bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 9, 2014 10:09:55 GMT -5

MMXV-Beta agrees with the editor of WSJ: MMXV-Beta projection is 20,265.7224439136.  should read 10/09/2015 or 15 months Future projections are based on dynamic broadest money M3 with correlation of 64.468549623613600%  That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865% That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865%

Just a thought BiMetalAuPt  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 9, 2014 23:27:36 GMT -5

You Mean the sane WSJ that missed the dot-com bust and the housing disaster.   A few more people taking about that economy thing that was have been talking about since Jan. No these aren't doom and gloom, end of America gold bugs... Heck  even perma bulls are calling looking at "the stall". Looks like it's getting close to buying time.   Why this bullish pro sees big market drop soon Why this bullish pro sees big market drop soon |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jul 9, 2014 23:31:55 GMT -5

You got it all figured out? Yet

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 9, 2014 23:58:17 GMT -5

If you would have actually read anything I have been posting over the last 18 months.. You know, like how got egg all over your face with the whole margin debt conversation?  Slow and steady US growth...  10 states with the fastest-growing economies 10 states with the fastest-growing economies |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jul 10, 2014 5:31:26 GMT -5

Bond bubble next? Ied s just waiting to go off. You know yellow and her " macroprudential "

policys . Qe4 dead ahead.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 10, 2014 9:09:00 GMT -5

Hahaha, the US has been refinancing debt at half of what it was. I guess you missed that the FED will have exited by Oct and that the US jobs numbers were, again, very good today. It's called interest on excess reserves. Bond bubble, hahaha...  |

|

AgeOfEnlightenmentSCP

Distinguished Associate

Joined: Dec 21, 2010 11:59:07 GMT -5

Posts: 31,709  Favorite Drink: Sweetwater 420

Favorite Drink: Sweetwater 420

|

Post by AgeOfEnlightenmentSCP on Jul 10, 2014 10:47:57 GMT -5

MMXV-Beta agrees with the editor of WSJ: MMXV-Beta projection is 20,265.7224439136.  should read 10/09/2015 or 15 months Future projections are based on dynamic broadest money M3 with correlation of 64.468549623613600%  That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865% That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865%

Just a thought BiMetalAuPt  I will bet you a house in Indiana that this doesn't happen. |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 10, 2014 15:52:44 GMT -5

MMXV-Beta agrees with the editor of WSJ: MMXV-Beta projection is 20,265.7224439136.  should read 10/09/2015 or 15 months Future projections are based on dynamic broadest money M3 with correlation of 64.468549623613600%  That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865% That is WSJ estimate of 20,000 is within Standard Deviation of 19.6313045865%

Just a thought BiMetalAuPt  I will bet you a house in Indiana that this doesn't happen. But I Live in Midland,TX: The area is good for another 50 Billion Barrels of WTI and 2,000 Trillion cubic feet of methane. M3 should hit 22 Trillion USD at 15% growth by 9/30/2015. We have A DEPRESSION IN THE PIIGS AND WAR IN THE MIDDLE EAST Pioneer Natural Resources Co. (PXD) -NYSE Following 224.14 Down 1.90(0.84%) 4:03PM EDT EOG Resources, Inc. (EOG) -NYSE Follow 114.96 Down 1.60(1.37%) 4:02PM EDT Spectra Energy Corp. (SE) -NYSE Follow 42.66 Up 0.10(0.23%) 4:01PM EDT DO YOU THINK SOME ONE NOTICED: T. BOONE & ME!! TO FIGHT WITH THE FEDERAL RESERVE & USD.     BiMetalAuPt |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 18, 2014 23:20:55 GMT -5

FOR THE OCT 18/2014 DEAL BRA KING BUYS: RISK (RIDK).. 1111.66215705588UPSIDE TIL Oct 18, 2015: 3325.57244391362HOW ABOUT UPSIDE FOR 10 18 2015: UPSIDE /DOWNSIDE PER MMXV-BETA! 299.1531575313%

Just a thought from MMXV-BETA BioMetalAuPt  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 19, 2014 14:02:55 GMT -5

So we are going to get to 2015 like we were talking about, eh?

Considering the margin debt in the market...

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 19, 2014 17:19:41 GMT -5

RIDK 1216.56625247833 20487.3278223232 UPSIDE 3387.1478223232 DJIA UPSIDE/RISK 278.4186899335% SD DJIA: 19.8076735001% SD DJTSM : 24.0598985% forecast for DJTM Oct 19 .2015 18252.3321309056 projected loss 2383.51786909435

DJIA and DJTUA numbers were created mutuly independently. Most of that effect on the ISV was SD. Correlation of DJIA to M3: 64.563195748749300% Correlation of DJTS to M3: 55.909426426496800% Looks like a bubble in the Dow Jones Total US stock market more then the DJIA! Current numbers just ran weekly data block for week ending 7/18/2014: block from data block with only close numbers.Value is by Intrinsic value of cash flow related to beta. Just a thought,' BiMetalAuPt  |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 19, 2014 18:01:47 GMT -5

So we are going to get to 2015 like we were talking about, eh? Considering the margin debt in the market... Looks like the vast biotech bubble, internet bubble and small cap accelerator could see a correction. Did you see my numbers. SD of 24.06% could be a wild ride..... BiMetalAuPt |

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Jul 19, 2014 18:07:55 GMT -5

Bruce, where's the best place to put your money at? It doesn't look like bonds because they hold all of the Debt.

|

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 19, 2014 18:58:09 GMT -5

Bruce, where's the best place to put your money at? It doesn't look like bonds because they hold all of the Debt. ty3,  Kash is king! Kash is king!  I will argue that in times of black swans T-Bonds do well. Yes you pay for the insurance, like buying puts but that is the subject for DI. I own some 2020 30 year that have a 8.75% coupon. The total return has gone as low as 2.9%. I will give a better answer tomorrow on my new investment post. On the new system using ISV a 10% study of the DJIA... 07/19/14...........nyse.......... value pro ibm..................192.5...........349.4 hd....................80.08..........101.62 jnj...................101.8............127.41 total..................374.38..........578.43 factor n 1.545034457  Just a fast response, I am trying to develop a math-model to demonstrate Put and Call effect one risk off shifting and valuation in a delta = 0.00 system. You should see my Gamma. Now with reference TO Hull, Ed 9, Jan 2014 BiMetalAuPt  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 19, 2014 20:03:12 GMT -5

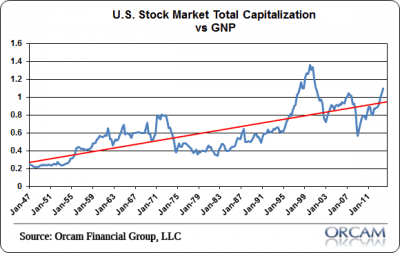

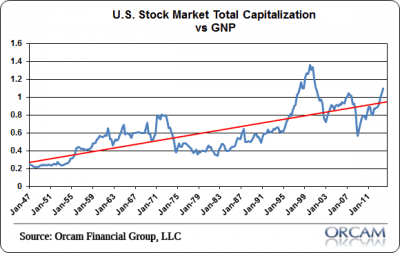

So we are going to get to 2015 like we were talking about, eh? Considering the margin debt in the market... Looks like the vast biotech bubble, internet bubble and small cap accelerator could see a correction. Did you see my numbers. SD of 24.06% could be a wild ride..... BiMetalAuPt  , Yes, it's looking like a very wild ride. The Russell P/E is just unreal! The VIX would have made ya close to 30% this week, talk about a rollercoaster.. I think Buffets GNP indicator(DJTA) is a very good market to economy indicator. The good news is that the New Development Bank means the west isn't going to have to spend, spend, spend to restore the global economy, and this time around everyone will finally have something to lose. I don't mind building a king kash pile that is for sure.  Hope you're having a good weekend, looking forward to your new study. God bless,  Oh ya your mail didn't get pushed through to my phone while we were gone. J and I will ttyl. |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 19, 2014 21:35:29 GMT -5

A++++,  and  Russell 2000 is way ahead of itself by some $131.37 (at Oct 19, 2015)  Correlation Russell 2000 to M3: 79.058354634653400% Oct 19/2015 forecast 1020.23675488541. Just a thought, BiMetalAuPt  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 19, 2014 23:27:38 GMT -5

BioMetal  , Sorry, I was talking about my oldest.  The future, future, Dr. A...(Yes, I decided on school, regardless of how long it takes.) The Russell: that's what I'm talking about. Now, if you're saying the DJTA is more bubbly than the IA... I'm saying that since the IA has a 50% draw from the global economy then the correlation to US GNP isn't as strong as in the past, but it would still be very much connected to the DJTA... Since the IA follows the TA... As you say, just some thoughts... God bless,   |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Jul 21, 2014 0:59:10 GMT -5

BioMetal  , Sorry, I was talking about my oldest.  The future, future, Dr. A...(Yes, I decided on school, regardless of how long it takes.) The Russell: that's what I'm talking about. Now, if you're saying the DJTA is more bubbly than the IA... I'm saying that since the IA has a 50% draw from the global economy then the correlation to US GNP isn't as strong as in the past, but it would still be very much connected to the DJTA... Since the IA follows the TA... As you say, just some thoughts... God bless,   NEGATIVE GAMMA IS BLOWING MY STOCK EQUITY HIGH BETA HOLDINGS APART: DELTA IS KILLING ME. THE GAME FROM HERE TO 10/20/2014 IS DEFENSE: LOW BETA, PUTS, SHORTS WITH COVERED PUTS!! WHERE IS D.I. WHEN YOU NEED HIM THE MOST?    |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 21, 2014 23:16:49 GMT -5

Speaking of defence.. NOC:NYSE has been an a tear since it was on sale there a couple months back... On guard for sure. I like the idea of an income for life annuity. I have been trying to get my in-laws to lock on down for 18 months now. Even more so now because there home value is at risk and the equity in that would provide great income. As you say, just a thought.  |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Sept 1, 2014 14:45:14 GMT -5

New 90 day (3 month) Permutation re-re-re derangement study ( alpha MMXV- Good Permutation Test)) correlation of M3 to DJIA....... 99.7573637580% forecast ..............................17394.4592572526(11-31-2014) Lamma ..............................99.989893530230% I read this to indicate buying from 10-31-2014 to 11-15-2014) stochastic cross of %K&%D from under 20% as a buy. ++ from the new Alpha MMXV study ( inspired by Springer Series in Statistics, Phillip Good, Permutation Tests, 14.2 Maximizing the Power; page 169-178.) Just a thought, BiMetalAuPt  |

|

jarrett1

Established Member

Joined: May 17, 2013 18:16:11 GMT -5

Posts: 426

Today's Mood: Mr. Lucki

Location: everywhere

|

Post by jarrett1 on Sept 2, 2014 8:35:16 GMT -5

C'mon guyz...S&P 2300 December 31 2014...Dow 18,000...what are you looking at

This is Not 1987..Not 1990...Not 1994...Not 1999...Not 2007...If you want a comparison

Tesla 80 times P/E vs most of the S&P & Dow 16-18 times...C'mon...the trend is your friend until it ends...this is not over...

|

|

usaone

Senior Member

Joined: Dec 21, 2010 9:10:23 GMT -5

Posts: 3,429

|

Post by usaone on Sept 2, 2014 9:39:31 GMT -5

Swimming in liquidity..........  Climbing a wall of worry......  Small investors have yet to enter this up cycle.......  |

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Sept 2, 2014 11:26:05 GMT -5

This time it might be a little different because the last 6 years has made it so the Small Investers have no money left to put into the Market. I'm talking about the Middle Class. There is a reason why GDP is only growing at 2% not the 4 to 5 % needed to make the normal recovery and the really good times roll. It's when this 2% becomes in trouble that we need to be really concerned. Are we getting concerned? JMO

|

|

usaone

Senior Member

Joined: Dec 21, 2010 9:10:23 GMT -5

Posts: 3,429

|

Post by usaone on Sept 2, 2014 12:54:30 GMT -5

This time it might be a little different because the last 6 years has made it so the Small Investers have no money left to put into the Market. I'm talking about the Middle Class. There is a reason why GDP is only growing at 2% not the 4 to 5 % needed to make the normal recovery and the really good times roll. It's when this 2% becomes in trouble that we need to be really concerned. Are we getting concerned? JMO I agree Ty. I'm all for a little less profit and more pay to the middle class. There needs to be a balance. That money will flow right back into the economy. |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Sept 2, 2014 14:21:46 GMT -5

J1,  Looking at 600 points run from 10/31/2014 to 12/31/2014  : just one great buying season  .  Remember 1929: a bull year to say the least: just look up the action of Nov 1929 and Dec 1929!!!!  Just a thought, Bruce  CORRELATION OF M3 TO DJIA VIA RE-RE-RE REARRANGING(PERMUTATION TEST)............ 99.7573637580% forcast 17394.4592572526 p1 (last)....17378.580000....(THIS WEEK) Lamma 99.944836189099% < 100% m3 Po 17404.06 > p1 forecast Po.... 17419.8183052772 ( past week) |

|