djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 20, 2017 10:56:09 GMT -5

While it's not a popular situation, the trickle down was felt in China and other places more than in the USA. This in turn created demand in what is now the second largest economy in the world - which has the largest consumer base on the planet. Wages have been rising in China which has started to drive the trend of reshoring. now this point i somewhat agree with. since there was no demand at home, investment was offshored, which helped build economies elsewhere. and while this is a good thing for the world, i think many would argue that our tax policy should focus on the US as beneficiaries. if some Chinese person becomes successful at the EXPENSE of some American because of that policy, i am guessing that most Americans would have issue with that. to paraphrase: supply side economics creates jobs, but not here. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 21, 2017 19:25:27 GMT -5

the real problem (for the US, in terms of GDP growth) is that wages have not kept up with productivity. that is worth a long discussion, but i think it takes us pretty far from OldCoyote 's question. edit: i don't think corporate tax cuts will stimulate demand, for the record. why would they? where does demand come from? it comes from the bottom, not the top. this whole discussion ends up sounding like Marie Antoinette. I think productivity in the US and in the "Western World" in general is grossly over stated. The amount of product we consume which is produced overseas has - IMO - skewed those numbers. Lower corporate taxes gives business more capital to invest. More capital to invest is a tenet of demand side economics, right? The other side of the coin, if we look at the restaurants in Calgary as a case study, high taxes is driving the closure of business as much as lower foot traffic is. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 21, 2017 19:41:05 GMT -5

While it's not a popular situation, the trickle down was felt in China and other places more than in the USA. This in turn created demand in what is now the second largest economy in the world - which has the largest consumer base on the planet. Wages have been rising in China which has started to drive the trend of reshoring. now this point i somewhat agree with. since there was no demand at home, investment was offshored, which helped build economies elsewhere. and while this is a good thing for the world, i think many would argue that our tax policy should focus on the US as beneficiaries. if some Chinese person becomes successful at the EXPENSE of some American because of that policy, i am guessing that most Americans would have issue with that. to paraphrase: supply side economics creates jobs, but not here. Agreed; supply created jobs, and it's been this way since we have been free to invent products and invest capital. (nobody knew they needed and electric ice box, a Radio, a car, etc, etc... until someone created the supply) Bigger picture; as economies grew around the world demand for food/energy from North America did as well. As people in foreign countries increase their wealth, they travel and buy property; creating more work(demand) in North America. Eventually, as countries became more affluent wages began to rise which in turn created jobs elsewhere.(Reshoring) Where classical economic theory failed was explaining over supply and consumption. The debt binge of the 1920's was not understood properly, therefore the idea that government needed to stimulate the economy(demand) was able to take hold. From this concept, the idea the lower class needed to be continuously stimulated grew, and now demand side economics has left us with the largest debt bubble the world has ever seen. Unfortunately, the reality of economics is that regardless of how bad things get, a clearing level needs to be obtained so a regular(equity based) economic cycle can start over. Trying to stimulate demand through government spending was a failure when Rome tried it, and it's failed in every form since then.(Daily stipends have never worked) |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 21, 2017 22:53:38 GMT -5

the real problem (for the US, in terms of GDP growth) is that wages have not kept up with productivity. that is worth a long discussion, but i think it takes us pretty far from OldCoyote 's question. edit: i don't think corporate tax cuts will stimulate demand, for the record. why would they? where does demand come from? it comes from the bottom, not the top. this whole discussion ends up sounding like Marie Antoinette. I think productivity in the US and in the "Western World" in general is grossly over stated. The amount of product we consume which is produced overseas has - IMO - skewed those numbers. Lower corporate taxes gives business more capital to invest. More capital to invest is a tenet of demand side economics, right? The other side of the coin, if we look at the restaurants in Calgary as a case study, high taxes is driving the closure of business as much as lower foot traffic is. have you run a business, Aham? the reason i ask is that i have run six of them, and i can't remember a single occasion where i used POST TAX DOLLARS for investing in my OWN business. why? because i can use PRETAX DOLLARS and save about half the money insodoing! it is HORRIBLY tax inefficient to use post-tax dollars for business purposes. therefore, i use them exclusively for myself- buying houses around the globe. i am not alone. every rich person i now does it. why? because they are good, solid appreciable assets, and because once owned, you can have an incredible lifestyle associated with it. if i want to invest $1,000,000 in my business, i will ALWAYS do it before taxes. i will NEVER do it after. therefore, the tax rate i would be paying is irrelevant. the only relevant factor is how much cash i have, and whether or not i can make more money on it in my business than outside of my business (ROI). that's it. edit: from my standpoint, lower corporate taxes DISCOURAGES business investment by reducing this "penalty" for private wealth gain. if that comment doesn't make sense, let me know. if you have a different experience, i would like you to share it, because i can't understand why anyone would think any differently than this. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 22, 2017 0:24:30 GMT -5

Further, as in the Calgary restaurant case study, if your looking at REDUCTIONS in your run rate, the amount of free cash flow chewed up by taxes might be the determining factor on if you keep the business open or not. So, in that case higher tax kills business and REDUCED demand further by killing jobs.

Honestly, the only business people I have ever seen saying they don't care about tax on their businesses are ppl like Buffet and Soros...

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 22, 2017 10:01:30 GMT -5

that not the question i am asking.

nobody likes to pay taxes, Aham. this is like asking a kid "do you care if i just give you your allowance for NOT doing your chores?" very few kids will say YES to that question. the ones that do are acting NOT in their self interest (or, in the case of corporations, in the interests of the corporation to do NON productive things with cash, such as stock buybacks).

the question is this: if we lower your taxes, will you invest in jobs and equipment? this is the supply side question.

when you ask that question, very few will say YES. if you don't believe me, i can PROVE it.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 22, 2017 20:57:01 GMT -5

There is nothing to prove, dj. You have already proven/stated that capital expenditures have income tax breaks that come along with them. Flip it around and see how much investment in equipment there would be if those income tax deductions were eliminated... Also; when wind, solar and EV demand wasn't strong, what was the response to stimulate demand? Tax deductions/incentives. Investment in equipment is one area of business resources, another being wages; which you have already stated that lack of increase in wages has been a problem in the US economy. This study - carried out over 15 years - clearly outlines how lower marginal taxes raised wages, keeping them level kept wages stagnant and raising them decrease wages: taxfoundation.org/economic-growth-corporate-tax-rate/The best part - IMO - is the summary. Since the time of Smith it has "been shown taxes stifle the incentive for individuals to work, take risks, and buy and sell goods..... research should focus on quantifying the tax burden on business and individuals, and the extent to which each type of tax affects economic incentives." On that point; you actually destroyed your own argument of wealthy people not spending 10x when you talk about real estate. Wealthy individuals spend - at one time - as much on houses, boats, cars, paintings, watches, etc; as some people make over months, years, decades; even their lifetime. Every asset purchased - to a varying degree - helps aggregate demand. Not to pile on, but another point to supply creating demand: during the 1990's the economic boom was fueled by technology. A brand new supply of products and innovation hit the market which spawned new industries that were essentially science fiction up until that point(even more so now). It's also a classic example of how over consumption(excessive demand) focused into once sector caused irrational expectations, and eventually lead to an economic bust. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 1:42:20 GMT -5

the best incentives are pretax. i take all of them that make sense. of course, if i am not making money, i don't take ANY.  i still say that demand is bottom up, not top down. i can build 100 factories, but unless i have 2400 people to buy my machines, i am wasting my money. the only companies that would profit from the investment are those that sold me the equipment. i would be as in debt as Oklahoma by the time i was done. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 1:50:31 GMT -5

On that point; you actually destroyed your own argument of wealthy people not spending 10x when you talk about real estate. Wealthy individuals spend - at one time - as much on houses, boats, cars, paintings, watches, etc; as some people make over months, years, decades; even their lifetime. Every asset purchased - to a varying degree - helps aggregate demand. that was not what i meant by "consumption". durable goods are not the same as consumer goods. what i meant is food, clothing, and transportation- the stuff of life. that is the kind of consumption that drives an economy. having 1000 rich guys buy yachts is not going to make nearly the difference of having 1M people dining out, or buying a new dishwasher, even if the $ are the same. there are going to be way more people employed, HERE, by the latter than the former. but the other thing is that rich guys like me can only buy so many yachts. the smarter ones invest it- often in non-productive vehicles like art, or buying stuff from other rich people. i am betting you know all of this. i am just pointing out the obvious. |

|

OldCoyote

Senior Associate

Joined: Dec 21, 2010 10:34:48 GMT -5

Posts: 13,449

|

Post by OldCoyote on Nov 23, 2017 8:20:07 GMT -5

There is nothing to prove, dj. You have already proven/stated that capital expenditures have income tax breaks that come along with them. Flip it around and see how much investment in equipment there would be if those income tax deductions were eliminated... Also; when wind, solar and EV demand wasn't strong, what was the response to stimulate demand? Tax deductions/incentives.Investment in equipment is one area of business resources, another being wages; which you have already stated that lack of increase in wages has been a problem in the US economy. This study - carried out over 15 years - clearly outlines how lower marginal taxes raised wages, keeping them level kept wages stagnant and raising them decrease wages: taxfoundation.org/economic-growth-corporate-tax-rate/The best part - IMO - is the summary. Since the time of Smith it has "been shown taxes stifle the incentive for individuals to work, take risks, and buy and sell goods..... research should focus on quantifying the tax burden on business and individuals, and the extent to which each type of tax affects economic incentives." On that point; you actually destroyed your own argument of wealthy people not spending 10x when you talk about real estate. Wealthy individuals spend - at one time - as much on houses, boats, cars, paintings, watches, etc; as some people make over months, years, decades; even their lifetime. Every asset purchased - to a varying degree - helps aggregate demand. Not to pile on, but another point to supply creating demand: during the 1990's the economic boom was fueled by technology. A brand new supply of products and innovation hit the market which spawned new industries that were essentially science fiction up until that point(even more so now). It's also a classic example of how over consumption(excessive demand) focused into once sector caused irrational expectations, and eventually lead to an economic bust. Excellent point,, |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 10:47:18 GMT -5

There is nothing to prove, dj. You have already proven/stated that capital expenditures have income tax breaks that come along with them. Flip it around and see how much investment in equipment there would be if those income tax deductions were eliminated... Also; when wind, solar and EV demand wasn't strong, what was the response to stimulate demand? Tax deductions/incentives.Investment in equipment is one area of business resources, another being wages; which you have already stated that lack of increase in wages has been a problem in the US economy. This study - carried out over 15 years - clearly outlines how lower marginal taxes raised wages, keeping them level kept wages stagnant and raising them decrease wages: taxfoundation.org/economic-growth-corporate-tax-rate/The best part - IMO - is the summary. Since the time of Smith it has "been shown taxes stifle the incentive for individuals to work, take risks, and buy and sell goods..... research should focus on quantifying the tax burden on business and individuals, and the extent to which each type of tax affects economic incentives." On that point; you actually destroyed your own argument of wealthy people not spending 10x when you talk about real estate. Wealthy individuals spend - at one time - as much on houses, boats, cars, paintings, watches, etc; as some people make over months, years, decades; even their lifetime. Every asset purchased - to a varying degree - helps aggregate demand. Not to pile on, but another point to supply creating demand: during the 1990's the economic boom was fueled by technology. A brand new supply of products and innovation hit the market which spawned new industries that were essentially science fiction up until that point(even more so now). It's also a classic example of how over consumption(excessive demand) focused into once sector caused irrational expectations, and eventually lead to an economic bust. Excellent point,, only if the investments stand on their own merits. nobody invests JUST to save taxes. the investment has to perform as an asset, or nobody will make it. or i should say "only an idiot will make it". as i said on the other board, the only way i invest in your job is if i can make money off you. period. if the government wants to create a tax incentive for doing it, that's just ducky. i will take that money, too. but i won't create the job unless i can make money off you. and to go further, i would make the investment whether i was given the tax incentive or not. the US economy has added hundreds of millions of jobs since the corporate tax rate went to 35% because there was sufficient demand in the economy to create those jobs. in other words, it starts with the NEED to create that job (and the money to do it), not with the tax incentive. edit: depreciation allowances are pretax. so, the taxfoundation article actually proves MY point.  |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 13:00:07 GMT -5

i have another point about this.

the offshoring of investment has little or nothing to do with taxes, but rather the cost of labor. and the reason why makes perfect sense. let's take my main business, for example (the business from which i derive half my current income).

this business has a 50% gross margin and a 25% cost of labor. our average labor rate is well over $20/hr. therefore, my cost of labor is about 1%/$/hr. if i were to move operations to China, my labor cost would fall about 75%, which would increase my gross and pretax margin by about 20%.

my margin before taxes is about 10%. if i offshore to China, my margin before taxes is 30%. even if my effective tax rate is 75% in China, i am still way ahead by moving there, because the labor costs are so low (assuming that i can get the same productivity in China, and that it would not be an impediment to manufacturing and selling product, neither of which is true, but is a separate issue). in fact, the tax rate in China is about 25% (about the same as here), and Chinese government takes 51% of your operations. so, yeah, it really is like a 75% tax- but you STILL see companies moving there like gangbusters.

i am sure that all of this sounds like "blah blah blah" to you guys. i am just telling you that there is no way in hell i am moving to China or India, but if i were to do so, taxes would be so far down the list that it could be considered irrelevant to my decision. i doubt that most businesses are any different.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 23, 2017 21:40:09 GMT -5

Dj, I don't know why you keep referring to pretax incentives. Deductions are always pretax, that's what makes them deductions.... The point of deductions for capital expenditures wasn't that people make them JUST for the tax breaks, it's that lowering taxes is incentive for investment; which helps make the choice to invest in growth easier.(this is why I included the green tech point) Lower taxes leading to more investment is what you're trying to argue against... so no, the tax foundation article doesn't prove your point, at all. Nice try though.  As far as consumption, yes I do understand what you're saying. But yachts, houses, watches, etc all have to be made(to the point about your factory comments) All this provides jobs which drive durable goods. Reselling/remodeling houses involves lawyers, real estate agents, bankers, contractors, etc... (jobs) Further; boats, houses, cars, etc; all need to be maintained, again this drives durable goods. Plus, those with disposable income are the ones that regularly eat out, go to shows, travel, etc... all providing service sector jobs and driving the economy. (Which is what I meant by adding to aggregate demand to varying degrees.) As far as you post on cost of labour. Exactly!! COST. It's all about costs in business; and yes, taxes are part of cost. So if the cost of taxes goes down, there is more cash for investment! Thank you again for proving the point that lowering taxes gives more money for businesses to invest, as the tax foundations article outlines nicely. Bottom line; an economy can't be built from the bottom up (Unless you are talking about taking everything from wealthy people and redistribution.) You even said so yourself dj, you're not creating a job unless it benifits your business. So, what? It's up to the government to create a bunch of usless jobs with tax money to benefit business? Even in this is the case, the money still has to come from the top down because the fact of the matter is a lot of lower income folks end up paying no tax. (tax breaks for 30% are essentially impossible) It's all about balance. Providing a solid foundation for an economy to grow is the best way to build an economy, and that is what the rule of law does(which should be to sole purpose of government in the economy). Why? Poverty levels have stayed the same since 1965, while social spending has exploded and income inequality has gotten worse (which proves that even when the government tries to be Robin Hood it does nothing). Honestly, the whole point is to start at the bottom and build yourself up; and there are so many life stories of people in North America that prove this is possible it's not even funny anymore.  |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 22:32:57 GMT -5

happy thanksgiving, Aham!!! (before i forget!)

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 22:37:25 GMT -5

Dj, I don't know why you keep referring to pretax incentives. you can also get a direct tax deduction (tax credit). that is way different than a w/o. but what i am talking about is having your tax rate influence your buying decisions. think of it this way: if your tax rate were 0%, then buying things as an expense or deduction would be pointless. therefore, the HIGHER the tax rate, the GREATER the incentive to take the deduction. when the rate drops to 0%, the government loses all leverage. if you are buying stuff AFTER you pay the taxes, you are stupid. that is my only point. and if you are the government, you are decreasing the incentive for buying BEFORE you pay taxes by lowering the rate. please tell me how my logic is flawed. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 22:39:14 GMT -5

Bottom line; an economy can't be built from the bottom up (Unless you are talking about taking everything from wealthy people and redistribution.) no, i am talking about providing** disposable income to those that will spend it rather than save it. and it is precisely how economies are built. well, not so much in the US since 1973, but in most other places and times. **i am not suggesting that the guv-mint do it. i am only suggesting it needs to happen. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 22:46:52 GMT -5

Even in this is the case, the money still has to come from the top down because the fact of the matter is a lot of lower income folks end up paying no tax. (tax breaks for 30% are essentially impossible) It's all about balance. Providing a solid foundation for an economy to grow is the best way to build an economy, and that is what the rule of law does(which should be to sole purpose of government in the economy). Why? Poverty levels have stayed the same since 1965, while social spending has exploded and income inequality has gotten worse (which proves that even when the government tries to be Robin Hood it does nothing). Honestly, the whole point is to start at the bottom and build yourself up; and there are so many life stories of people in North America that prove this is possible it's not even funny anymore.  1) almost everyone who works pays taxes. (according to your article, the number is less than 10%) 2) poverty rates fell until 1973, when wages stopped growing. and yeah, they have risen since then, because wages have not gone anywhere, even though productivity is up about 50%. there are a lot of systemic problems in the US economy. tax rates have also fallen since 1973, so the (federal) government is doing LESS "robin hooding" since that time, not more. NOTE: i am not making a case FOR wealth distribution, merely pointing out that you didn't make an effective case against it. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 23:07:21 GMT -5

PS- Aham- i appreciate the fact that we can talk about things without insulting each other. if i come off as a grumpy bastard it is because i am a grumpy bastard, not out of any animus for you (i have none).

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 23, 2017 23:38:43 GMT -5

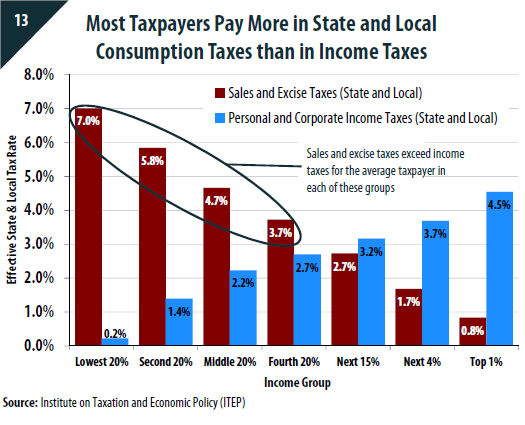

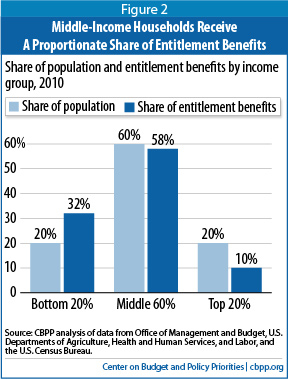

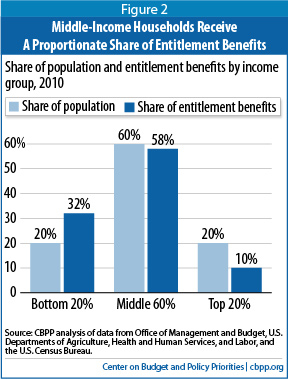

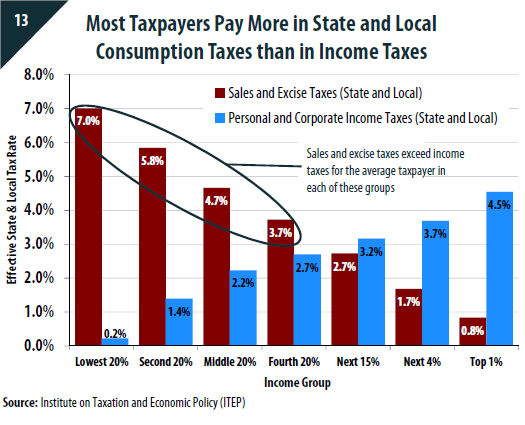

Thanksgiving was a month and a half ago.  Happy Thanksgiving! NP, on the discussion. I enjoy a good debate with a fellow grouchy bastard.  Your logic is flawed on taxes because the point of the discussion is that lower taxes gives companies more money to invest and grow, and it's already been shown that lower marginal rates helps raise wages. So, if the rate were 0% it would give companies more cash to increase disposable income, drive growth in the economy and increase profits. Which also solves the disposable income to lower tax brackets issue you have pointed out. You might want to look at the tax bracket article again I'll post the graph:  Everyone in the right pays no income tax and only 18% have a positive tax total. Another chart which shows poverty has been essentially "stagnent" since about 1966, regardless of money spent on the problem through "disposable income distribution."  So, where we agree is that all people deserve their shot at prosperity, and that disposable income grows the economy. Now, all you have to do is admit that money has to "trickle down" from the top.  |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 23, 2017 23:53:08 GMT -5

Thanksgiving was a month and a half ago.  Happy Thanksgiving! NP, on the discussion. I enjoy a good debate with a fellow grouchy bastard.  Your logic is flawed on taxes because the point of the discussion is that lower taxes gives companies more money to invest and grow, and it's already been shown that lower marginal rates helps raise wages. So, if the rate were 0% it would give companies more cash to increase disposable income, drive growth in the economy and increase profits. Which also solves the disposable income to lower tax brackets issue you have pointed out. You might want to look at the tax bracket article again I'll post the graph: i looked at it before i posted. i couldn't make sense of the 18% that pay "no payroll tax". every employed person in the US pays payroll tax. i don't really have time to research where they got that, but if you can figure it out let me know. i ASSUMED that they were referring to the WFP, which means that 18% are NOT WORKING. and that is correct. but that also doesn't contradict what i said earlier: that virtually all working people pay taxes. the figure is actually higher than stated, because it doesn't include sales taxes and excise taxes, both of with disproportionately affect the poor. but i didn't feel like being a dick and saying that "even non-working people pay taxes". i would appreciate it if you would not ask me to do so.  edit: and it is not correct to assume that if corporations paid NO tax that they would spend it on their employees or other "positive economic activity". they need to produce shareholder value, and that is not done by increasing costs. so, the chances are that they would hoarde the money, use it for stock buybacks, for M&A activity, for dividends, bonuses, or offshore it, none of which creates job or wage growth in the US. but let's try to just stick to the tax argument for a moment, and see if we can sort THAT out. what corporations do with their excess reserves is a far more nebulous debate. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 24, 2017 0:03:15 GMT -5

your second graph is kinda deceptive. i found this at another site: When you adjust for inflation, the U.S. spent 74 percent more on social welfare programs in 2007 than it did in 1975, but the programs that have seen the biggest budget increases aren't helping the poorest Americans. That's according to a study scheduled for publication next year in the academic journal Demography, and which has already been making headlines this month.

The research was conducted by Johns Hopkins University economics professor Robert Moffitt, who presented his findings earlier this month at an annual meeting of the Population Association of America. He found that a family of four earning $11,925 a year in 2014 likely gets less government aid than a same-sized family bringing home $47,700. so, yeah, it makes sense that poverty is still high, given that those that get the most aid are not living in poverty. in other words, simply dividing the total aid by the total number of those in poverty is blurring the picture, since those in poverty are getting less than half of the aid.  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 24, 2017 20:53:47 GMT -5

Thanksgiving was a month and a half ago.  Happy Thanksgiving! NP, on the discussion. I enjoy a good debate with a fellow grouchy bastard.  Your logic is flawed on taxes because the point of the discussion is that lower taxes gives companies more money to invest and grow, and it's already been shown that lower marginal rates helps raise wages. So, if the rate were 0% it would give companies more cash to increase disposable income, drive growth in the economy and increase profits. Which also solves the disposable income to lower tax brackets issue you have pointed out. You might want to look at the tax bracket article again I'll post the graph: i looked at it before i posted. i couldn't make sense of the 18% that pay "no payroll tax". every employed person in the US pays payroll tax. i don't really have time to research where they got that, but if you can figure it out let me know. i ASSUMED that they were referring to the WFP, which means that 18% are NOT WORKING. and that is correct. but that also doesn't contradict what i said earlier: that virtually all working people pay taxes. the figure is actually higher than stated, because it doesn't include sales taxes and excise taxes, both of with disproportionately affect the poor. but i didn't feel like being a dick and saying that "even non-working people pay taxes". i would appreciate it if you would not ask me to do so.  edit: and it is not correct to assume that if corporations paid NO tax that they would spend it on their employees or other "positive economic activity". they need to produce shareholder value, and that is not done by increasing costs. so, the chances are that they would hoarde the money, use it for stock buybacks, for M&A activity, for dividends, bonuses, or offshore it, none of which creates job or wage growth in the US. but let's try to just stick to the tax argument for a moment, and see if we can sort THAT out. what corporations do with their excess reserves is a far more nebulous debate. No, they grow business through increasing profits. They increase profits by increasing consumption of their products. As you are aware as a business owner, as your business grows you have to eventually hire more people, which further drives demand for products. Again, it's been studied and proven that lower marginal rates produce higher wages, so there is no reason to think that with no taxes there wouldn't net benefits to the working class. Of course there would be buybacks, dividends and M&A; especially from very large companies that have started to stagnate. However, if you think about it like this, with no tax there is no need for offshore tax havens. There is no need to keep money parked over seas due to tax levies for money brought in from doing business in foreign countries. All that extra cash in the economy would - without a doubt - add to aggregate demand and again be a net benefit to the working class. As you have pointed out, as of now, China and India have essentially no competitive advantage over North America. (Ironic because affluent Chinese ppl prefer foreign products) This is exactly what I have outlined a couple times now with reshoring. So, at this point in time, there is massive incentive to invest capital in the largest economy in the world; and we can see that with recent deals made for large manufacturing facilities in the US that came with sweetheart tax deals. Sure, there is going to be automation in these factories, but fixing and programming automation pays well. Another interesting hypothetical to consider, social spending has essentially "kept the population at bay." If we eliminate social spending, all of a sudden it's on the corporate world to keep people happy. I'm pretty sure you were getting at something similar to this point when talking about how wages have gone nowhere since 1973... On the point of no payroll taxes though, yes I agree the 18% is ppl not working. What my point is, with 18% not paying income or payroll, and 9% at zero or negative, the only tax breaks that would help them would have to be an across the board tax that would benefit all tax brakets, eg) sales tax.   |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 24, 2017 21:03:31 GMT -5

your second graph is kinda deceptive. i found this at another site: When you adjust for inflation, the U.S. spent 74 percent more on social welfare programs in 2007 than it did in 1975, but the programs that have seen the biggest budget increases aren't helping the poorest Americans. That's according to a study scheduled for publication next year in the academic journal Demography, and which has already been making headlines this month.

The research was conducted by Johns Hopkins University economics professor Robert Moffitt, who presented his findings earlier this month at an annual meeting of the Population Association of America. He found that a family of four earning $11,925 a year in 2014 likely gets less government aid than a same-sized family bringing home $47,700. so, yeah, it makes sense that poverty is still high, given that those that get the most aid are not living in poverty. in other words, simply dividing the total aid by the total number of those in poverty is blurring the picture, since those in poverty are getting less than half of the aid.  "Likely" eh? Those are convincing words in a study for sure.. Considering the data is available for extrapolating:   |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 11:53:30 GMT -5

your second graph is kinda deceptive. i found this at another site: When you adjust for inflation, the U.S. spent 74 percent more on social welfare programs in 2007 than it did in 1975, but the programs that have seen the biggest budget increases aren't helping the poorest Americans. That's according to a study scheduled for publication next year in the academic journal Demography, and which has already been making headlines this month.

The research was conducted by Johns Hopkins University economics professor Robert Moffitt, who presented his findings earlier this month at an annual meeting of the Population Association of America. He found that a family of four earning $11,925 a year in 2014 likely gets less government aid than a same-sized family bringing home $47,700. so, yeah, it makes sense that poverty is still high, given that those that get the most aid are not living in poverty. in other words, simply dividing the total aid by the total number of those in poverty is blurring the picture, since those in poverty are getting less than half of the aid.  "Likely" eh? Those are convincing words in a study for sure.. Considering the data is available for extrapolating:   this actually pisses me off. why should anyone making over $100k get ANY federal benefits? this actually proves my point, and does so in a really irritating way. edit: it makes perfect sense that federal benefits should disproportionately go to the poor. they need them. that doesn't bother me at all. does it bother you? your chart shows that 2/3 of aid goes to the top 80%. that is stone cold stupid if we are trying to eliminate poverty. so, i guess we aren't trying to do that. i don't understand that at all. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 12:08:25 GMT -5

No, they grow business through increasing profits. They increase profits by increasing consumption of their products. huh? how does that work? this is like saying that you gain weight by buying more food. no, you gain weight by EATING more food. i can't encourage my customers to buy more by making more money. i guess i am not following you, because this makes no sense. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 12:11:01 GMT -5

Again, it's been studied and proven that lower marginal rates produce higher wages, so there is no reason to think that with no taxes there wouldn't net benefits to the working class. i have never seen any study that shows that lower marginal rates lead to wage growth. do you mind providing a link? |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 12:12:56 GMT -5

On the point of no payroll taxes though, yes I agree the 18% is ppl not working. What my point is, with 18% not paying income or payroll, and 9% at zero or negative, the only tax breaks that would help them would have to be an across the board tax that would benefit all tax brakets, eg) sales tax.   i actually agree with you, here. the way to get consumers to spend more is to reduce consumption taxes. but we have not really been discussing consumption taxes here, have we (before now)? |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Nov 25, 2017 12:33:10 GMT -5

People making over 100k a year receiving benifits would be in the form of social security. Which they paid into. Are you going to give up you social security? It doesn't bother me that lower income people receive the most from welfare, no. It bothers me when it's abused, which there are cases. It bothers me more that our political establishment keeps doing the same thing over and expecting a different result. Just throwing money at the problem isn't working and it's just getting more expensive.. aka diminished returns. That is actually a terrible analogy, sorry. If you buy more food I get more money, I don't care if you eat it or not. You increase demand through advertising. As demand grows your business increases wages and hiring, which in turn increases demand for products. The link is posted above, you even stated you read the link. So yes, technically you have seen a study that proves a lower marginal rate increased wages. The entire discussion has been on lower taxes, more money in the economy leading to stronger growth. So, thanks for agreeing - once again - that lower taxes/incentives leads to increased growth.  |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 13:31:00 GMT -5

People making over 100k a year receiving benifits would be in the form of social security. Which they paid into. Are you going to give up you social security? actually, i have no problem with that. but i was not thinking of SS when i made this comment. |

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Nov 25, 2017 13:33:53 GMT -5

The entire discussion has been on lower taxes, more money in the economy leading to stronger growth. So, thanks for agreeing - once again - that lower taxes/incentives leads to increased growth.  sorry, i was not speaking so broadly. i was referring specifically to income taxes. not consumption taxes. not investment taxes. JUST income taxes, ok? and no. i bloody well do NOT agree that cutting them has economic benefits to anyone other than the group who has their taxes cut. which is fine, as i said on another thread. the quicker this bill passes, the quicker i can buy some real estate outside the US.  |

|