14, 2011 15:38:06 GMT -5

Yup,

IMO, the next leg will take the dollar to 72.5 range and gold over 1520. After that as you suggest a price over 1700 is likely depending on many factors.

However, the world has turned into a fast paced machine and long term forecasts or not very good beyond about 3 months, again IMO.

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 14, 2011 15:49:07 GMT -5

MMXI Gold had this leg with a 0.96834853023999 confidence level to be $ 1483.9738519874...

last run 4/14/2011... only buy is still qqq.. gold on pull backs but who knows.. I have increased my Merlot 95%/ Cab Franc 5% by 100%.. Petrus has price is about $4,000 for 750ml for the 2001.. or golden ten year.. Mine most about $25/ 750.

MMXI Gold..Version III...

4/14/11 Central Tendency current discount sd close 2009 2010 profits Target (12/1/2011)

djia 11332.8972902212... 12380.05... -8.45839% ...12.4192% ...10428 ...904.897290221203... 12670.0952966394

djtm 13208.45263 13925.5 -2.25561684% 15.6977977% 11182.39 2026.06263 16297.1210517399

djua 428.690079918739 414.450 4.337158% 23.0469335255% 379.200 49.4900799187395 513.826722278346

russell 2m 729.995786790838 840.89 -9.60588100% 18.38680965% 625.39 104.605786790838 841.533052049273

QQQ 67.7862374449893 56.95 19.0276337928% 18.3309% 45.98 21.8062374449893 75.4657596780709

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 14, 2011 22:30:18 GMT -5

Hey BTI! Great to see you posing again. You so sneaky.  ;D Change in economic indicators 1929-32 USA Britain France Germany Industrial production −46% −23 −24 −41 Wholesale prices − -32% -33 −34 -29 Foreign trade −70% −60 −54 −61 Unemployment +607% +129 +214 +232 |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 15, 2011 10:44:46 GMT -5

Ben B. and Dudley Due Write have equability reduced the QE2 bond purchase rate.. Increase in SOMA has been reduce from some 25 Billion a week to 15.Billion/Week.. Next  gold prices are out of their control .... Securities Holdings as of April 13, 2011 ($ thousands) Export all to: Excel | PDF | Txt Summary T-Bills T-Notes & T-Bonds TIPS Agencies Security Type Total Par Value US Treasury Bills (T -Bills) 18,422,636.7 US Treasury Notes and Bonds (Notes/Bonds) 1,289,825,708.4 Treasury Inflation-Protected Securities (TIPS)1 59,486,305.0 Federal Agency Securities2 130,888,000.0 Mortgage-Backed Securities3 (Settled Holdings) 937,155,054.8 Total SOMA Holdings 2,435,777,704.9 Change From Prior Week 14,804,000.0 1 Does not reflect inflation compensation of $6,959,909.2 2 Fannie Mae, Freddie Mac and Federal Home Loan Bank 3Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of the underlying mortgages. |

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Apr 15, 2011 13:12:09 GMT -5

Elegant, accurate. I like it, Bruce.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 16, 2011 2:27:09 GMT -5

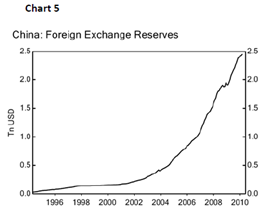

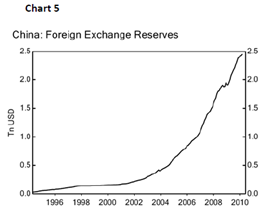

Yes but the question is where is this depression going to land the hardest if things do fall apart, if there actually will be a severe depression. BTI, I know how much of a fan you are of what Ben has done at the FED so far. If China’s two biggest trading partners go offline, their 35% consumer driven economy is going to fall further and into an all out terrible, terrible situation.(possibly war) There is a good chance that China is heading to a Japan like situation, 15, 20 years of deflation about 6 or 7 years from now. Expect it will probably be stagflation because of the voume, land mass, ect. Ther is a reason that China's new goal is happiness, not GDP...  They will keep propping things up to save themselves. They are still building reserves while buying debt from around the world.  China M2 Up 16.6% In March: www.capitalvue.com/home/CE-news/inset/@10063/post/1353084 China willing to buy more Spanish debt: Wen: www.google.com/hostednews/afp/article/ALeqM5hgakOOiL21ZBBbvKGYzbMgiDZUnw?docId=CNG.9c5e7c22c603a45f186361b881bf9d3f.3f1 |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 17, 2011 10:31:42 GMT -5

Yes but the question is where is this depression going to land the hardest if things do fall apart, if there actually will be a severe depression. BTI, I know how much of a fan you are of what Ben has done at the FED so far. If China’s two biggest trading partners go offline, their 35% consumer driven economy is going to fall further and into an all out terrible, terrible situation.(possibly war) There is a good chance that China is heading to a Japan like situation, 15, 20 years of deflation about 6 or 7 years from now. Expect it will probably be stagflation because of the voume, land mass, ect. Ther is a reason that China's new goal is happiness, not GDP...  They will keep propping things up to save themselves. They are still building reserves while buying debt from around the world.  China M2 Up 16.6% In March: www.capitalvue.com/home/CE-news/inset/@10063/post/1353084 China willing to buy more Spanish debt: Wen: www.google.com/hostednews/afp/article/ALeqM5hgakOOiL21ZBBbvKGYzbMgiDZUnw?docId=CNG.9c5e7c22c603a45f186361b881bf9d3f.3f1A++, I understood that China has said it did not say it would but it might buy Spanish Debt?? The Debt is looking high risk to me.. too.. We need more M2 in our own banking system.. Current we have about 4.3% growth year over year for M2.. Not enough to support growth.. The last week was a real shocker.. Esp for the real numbers.. Bruce Attachments:

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 17, 2011 11:41:43 GMT -5

Elegant, accurate. I like it, Bruce.  Virgil, Thank-you for your kind words.. The USA has a law saying the Mint must supply all the gold or silver coins collectors want.. Looks like M2 would be larger if you added gold coins to savings account. Well Q2 will be weaker if savings would increased a bit.. Good for the USA but not for China. I heard Dr. Johnson from MIT say he strongly thought we needed Tier 1 raised to 20% with total Capital going to 30%. Now where will the showdown start and the shadow banking system starts.. ;D Like the Farmers Credit Bank of Texas ..We have more then one Central Bank. So where is that Bank of North Dakota in the long term thinking of many other states??    Just a thought, Bruce Attachments:

|

|

dothedd

Senior Member

Joined: Dec 27, 2010 20:43:28 GMT -5

Posts: 2,683

|

Post by dothedd on Apr 17, 2011 12:55:12 GMT -5

THANKS BRUCE...for a very informative thread!

4YOU 4YOU

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 17, 2011 14:09:39 GMT -5

Do the D.D., Well .. Did nothing I say make you wonder about why gold is up???Gold cost money to store and does not pay interest... Thank-you for your kind words... Back in March 2009 we had a 9.4% year over year saving rate.. Like Norway and Sweden .. did we need to get back to basics and save.. Sure be better then depending on China to buy our bonds.. Just a thought and Thank-you again for your kind words, Bruce Attachments:

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 17, 2011 15:52:57 GMT -5

Hey B. I hear you about the m2. I have suspected for a while that the banks are hording because of the mortgage issues. I'm sure you heard that the big banks were just again asked to pay back billions because of illegal foreclosures. So weaker M2 growth is no suprise to me. China will keep buying debt because they need our money. Big time. It's all coming out B!!  I would say that spanish debt is way to risky for you and me though  Is the People’s Bank of China Insolvent?: blogs.forbes.com/gordonchang/2011/04/17/is-the-peoples-bank-of-china-insolvent/ |

|

dothedd

Senior Member

Joined: Dec 27, 2010 20:43:28 GMT -5

Posts: 2,683

|

Post by dothedd on Apr 17, 2011 16:52:04 GMT -5

Do the D.D., Well .. Did nothing I say make you wonder about why gold is up???Gold cost money to store and does not pay interest... Thank-you for your kind words... Back in March 2009 we had a 9.4% year over year saving rate.. Like Norway and Sweden .. did we need to get back to basics and save.. Sure be better then depending on China to buy our bonds.. Just a thought and Thank-you again for your kind words, Bruce

Frankly, I have not had the time to analyze all that you have shared on this thread as I am franticly trying to get ready to leave town this week, but I downloaded the thread into my laptop so that I can give it my full attention in a less frantic state.

Twenty-five percent of my non-stock-investments are in ($50 Dollar gold coins), period antiques and art … and I am entertaining the thought of selling the antiques and art as I plan a permanent move to Montana and they will not work into the design of my new house. I relish the thought of major changes as in off with the old and on with the new.

Bruce do you drink any of that wonderful wine? |

|

dothedd

Senior Member

Joined: Dec 27, 2010 20:43:28 GMT -5

Posts: 2,683

|

Post by dothedd on Apr 17, 2011 16:54:08 GMT -5

P.S.

....in lieu of today’s prices. NOT THAT I WOULD!

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 17, 2011 23:00:29 GMT -5

P.S.

....in lieu of today’s prices. NOT THAT I WOULD! DD, I do have a limited wine collection of wine from my vineyard ( Texas)... Gold is on the up swing meaning most of the Central Banks are increasing gold reserves.. They sold at the bottom and buy at the top.. Great thinking.. Watch Korea as they have never had gold to any degree.. The did say they were buying as a tool for monetary stability.. Water under the bridge. We have a new higher number today.. $1779.25 with a 0.9417265 confidence level..MMXI gold Version 3 ... OK the IA64 are not conceded .. they are convinced.. Number can and do change on a dime..    so try some Cheese ;D ;D ;D with that Port...  Just a thought, BRUCE |

|