djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 13:35:03 GMT -5

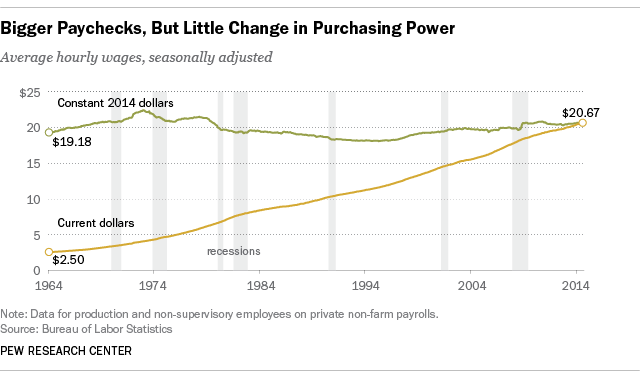

The link is posted above, you even stated you read the link. So yes, technically you have seen a study that proves a lower marginal rate increased wages. i am still a bit drowsy today. will go review this now. edit: ok, i reviewed it. however, this study is using EMTR not "top marginal rates" to make their case. i honestly don't even understand what EMTR is, so i can't comment on it. but if you compare top marginal rates to wage growth, in the US at least, the result is that cutting top marginal rates IN HALF resulted in 0% wage growth (for the bottom 50%) in the (45) year period ending today. i don't know about Canada. i am not going to study your tax code to figure it out. but that is what happened here. my point is this: prior to 1973, productivity and wages grew at the same rate. since 1973, productivity has continued to grow, but wages have NOT. and the result is that economic growth has become unhinged from income growth, and dependent on debt. i think we can both agree that borrowing one's way to success will eventually turn in on itself and result in disaster, and i think that is where the US is going. edit2: i am not too keen on a (15) year study. the US tax rate has been pretty flat during that time. if we want to see the impacts, a (45)+ year study involving the US (and Canada) would be better. any such study should also treat GDP as an independent variable so as to determine definitively that, for example, LOW UE isn't the causative factor in wage growth (rather than tax policy). |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:05:01 GMT -5

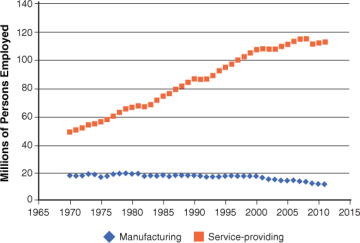

Believe whatever you would like. The data proves - broadly - that lower taxes means more money in the economy and the potential for more growth. And as we discussed at the start of this year, the US isn't heading into a recession this year, which you adamantly argued it would because of "the economic miracle".  It literally explains what Effective Marginal Tax Rate is in the study, sorry to say. What it means is that when all tax is considered these are the rates. And 15 years is plenty of enough time to outline an observable trend. Edit: also, the study involves; Canada, the US and the UK!!! I'm sorry, but I have to wonder if you are actually reading it?? I see now you have changed the wording to a degree... Bottom line, the study is an observable trend. If you find it flawed, please conduct one that disproved it. Also, we have discussed productivity already and how the numbers aren't accurate because of the amount of foreign goods. The other thing you need to keep in mind is that since 1973 there has been a very large service sector created, which has lower wages in general; dragging down the average. Wages have risen since 1973, it's the purchasing power studies you are talking about. And since this debate started at "trickle down" aka "Reganomics" which first started in the 1980's and you keep using the year which the US left the gold standard, I'm thinking you're substituting one for the other. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 14:07:10 GMT -5

It literally explains what Effective Marginal Tax Rate is in the study, sorry to say. why are you sorry? i read it FOUR TIMES and i still don't understand it. did you? if so, explain it to me. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 14:09:04 GMT -5

Edit: also, the study involves; Canada, the US and the UK!!! I'm sorry, but I have to wonder if you are actually reading it?? yep. it showed US tax rates as flat during the study period, right? i thought i would focus on OUR TWO COUNTRIES, Aham. is that OK with you? after all, i know an IMMENSE amount about US tax policy, and i would bet that you know enough to comment about Canada. i don't know enough to comment about the UK. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:10:26 GMT -5

It literally explains what Effective Marginal Tax Rate is in the study, sorry to say. why are you sorry? i read it FOUR TIMES and i still don't understand it. did you? if so, explain it to me. I did, right after the sentence you quoted. And again, it explains it in the article. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:12:01 GMT -5

Edit: also, the study involves; Canada, the US and the UK!!! I'm sorry, but I have to wonder if you are actually reading it?? yep. it showed US tax rates as flat during the study period, right? i thought i would focus on OUR TWO COUNTRIES, Aham. is that OK with you? after all, i know an IMMENSE amount about US tax policy, and i would bet that you know enough to comment about Canada. i don't know enough to comment about the UK. The study takes from three scenarios. One flat, one dropping, one rising. Focus on on the fact it covers real world tax policies for a flat, a rising and a dropping rate; which makes it a good sample. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 14:15:41 GMT -5

The other thing you need to keep in mind is that since 1973 there has been a very large service sector created, which has lower wages in general; dragging down the average. Wages have risen since 1973, it's the purchasing power studies you are talking about. And since this debate started at "trickle down" aka "Reganomics" which first started in the 1980's and you keep using the year which the US left the gold standard, I'm thinking you're substituting one for the other. between 1860 and 1973, the service sector went from 30-55% of the economy. the trend has continued since 1973, and the service sector is now in the upper 70's in terms of the economy. however, between 1860 and 1973, wage growth kept up with productivity, and since then, it has not. i can think of a better reason than this why wage growth has not kept up with productivity. but i would like to see if you can guess it, first. and no, it is not the purchasing power studies. it is this:    |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 14:18:58 GMT -5

why are you sorry? i read it FOUR TIMES and i still don't understand it. did you? if so, explain it to me. I did, right after the sentence you quoted. And again, it explains it in the article. ok, then we are talking about two different things. i am ONLY talking about top marginal rates. if you want to talk about overall taxation, that is far murkier. some tax changes stimilate economic growth, and others do NOT. therefore, looking at the overall rate and comparing it to growth will give indeterminate results. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:34:50 GMT -5

Yes, but the type of service sector job has changed. The service sector now includes things like fast food, lots of retail, etc; not just doctors, lawyers, etc. So, this skews the number down. Also, the loss of manufacturing jobs during this time has resulted in average wages decreasing.(as a side note starting in the 1860s a lot of work was offshored to the USA); and yes, those are INFLATION related, right?

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 14:39:42 GMT -5

Yes, but the type of service sector job has changed. The service sector now includes things like fast food, lots of retail, etc; not just doctors, lawyers, etc. So, this skews the number down. Also, the loss of manufacturing jobs during this time has resulted in average wages decreasing.(as a side note starting in the 1860s a lot of work was offshored to the USA); and yes, those are INFLATION related, right? yes. but purchasing power studies (PPP) are also adjusted for local cost of living. forgive me if i thought you were talking about PPP, not "true wages". i am not sure about your assertion on service economy, but i gotta get going. i will look into it later. thanks for a fun discussion. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:41:29 GMT -5

I did, right after the sentence you quoted. And again, it explains it in the article. ok, then we are talking about two different things. i am ONLY talking about top marginal rates. if you want to talk about overall taxation, that is far murkier. some tax changes stimilate economic growth, and others do NOT. therefore, looking at the overall rate and comparing it to growth will give indeterminate results. Exactly, taxes are complex, time draining endeavors. Excellent point on another way taxes remove money from the economy; which at this point has been proven ad nauseum. I agree however, the we agree, that using debt as a means to prosperity doesn't work. Which is why the facist, globalized and socalized govt system that exists today is headed for disaster(with the help of war). Where we probably differ, is our veiws on What will emerge; which my studies come to the conclusion of strong nation states that operate within a global business community based on American made free enterprise.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 14:48:07 GMT -5

Yes, but the type of service sector job has changed. The service sector now includes things like fast food, lots of retail, etc; not just doctors, lawyers, etc. So, this skews the number down. Also, the loss of manufacturing jobs during this time has resulted in average wages decreasing.(as a side note starting in the 1860s a lot of work was offshored to the USA); and yes, those are INFLATION related, right? yes. but purchasing power studies (PPP) are also adjusted for local cost of living. forgive me if i thought you were talking about PPP, not "true wages". i am not sure about your assertion on service economy, but i gotta get going. i will look into it later. thanks for a fun discussion. I'm talking about this:  The inflation average adjusted wages, brought down by lower paying jobs, which IMO is the bases for the entire " wage stagnation" argument. Have a good day.  |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 8:57:43 GMT -5

@ oldcoyote:

"Trickle down" doesn't work. The basic idea of supply side economics is to create an economic milieu that will foster increased production of higher quality goods and services which can be marketed at competitive prices. To achieve these objectives we need to reduce monopolistic elements in the price structure (monopolistic prices of goods or services tends to increase prices and restrict output); increase labor productivity; reduce unit labor costs; reduce transfer payments to the non-productive sectors; eliminate excess regulatory burdens, excessive rates of taxation on producers and savers, etc.

The caveat is that supply side economics requires structural and attitudinal changes which will be zealously resisted by powerful special interest groups. Even more intractable are constraints imposed by resource and technological factors. Gains will be limited and a long time in coming even with our best efforts. Up until now we have ameliorated these unnecessary self-imposed economic hardships largely through massive transfer payments to non-productive recipients. Deficit financing by the Federal Government provided the principal source of funds. As we all should know, there is a finite limit to this "remedy".

Supply-side economics, as applied to the deficit, assumes that if enough tangible financial encouragement is given to the business community and investors, then plant expansion, production, employment and taxable incomes will increase sufficiently to enable the economy to "grow out of the deficit". All of this, the supply-siders contend, it possible without burdening ourselves with higher taxes or endangering our national security through “real” reductions in the federal budget.

Methods already adopted to achieve these supply-side objectives include: 1) sharply lower corporate income taxes; 2) more generous treatment of capital gains; 3) tax credits for capital outlays; 4) tax deductions for certain types of investments: 5) accelerated depreciation on plant and equipment and rental housing; 6) removal of costly (and presumably unnecessary) government regulations, etc.

However, further tax incentives, especially to corporations, are likely to be counterproductive. That is, the adverse effects on the deficit and interest rates will more than offset the simulative effects on the economy. Many corporations, including some of the largest, pay little or no income taxes. A past survey of 250 of the Fortune 500 found these 250 paying net corporate income taxes at an average annual rate under 15 percent. Very few were paying anything close to the maximum rate.

There is one all-important ingredient that the supply-siders ignore; namely that the demand for capital goods is a derived demand, derived from primary consumer demands. That even in a capitalistic system the end and objective of all production is human consumption. The demand for inventory or plant and equipment, however far removed from the ultimate consumer, is derived from final consumer outlays in the marketplace.

Demand is always paramount in successful business planning and commitment decisions. If sufficient demand is not expected to exist, it matters not what the expected costs will be. "Sufficient" demand, of course, covers all costs plus and expected after tax profit margin.

Supply-siders approach the demand side of the equation on a "trickle down" basis; build the plants and produce the goods, and demand will take care of itself. Supply creates its own demand.

Unfortunately, we do not live in that kind of world. The proposition is simple. An economy such as ours which is geared to mass production requires concomitant mass consumption. Payrolls must be sufficient to buy the goods and services produced - at the asked prices.

Only in the frictionless world created by the mathematical model builders are the asked prices in equilibrium with consumer spendable income. In the real world, there is always a purchasing power deficiency gap of varying proportions. This is just another way of saying that to have high levels of production and employment, we need not only a vastly more competitive price structure, we also need a steady but slightly inflationary monetary policy (prices increase c. 2 percent annually), and a tax policy that contains some elements of compulsory income redistribution - downward.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:00:40 GMT -5

The current economic blue print was accurately advanced over 60 years ago, in the late 1950s, by Leland J. Pritchard, Ph.D., Economics Chicago, 1933, MS, Statistics, Syracuse. Unfortunately the Gurley-Shaw thesis, a Keynesian abstraction (that there is no difference between money and liquid assets, viz., the “liquidity test” of an asset), overshadowed the gospel. You'd better read economist Phillip George (even if his underpinnings are wrong): bit.ly/2u3xiBV"The riddle of money, finally solved" (it's about the use or non-use of savings). As Princeton Professor Lester V. Chandler (Ph.D., Yale, Economics), originally theorized in 1961, viz., that in the beginning: “a shift from demand to time “savings” accounts involves a decrease in the demand for money balances (Keynes’ fallacious liquidity preference curve), and that this shift will be reflected in an offsetting increase in the velocity of money”. His conjecture was correct up until 1981 – up until the plateau of financial innovation for commercial bank deposit accounts (the sweeping monetization of commercial bank time “savings” deposits). The saturation of DD Vt according to Chicago Professor Marshall D. Ketchum: Ketchum: “It seems to be quite obvious that over time the demand for money cannot continue to shift to the left as people buildup their savings deposits; if it did, the time would come when there would be no demand for money at all”. Thus, as Professor emeritus Pritchard predicted in May 1980 issue of IMTRAC (a publication by Dr. Christopher Y. Thomas), began the secular decline in money velocity (and secular strangulation) as money velocity climaxed in the 1st qtr. 1981, from the “time” bomb (savings deposit’s), resulting in a 19.1 % 1st qtr. 1981 N-gNp figure: monetaryflows.blogspot.com/fred.stlouisfed.org/series/MZMVfred.stlouisfed.org/series/A001RP1A027NBEAAs Dr. Pritchard proposed in the late 1950’s: “Savings require prompt utilization if the circuit flow of funds is to be maintained and deflationary effects avoided…The growth of time “savings” deposits shrinks aggregate demand and therefore produces adverse effects on gDp…The stoppage in the flow of funds, which is an inexorable part of time-deposit banking, would tend to have a longer-term debilitating effect on demands, particularly the demands for capital goods.” The remuneration of IBDDs exacerbates this reversal in the savings-investment process (hence QE’s muted impact), i.e., it destroys money velocity (where savings are matched with borrowers and investments). While velocity, Vi, has increased since the 2nd qtr. of 2017, it won’t be offsetting (and it won’t last). Money flows contract in the first qtr. of 2018 (which will cause an equity sell off). However, inflation contracts for the entire first half of 2018. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:06:37 GMT -5

The question is not whether net earnings on CD assets are greater than the cost of the CDs to the bank; the question is the effect on the total profitability of the commercial banking system. This is not a zero sum game. One bank’s gain is less than the losses sustained by the other banks in the System. The whole (the forest), is not the sum of its parts (the trees), in the money creating process. See the Fed’s propaganda in their own "Bible": by R. Alton Gilbert (retired senior economist and V.P. at FRB-STL) – who wrote: “Requiem for Regulation Q: what it did and why it passed away”, 2/1986 Review. files.stlouisfed.org/files/htdocs/publications/review/86/02/Requiem_Feb1986.pdfDr. Gilbert asked the wrong question. His implicit and false premise was that savings are a source of loan-funds to the banking system. Gilbert assumed that any potential primary deposit (funds acquired from other CBs within the system), were newfound funds to the banking system as a whole. Thereby in his analysis, Gilbert also assumes that every dollar placed with a non-bank deprives some commercial bank of a corresponding volume of loanable funds. Gilbert asked: Was the net interest income on loans/investments derived from "attracting" these savings deposits (viz., outbidding other CBs), greater than the interest attributable to the direct and indirect operating expenses of retail and this wholesale "funding"? |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:07:57 GMT -5

Commercial bank-held savings/investment accounts reduce money velocity and effective monetary demand, or AD. The interest-bearing character of the deposits results in the larger proportion of commercial bank deposits in the interest-bearing category. These DFI deposit classifications are an excellent device for the banking system to reduce its aggregate profits. It is hard for the average person to believe that banks do not loan out savings or existing deposits – demand or time deposits. However from a system’s belvedere, the DFIs always create the money by making loans to, or buying securities from the non-bank public. See: BOE “Working Paper No. 529 - “Banks are not intermediaries of loanable funds —and why this matters” by Zoltan Jakab and Michael Kumhof bit.ly/2sphBHDThis results in a double-bind for the Fed. If it pursues a rather restrictive monetary policy, interest rates tend to rise. This places a damper on the creation of new money but, paradoxically drives existing money out of circulation into the stagnant savings deposits. In a twinkling, the economy begins to suffer. The bank lending channel thus does not represent the credit channel nor the interest rate channel nor intermediated credit. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:09:38 GMT -5

It is a confusion of stock vs. flow (Nobel Laureate Dr. Milton Friedman was “one-dimensionally confused”). He pontificated that: “I would (a) eliminate all restrictions on interest payments on deposits, (b) make reserve requirements the same for time and demand deposits”. Dec. 16, 1959.

Since time/savings (investment) deposit classifications originate within the commercial banking system, there cannot be an “inflow” of time (savings) deposits and the growth of time deposits cannot per se increase the size of the banking system. In the politics of life, the ABA is public enemy #1.

Net changes in Reserve Bank credit (since the 1951 Treasury-Reserve Accord) are predetermined by the policy actions of the Federal Reserve. Note: the Continental Illinois bank bailout provides a spectacular example of William McChesney Martin Jr.’s “bartending” (net free or net borrowed reserve positioning).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:11:31 GMT -5

All savings originate within the framework of the payment's system. The source of commercial bank time "savings" deposits, is demand deposits, directly or indirectly via the currency route, or thru the DFI's undivided profits accounts. An increase in time/savings deposit account classifications depletes transactions deposits by an equivalent amount - and the source of demand deposits can largely be accounted for by the concomitant expansion of commercial bank credit.

Saver-holders never transfer their savings outside the system, unless they hoard currency, or convert to other national currencies. DFIs pay for their new earning assets, from the standpoint of the payment's system (macro-economics), by creating new deposits, not by using existing ones.

Whether the public saves, dis-saves, chooses to hold their savings in a DFI, or transfers their savings through a NBFI (invest directly or indirectly), does not determine the lending capacity of the DFIs. The lending capacity of the DFIs is determined by monetary policy, not the savings practices of the non-bank public. The DFIs could continue to lend even if the non-bank public ceased to save altogether.

The use or non-use of savings held by the commercial banks is a function of the velocity, not the volume, of their deposit liabilities. The parameters of economics are not those of mathematics – the whole is much larger than the sum of its parts. The decisions of the public to invest their bank-held savings will not, per se, change the aggregate liabilities, or the existing assets, of the payment’s system. The expansion of time “saved” deposits adds nothing to N-gDp.

The oligarchic redistribution of savings deposits (derivative deposits from a system’s perspective), thru the attraction of savings (primary deposits to the recipient bank), un-necessarily increases that particular commercial bank’s costs, without a concomitant increase in income.

Therefore all bank-held savings are un-used and un-spent, lost to both consumption and investment (indeed to any type of expenditure or payment)- until their owners spend/invest directly or indirectly via non-bank conduits. All bank-held savings are never activated when so held, and never put back to work, completing the circuit income velocity of funds.

Voluntary savings require prompt utilization if the circuit flow of funds is to be maintained and the deflationary effects avoided. This is the sole and unique source of both stagflation c. 1965, and secular strangulation c. 1981.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:32:59 GMT -5

The proposition is quite simple. The redistribution of income in a capitalistic society is about the redistribution of the upper income quintiles' savings. It is not about gov't taxation and any distribution of those funds, and borrowed funds, to non-productive recipients. The U.S. Golden Era in economics was where savings were largely put back to work into real-investment outlets (affordable single-family housing), and the pooled savings utilized by the non-banks were insured, negating deposit runs (the exact opposite of today's policies).

The expiration of the FDIC's unlimited transaction deposit insurance is prima facie evidence. Hence my forecast on 12-16-12, 01:50 PM “Jan-Apr could be a market zinger” was yet another “predictive success”, a precursor of the upcoming reversal in the flow of funds (the subsequent "taper tantrum" was a misnomer).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Nov 26, 2017 9:37:36 GMT -5

The mind boggling errors of macro have very dark and sinister pasts.

Historical FDIC's insurance coverage deposit account limits:

• 1934 – $2,500

• 1935 – $5,000

• 1950 – $10,000

• 1966 – $15,000

• 1969 – $20,000

• 1974 – $40,000

• 1980 – $100,000

• 2008 – $unlimited

• 2013 – $250,000

Thus, “in a twinkling…” R-gDp is swallowed up." Vt has historically been almost 3 times as important as money.

This isn’t the 1974 “case of missing money” (the upsurge in Vt), nor is it: “[t]he biggest surprise in the US economy this year has been inflation” (downswing in Vt) – Janet Yellen 2017.

Nonetheless oil has hit $57 / barrel (as Vi has accelerated in the 2nd, 3rd, and 4th qtrs. of 2017.

DFI’s Time deposits vs. demand deposits:

1939........15~~~~~~ 33

1954........47~~~~~ 121

1964......126~~~~~ 156

1974......421~~~~~ 274

1979......676~~~~~ 401

1986...1,215~~~~~ 491

1996...1,271~~~~~ 420

2006...3,696~~~~~ 317

2016...8,222~~~~1,233

Ratio of TD/DD in 1939 = 0.45

Ratio of TD/DD in 2016 = 6.67

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 26, 2017 11:58:43 GMT -5

The caveat is that supply side economics requires structural and attitudinal changes which will be zealously resisted by powerful special interest groups. bingo. the goal of the modern corporation (and their respective management) is not to lift up the masses. it is to accrete profit, assets, and power. if you cut my taxes 50%, i am not going to raise wages, nor am i going to increase productive capacity. why would i? the ONLY reason i will do so is IF I HAVE TO. what necessitates the need? demand. that is the ONLY thing that does it. the next question is: where does demand come from? if you are a B2B that has no middle class consumers in the chain, you are golden. otherwise, you are going to use that money for private jets, bonuses, and houses in Europe and Central America.  the money gets frozen into non-performing assets and taken out of the economy where all proper change happens. i know that OldCoyote will never believe me, because he thinks i am an ass. that's fine. but maybe he will believe you.

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 26, 2017 12:01:34 GMT -5

There is one all-important ingredient that the supply-siders ignore; namely that the demand for capital goods is a derived demand, derived from primary consumer demands. That even in a capitalistic system the end and objective of all production is human consumption. The demand for inventory or plant and equipment, however far removed from the ultimate consumer, is derived from final consumer outlays in the marketplace. Demand is always paramount in successful business planning and commitment decisions. If sufficient demand is not expected to exist, it matters not what the expected costs will be. "Sufficient" demand, of course, covers all costs plus and expected after tax profit margin. Supply-siders approach the demand side of the equation on a "trickle down" basis; build the plants and produce the goods, and demand will take care of itself. Supply creates its own demand. bingo, again. businesses don't commit outlays unless they are COMPELLED to do so by demand. i wish i were as articulate about it as flow5. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 26, 2017 13:37:47 GMT -5

The inflation average adjusted wages, brought down by lower paying jobs, which IMO is the bases for the entire " wage stagnation" argument. Have a good day.  ok, let's review. in the (45) years prior to 1973, REAL wages (adjusted for inflation) DOUBLED, and this created the most prosperous nation on Earth. since 1973, REAL wages have gone NOWHERE. if it is true that "low paying jobs" are the problem, there is a very simple and elegant solution: raise FMW.  |

|

thyme4change

Community Leader

Joined: Dec 26, 2010 13:54:08 GMT -5

Posts: 40,879

|

Post by thyme4change on Nov 26, 2017 16:48:13 GMT -5

Company growth and increased profits don't often help the already employed, regular worker. It may increase payroll, but that doesn't mean they increased wages.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 26, 2017 18:12:42 GMT -5

The inflation average adjusted wages, brought down by lower paying jobs, which IMO is the bases for the entire " wage stagnation" argument. Have a good day.  ok, let's review. in the (45) years prior to 1973, REAL wages (adjusted for inflation) DOUBLED, and this created the most prosperous nation on Earth. since 1973, REAL wages have gone NOWHERE. if it is true that "low paying jobs" are the problem, there is a very simple and elegant solution: raise FMW.   Exactly! Increasing supply (in this case $$) creates demand! I'm happy you finally agree. Especially because you have repeatedly said you would increase demand for homes with your tax breaks. (Increased SUPPLY of money) Increasing wages without tax breaks (ie) EMTR study) however, is futile. Why? Because as you have stated time and again, it's about profits. So an increase in costs needs to be offset, especially if it's mandated through a minimum wage. In the case of minimum wages and forced wage increases in industries with razor thin margins (were the majority of low paying jobs exist) and prices can't increase very much without a reduction in demand; we could be talking about detriment to the business . This is especially true when talking about small corporations and sole proprietorships. (As is the case with the Calgary restaurant study). |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 26, 2017 22:59:30 GMT -5

ok, let's review. in the (45) years prior to 1973, REAL wages (adjusted for inflation) DOUBLED, and this created the most prosperous nation on Earth. since 1973, REAL wages have gone NOWHERE. if it is true that "low paying jobs" are the problem, there is a very simple and elegant solution: raise FMW.   Exactly! Increasing supply (in this case $$) creates demand! I'm happy you finally agree. Especially because you have repeatedly said you would increase demand for homes with your tax breaks. (Increased SUPPLY of money) um...no. i never said that "increased supply creates demand". i know i didn't say it because i don't believe it. what i said is that increased disposable income creates economic growth. oh, and i said that it would create increased demand for homes outside the US by rich people like me. so, yeah, that is great news for Europe and Central America, but it won't do a damned thing for the US. if you are claiming that others WILL buy houses here, you are right. that is probably true. but it won't make up for the continuing deterioration of the middle class which has no end in sight. if you disagree, please explain why. i am prepared to listen to that argument. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 26, 2017 23:06:03 GMT -5

Increasing wages without tax breaks (ie) EMTR study) however, is futile. Why? Because as you have stated time and again, it's about profits. So an increase in costs needs to be offset, especially if it's mandated through a minimum wage. In the case of minimum wages and forced wage increases in industries with razor thin margins (were the majority of low paying jobs exist) and prices can't increase very much without a reduction in demand; we could be talking about detriment to the business . This is especially true when talking about small corporations and sole proprietorships. (As is the case with the Calgary restaurant study). whew. i don't even have the time to dissect this one. but increasing FMW doesn't change profitability, because businesses will respond to it by raising prices. and before you go telling me how this is inflationary and that wage earners will end up back where they started, this is also false. there is about a 10% impact of wage pricing in the low paying industries such as hospitality. in other words, if you double wages, the prices go up 10% to cover it IN THOSE INDUSTRIES. the general economic impacts are much lower- about 2%. so if you double the FMW, you can expect about a 2% inflationary impact. and nobody, even that commie Obama, was talking about raising FMW 100%. only Sanders was talking about anything that radical. but the economic impact for those wage earners is profound: poverty plummets and disposable income soars. in addition, welfare drops, because there are fewer poor to give it to. so, the best way to get government out of the welfare business is to reduce the need for welfare. tell you what. how about you stop pretending that i am agreeing with you?  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 27, 2017 1:22:54 GMT -5

Exactly! Increasing supply (in this case $$) creates demand! I'm happy you finally agree. Especially because you have repeatedly said you would increase demand for homes with your tax breaks. (Increased SUPPLY of money) um...no. i never said that "increased supply creates demand". i know i didn't say it because i don't believe it. what i said is that increased disposable income creates economic growth. oh, and i said that it would create increased demand for homes outside the US by rich people like me. so, yeah, that is great news for Europe and Central America, but it won't do a damned thing for the US. if you are claiming that others WILL buy houses here, you are right. that is probably true. but it won't make up for the continuing deterioration of the middle class which has no end in sight. if you disagree, please explain why. i am prepared to listen to that argument. Exactly, increase the SUPPLY of disposable income, increases GDP(DEMAND). But don't worry, just like when you asked me to ignore what you were posting on your Economic Miracle thread, I'll ignore that you continue to prove my points here. Just like I'll ignore that minimum wage in 1973 was about $1.70 and they are approaching $11-15 now. Meanwhile social spending has exploded during that time. I'll ignore these facts alone proves everything you've said in your post above about minimum wages increase, inflation and GDP wrong. In fact I'm going to completely ignore this thread once again because my points have been proven ad nauseum in this discussion, as I mentioned. Also, as mentioned, the US isn't heading towards recession as we speak, as some on this thread have claimed; and I have listed to ppl who were pissed off at the current political situation tell me the US has been headed for a disaster for... well since I've been posting on these boards. While they have continued to be wrong, my Economics and trends are holding up nicley. So, please carry on without me. I'm board and have plenty of things I'd rather do than have my points proven for me; while not even being realized that's what happening. the best way to avoid disillusionment is to avoid illusions  |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 27, 2017 2:07:24 GMT -5

um...no. i never said that "increased supply creates demand". i know i didn't say it because i don't believe it. what i said is that increased disposable income creates economic growth. oh, and i said that it would create increased demand for homes outside the US by rich people like me. so, yeah, that is great news for Europe and Central America, but it won't do a damned thing for the US. if you are claiming that others WILL buy houses here, you are right. that is probably true. but it won't make up for the continuing deterioration of the middle class which has no end in sight. if you disagree, please explain why. i am prepared to listen to that argument. Exactly, increase the SUPPLY of disposable income, increases GDP(DEMAND). that is not the way that i was taught supply and demand in school. those discussions were centered around commodities. when i manufacture a widget, there will need to be a purchaser on the other end. if it turns out that there are more purchasers than i have widgets, in a PERFECT MARKET the price will go up until one of the buyers drops out. money is the preferred exchange tool for ANY transfer of ownership. it is not the thing that is in "supply" any more than oxygen is part of the transaction. in short, i think you are conflating disposable income with "supply" to try to make it seem like i am agreeing with you, which i am not. and i spoke imprecisely before: increasing disposable income does not necessarily increase GDP. as i mentioned earlier, it is common for rich folks like me to buy expensive art, foreign goods, and investments with our extra $$, none of which contribute meaningfully to the US economy. if you increase disposable income of the POOR, however, that can be quite stimulating. unfortunately, the tax proposals that are on the table right now don't do that. they will therefore fail to generate much economic stimulus, but they will be great for me, so i am not really complaining for myself. i am, however, lamenting the impact it will have on the US economy as a whole, which will be to reduce economic turns of capital. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 27, 2017 2:27:45 GMT -5

um...no. i never said that "increased supply creates demand". i know i didn't say it because i don't believe it. what i said is that increased disposable income creates economic growth. oh, and i said that it would create increased demand for homes outside the US by rich people like me. so, yeah, that is great news for Europe and Central America, but it won't do a damned thing for the US. if you are claiming that others WILL buy houses here, you are right. that is probably true. but it won't make up for the continuing deterioration of the middle class which has no end in sight. if you disagree, please explain why. i am prepared to listen to that argument. Exactly, increase the SUPPLY of disposable income, increases GDP(DEMAND). But don't worry, just like when you asked me to ignore what you were posting on your Economic Miracle thread, I'll ignore that you continue to prove my points here. Just like I'll ignore that minimum wage in 1973 was about $1.70 and they are approaching $11-15 now. first of all, FMW is $7.25, ok? it might be $11-15 for you guys, but it most certainly is not for us. secondly, adjusted for inflation, that peak in 1973 was over $10. so, yeah, FMW has fallen 30% in real terms, which has created a huge amount of hardship in the US. please don't ignore that.  |

|