flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 21, 2014 17:43:50 GMT -5

davidstockmanscontracorner.com/

Comments by David Stockman

Lee Adler is on to something here. He assiduously tracks daily Federal tax collections and is struck by the fact that a winter that was wintery did not crimp the US Treasury’s haul—-which has been rising at double digit rates in recent weeks. But when you look under the hood, you can see the reverse-Robin Hood machinations of our monetary central planners diligently at work. To wit, income tax withholding was up about 18% on a year/year basis in recent weeks, while withholding for social insurance payroll taxes was up only 4.5%.

The latter tax falls on upwards of 150 million working people and is capped out at about $110,000. The former tax, as we learned from Mitt Romney, is not collected from the bottom 47% owing to tax credits like the EITC, family-based deductions from taxable income or the simple lack thereof. By contrast, the top 10 percent of households paid 71% of Federal income taxes in 2010; and now that Obama put his foot down on the top 2% in last year’s tax-cut for everyone else, the upper rung’s share currently being pocketed by the US taxman is doubtless even higher.

So, yes, the monetary politburo in the Eccles Building continues to pass out free money to the Wall Street gamblers and carry traders. And it promises to continue to so until mid-2015, meaning there will have elapsed about 80 months of free repo money since ZIRP incepted in late 2008. The truly mammoth gains from the resulting speculative mania will have gone to the hedge fund gamblers and social media company inventors that are riding these waves to flat-out lunatic valuations, but ”trickle down” is having its day, too.

Already, the value of household financial assets is up about $20 trillion from the 2009 crisis bottom or by 45%. While the top 10 percent own about 80% of these stocks, bonds, deposits, unincorporated businesses and partnerships etc., the care, feeding, churning and conspicuous burning thereof does “trickle down” to lawyers, accountants, the money management infrastructure, tony restaurants, resorts and recreation spots, the luxury goods trade, and also travel planners, estate planners, art collection planners, party planners and all the rest of the helpers. So they are kicking into Uncle Sam’s coffers, too.

But this isn’t evidence of a broad-based, pre-1987 style GDP recovery—of the kind that is frozen into the time-warp of Keynesian macro-economic models. The post-war Keynesian trick of “stimulating” GDP after a business downturn—which the Fed invariably caused by too much enthusiasm on the way-up—-worked because it essentially caused households to ratchet-up their leverage levels. That is, they permanently raised their ratio of total debt to wage and salary income. The latter rose from 80% in the days of William McChesney Martin’s sound money rectitude to a peak of 210% at the top of the last bubble in 2007; and the ratio still stands at a towering 180%, not withstanding nearly a trillion dollars of mortgage defaults, other credit write-downs and a smidgeon of genuine “deleveraging”.

But the bottom 90% of American households are stuck at “peak debt” and can no longer perform their assigned role as shop-until-you-drop “consumption units” in the great Keynesian scheme of borrowing our way to prosperity—otherwise known as “releasing pent-up demand” (by pushing the household debt ratchet higher). Stated differently, the so-called “credit channel” of monetary policy transmission is busted and can’t be revived: The baby boom is way too old to pay down its staggering debts and then start all over again in a new burst of the 1980-2007 style party of a lifetime.

So the only policy transmission channel left for the magic money printers at the FOMC is the “bubble channel”—that is, the one co-located in the canyons of Wall Street where carry traders accumulate ever higher mountains of “financial assets” and then fund them with free cost of goods (ZERO-COGS). The latter, of course, is obtained from the money markets, which the Fed has pegged at zero; and has also virtually guaranteed, upon the sacred honor of the state, that this blissful condition will not change without ample advance notice—at least to those adept at reading its words clouds.

So what Lee has spotted is most likely the Fed’s “bubble channel” at work, inflating the price of financial assets to nosebleed heights and generating a considerable wave of “trickle-down” income and bonuses to the next tier of vendors, helpers and care-givers who occupy the upper rungs of what has become “The Great Deformation” of capitalism in America.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 22, 2014 0:15:09 GMT -5

Two great articles you have posted flow. I would say that they outline two things very well. Interest rates are set to rise, without a doubt, and GDP growth will stay slow and steady for years to come. There maybe a surge due to another world conflict. But the underlying economy is going to take years to get back to a balanced capacity... Did you happen to catch this?? Sell Signal for Stocks Seen as Bears GrowlWhat you think??  |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 22, 2014 12:22:35 GMT -5

Right, big money bets that the market just topped out. Roc's in MVt may have just plateaued or maybe even peaked. Next release is very important. But my current take is that liquidity will be rising up until the next CB's reserve maintenance period. And Vt might be increasing just as the roc in the variable "M" slows or decreases (LIKE during the first half of 2013).

www.zerohedge.com/news/2014-03-21/who-just-dumped-220-million-nasdaq-futures-1-second

ZEROHEDGE: "At 10:27:21 ET, the Nasdaq 100 e-mini futures contract suddenly dropped on extreme activity as someone decided it was an opportune time to 3000 contracts or around $220 million notional. As Nanex notes, the ETF - QQQ - also collapsed (with over 1200 trades in 1 second) as bids and offers were crossed and markets went flash-crashy for a few tenths of a second" |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 22, 2014 12:37:41 GMT -5

See: www.federalreserve.gov/releases/h3/current/

Jan. 22, 2014

2,581,872 132,238 66,331 56,485 9,846 3,753,121 2,525,387 1,227,734

Feb. 5, 2014

2,592,105 141,180 70,676 61,368 9,308 3,757,478 2,530,737 1,226,741

Feb. 19, 2014

2,658,126 125,579 67,460 55,115 12,345 3,839,555 2,603,011 1,236,544

Mar. 5, 2014

2,669,919 141,766 64,206 55,166 9,040 3,865,841 2,614,753 1,251,088

Mar. 19, 2014

2,699,552 125,396 62,864 51,095 11,769 3,911,076 2,648,457 1,262,619

Notice that in the commercial banking system (where payments are cleared & settlements are netted), that the debit & credit activity oscillates in an alternating peak-to-trough pattern. Next release will show a higher figure. This figure might set up the trajectory for the entire 2014 year.

But this analysis is getting more complicated as now there are "penalty free bands" to watch, as well as "surplus and applied vault cash" to watch. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 22, 2014 12:39:28 GMT -5

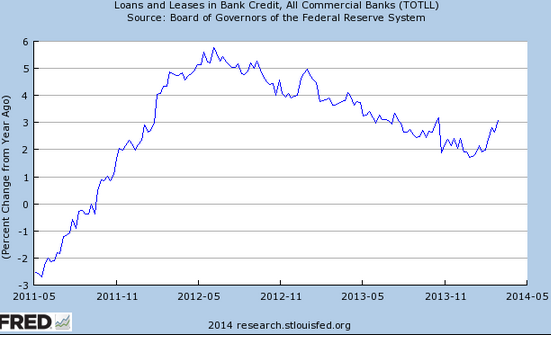

I have to find somewhere to get the ratio of non-bank to commercial bank credit on a timely basis. This will provide a Vt number.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 22, 2014 23:04:10 GMT -5

On guard! Eh?  You're talking something like this? Percent change at seasonally adjusted annual rates..... M1.........M2 3 Months from Nov. 2013 TO Feb. 2014.....................18.3........7.5 6 Months from Aug. 2013 TO Feb. 2014.....................13.4........6.6 12 Months from Feb. 2013 TO Feb. 2014...................10.4........6.3 M3 $17097.29 Billion up y/y 7.8% djia to m3 2009 to 2013 96.23155081% Now they worry Ms. Y is a hawk?  MMXVBETA SHOWS A CORRELATION m1 TO DJIA OF 0.76202252245374 OR 76.202252245374%. MMXVBETA SHOWS A CORRELATION m1 TO DJIA OF 0.76202252245374 OR 76.202252245374%.

BiMetalAuPt  Run up, until rates crate more high quality bonds for retirement? Like B says, there has been a lack of them for the lats 5 years. Of course there is always a possible "swan" sighting. Stay  flow. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 13:16:38 GMT -5

No, but if you subtract M-2 (less MMMFs), from M-3 (& added MMMFs to M3), then you could get a proxy (Vt ratio).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 13:25:40 GMT -5

Dr. Richard Anderson (senior V.P., & economist @ FRB-STL), gets it.

C. 2006:

"Today, with bank reserves largely driven by bank payments (debits), your views on bank debits and legal reserves sound right!"

c. 2006:

"Banks need central bank deposits for clearing checks and making other interbank payments, which gives the central bank leverage over money and bond markets.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 13:41:11 GMT -5

"The close relationship between the growth rates of required reserves and total checkable deposits reflects the fact that reserves requirements apply only to checkable deposits"

"to equate movements in required reserves with effective money creation"

"It is important to note that the $308.7 billion increase in total checkable deposits since QE2 occurred with only a $27.5 billion increase in required reserves. This reflects the relatively low effective reserves requirement on checkable deposits, apparently about 9 percent ($27.5/$308.7)"

See: bit.ly/yUdRIZ

research.stlouisfed.org/publications/es/12/ES_2012-02-03.pdf

Quantitative Easing and Money Growth:

Potential for Higher Inflation?

Daniel L. Thornton

--------------------------------

What's important though, it's not the money stock per se that reflects monetary policy, but the rate-of-change in legal (required reserves).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 13:58:55 GMT -5

Money grew at less than a 2 percent rate in the decade ending in 1964. In the nine subsequent years money supply grew at a rate in excess of 6.5 percent...

The problems originated from using the wrong criteria (interest rates as the FOMC's operating tool, rather than member bank legal reserves) in formulating & executing monetary policy. Net changes in Reserve Bank credit (since the Federal Reserve Accord of 1951) were determined by the policy actions of the Federal Reserve. But William McChesney Martin, Jr. changed from using a “net free” or “net borrowed” reserve position approach to the Federal Funds "Bracket Racket" c. 1965. Note: the Continental Illinois bank bailout provides a spectacular example of this practice.

See: Paul Meek's description of the FRB-NY's "trading desk" reverse repos in his 1974 booklet: "Open Market Operations". Therein, he described the same modus operandi that Paul Volcker supposedly first tried in 1979 (targeting non-borrowed reserves).

And: "the advantage of the auction facility (beginning in the 4th qtr of 2008), is the liberal rules regarding the types of assets that the discount window folks will accept as collateral -- including (gulp) certain CDOs. Such securities are not purchased by the Open Market Desk as it supplies non-borrowed reserves". There's a big difference between the type of securities that the Fed will accept at the Discount Window and at the Open Market Desk.

The effect of tying open market policy to a fed funds bracket is to supply additional (& excessive) legal reserves to the banking system when loan demand increases. Since the member banks have no excess reserves of significance, the banks have to acquire additional reserves to support the expansion of deposits -- resulting from their loan expansion. If they used the Fed Funds bracket (which was typical), the rate is bid up and the "trading desk" responds by putting through buy orders, free reserves are increased and soon a multiple volume of money is created on the basis of any given increase in costless legal reserves.

This combined with the rapidly increasing transaction velocity of demand deposits resulted in a further upward pressure on prices. This is the process by which the Fed financed the rampant real-estate speculation that characterized the 70's, et. al.

And 2013's latent rise in rates & fall in bond prices is related to the lagged method of calculating member commercial bank legal reserves - which enables bankers to act on the valid premise that they can make (& keep), any loan commitment, knowing that their legal (required), reserve requirements will be accommodated by the Fed. "Penalty Free Bands", "applied vault cash", interest rate manipulation, & paying interest on excess reserve balances, all combine to abdicate the Fed's "open market power" (control over the money stock).

Interest rates are the price of loan-funds, not the price of money. The price of money is represented by the various price indices.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 14:09:58 GMT -5

The effect of these "open market operations" on interest rates (now via the remuneration rate), is indirect, and varies widely over time, and in magnitude. What the net expansion of the money supply will be, as a consequence of a given injection of additional reserves, nobody knows until long after the fact. The consequence is a delayed, remote, & approximate control over the lending and money-creating capacity of the banking system.

The money supply (& commercial bank credit), can never be managed by any attempt to control the cost of credit (i.e., thru pegging the interest rate on governments; or thru "floors", "ceilings", "corridors", "brackets", or the remuneration rate on excess reserve balances, etc). In other words, Keynes’s liquidity preference curve is a false doctrine.

See: Scott Fullwiler | April 7, 2012 at 6:55 pm | Reply

I completely agree with your final sentence (!).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 14:16:56 GMT -5

That's how I denigrated Nassim Taleb's general theory of the "Black Swan" (the failure of circuit breakers and limits on high frequency trading) of May 6th 2010. I.e., I predicted the "flash crash" 6 months and within one day of the 1000 point swing.

As my favorite economist Dr. Richard Anderson always emphasizes: "All analysis is a model" - Ken Arrow

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 23, 2014 14:20:20 GMT -5

At the height of the Doc.com stock market bubble, Greenspan initiated a "tight" monetary policy (for 31 out of 34 months). A “tight” money policy is defined as one where the rate-of-change in monetary flows (our means-of-payment money times its transactions rate of turnover) is no greater than 2-3% above the rate-of-change in the real output of goods & services.

Greenspan then wildly reversed his “tight” money policy (at that point Greenspan was well behind the employment curve), & reverted to a very "easy" monetary policy -- for 41 consecutive months (i.e., despite 17 FOMC policy rate increases in the target FFR (June 30, 2004 until June 29, 2006), - every single rate increase was “behind the inflationary curve”). I.e., Greenspan NEVER tightened monetary policy.

Then, as soon as Bernanke was appointed to the Chairman of the Federal Reserve, he initiated a "tight" money policy (ending the housing bubble in Feb 2006), for 29 consecutive months, or at first, sufficient to wring inflation out of the economy, but persisting until the economy plunged into a depression). I.e., Bankrupt you Bernanke CAUSED THE GREAT RECESSION.

The FOMC continued to drain liquidity despite its 7 reductions in the FFR (which began on 9/18/07 until 4/30/08). I.e., despite Bear Sterns two hedge funds that collapsed on July 16, 2007, & immediately thereafter filed for bankruptcy protection on July 31, 2007 -- as they had lost nearly all of their value), the FED maintained its “tight” money policy (i.e., credit easing, not quantitative easing).

I.e., Bernanke didn’t initiate an “easy” money policy until Lehman Brothers later filed for bankruptcy protection (& it was one the Federal Reserve Bank of New York’s primary dealers in the Treasury Market), on September 15, 2008.

And Greenspan didn't start "easing" on January 3, 2000, when the FFR was first lowered by 1/2, to 6%. Greenspan didn't change from a "tight" monetary policy, to an "easier" monetary policy, until after 11 reductions in the FFR, ending just before the reduction on November 6, 2002 @ 1 & 1/4% (approximately coinciding with the bottom in equity prices).

I.e., Greenspan was responsible for both high employment (June 2003, @ 6.3%), & high inflation (rampant real-estate speculation, followed by widespread commodity speculation).

Bernanke then relentlessly drove the economy into the ground, creating a protracted un-employment, & under-employment rate, nightmare.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 24, 2014 9:59:52 GMT -5

Back to this eh? Well here's a nugget for ya. Your effectively saying the Ben B. should have bailed out Bear Sterns, Lehman, and all the other banks that came up with the sub prime debacle. You are saying that Ben B. should have printed and printed and printed in 2006 to "save" the US economy froma housing bust. You are effectively saying that there was no credit bubble created by decades of bad policy, which you outline above!!!!! In other words, you are saying one thing about policy, but another about the result. I was enjoying this thread.... I just love how its impossible that your wrong about Ben B.'s actions...  |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 25, 2014 12:47:47 GMT -5

NO, you should read David Stockman's book "The Great Deformation". He nailed the those crony culprits principally responsible for all the "regulatory malfeasance". Problem is that David Stockman doesn't understand monetarism. You actually have cause & effect wrong. I think Friedman's "rule" was right only in that the properly regulation of money flows will prevent undue and excessive speculation. I.e., the "administered" prices would not be the "asked" prices if monetary flows didn't validate them.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 25, 2014 16:10:55 GMT -5

I will read it for sure. But I don't think I am wrong about the cause because we are saying the same thing. Years of deregulation in the housing and finicial markets created a distorted marketplace. Where we differ, my friend, is Im not giving Ben B as much credit as you are. I also don't agree that puming money into the economy in 2006 would have saved anything. In fact, in the deregulated marketplace that was a massive bubble because of decades of bad policy, all that would have happened is the bubble would have gotten bigger. Then when that one went, whenever that would have been, it truly would have been the end of the world as we know it.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 26, 2014 12:35:13 GMT -5

The 2008 recession was already “baked in” by the FOMC’s policy actions in Dec 2007 (the trajectory for the roc in the 10 month proxy for real-output would inevitably prove contractionary - roc's less than zero). Paying interest on excess reserve balances was its coup de grace. Dr. Henry C.K. Liu predicted this “Repo Time Bomb”: www.atimes.com/atimes/Global_Economy/GI29Dj01.htmlAnd any institution whose liabilities can be transferred on demand, without notice, & without income penalty, via negotiable credit instruments, or data pathways, & whose deposits are regarded by the public as money, can create new money, provided that the institution is not encountering a negative cash flow. So the rogues (investment banks), needed some type of gov’t backstopping when they rolled-over huge volumes of short-term wholesale money market funding on a day-to-day basis (repurchase agreements & commercial paper, etc.), in their borrow-short to lend at higher: risks/rewards business’ plans. I.e., Bankrupt you Bernanke destroyed the savings->investment process, or non-bank lending/investing (which, pre-Great-Recession, represented 82% of the pooling & lending markets) – see: Z.1 release, sectors, e.g., MMMFs, commercial paper, GSEs, etc. |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 26, 2014 15:18:49 GMT -5

Ben B, destroyed the savings and investment cycle? Or did investment banks and consumers already do a good job of that themselves?  |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 26, 2014 19:26:20 GMT -5

The personal savings rate simply reflects real rates of interest (e.g., nominal minus CPI).

Never are the CBs intermediaries in the savings-investment process. CBs always create new money when they lend/invest (they never loan out existing deposits, saved or otherwise). The NBs are the conduits between savers & borrowers. Bankrupt you Bernanke destroyed NB lending/investing. Bankrupt you Bernanke induced dis-intermediation among just the NBs (where the size of the NBs shrinks, but the size of the CB system remains unaffected), i.e., just like raising Reg. Q ceilings in Dec 1965 caused an outflow of funds or negative cash flow for the thrifts (MSBs, S&Ls, & CUs).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 26, 2014 19:38:47 GMT -5

I.e., the source of all time/savings deposits to the CB system are other bank deposits, directly or indirectly via the currency route (& only temporarily), or thru the CB's undivided profits accounts. Never are the CBs intermediaries in the savings->investment process. Bank held savings are a leakage in Keynesian National Income Accounting (savings are impounded within the CB system). And savings flowing thru the NBs never leaves the CB system. I.e., the CBs pay interest to depositors for what they already own.

Redirecting the flow of savings thru the NBs lowers the overall term-structure of interest rates. It increases the supply of loan-funds. It increases CB & NB profits. It increases real-output. This is the source of the pervasive error that characterizes the Keynesian economics (the Gurley-Shaw thesis). |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 26, 2014 19:40:14 GMT -5

It began with the General Theory, John Maynard Keynes gives the impression that a commercial bank is an intermediary type of financial institution serving to join the saver with the borrower when he states that it is an “optical illusion” to assume that “a depositor & his bank can somehow contrive between them to perform an operation by which savings can disappear into the banking system so that they are lost to investment, or, contrariwise, that the banking system can make it possible for investment to occur, to which no savings corresponds.”

In almost every instance in which Keynes wrote the term bank in the General Theory, it is necessary to substitute the term financial intermediary in order to make the statement correct.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 26, 2014 20:47:50 GMT -5

The personal savings rate reflects how the "consumer unit" tapped itself out, as one of your previous post points out. It might not matter to CB's deposits and flows, but it really matters when it comes down to the general economy. AKA the general economy was tapped.

Here's what I don't understand, to me you seem to be saying that there wasn't a massive housing bubble and that these "financial" products that were backed by bad loans, weren't bad investment products. You seem to be saying that Ben B. should have injected money into a systemic system to keep the bubble growing, just so that the boomers could "get out".

You seem to be overlooking that, and this is from the FEDs minutes, they were saying that these investment banks need to be accountable for their actions. The only thing was, all these complex "financial products" were nothing but a black hole.. So yes, I'm sure they knew there was going to be a "fallout", however, they failed to understand the gravity of the situation Why do I keep saying this? Because the majority of financial professionals couldn't even explain what these "financial products" were!

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 27, 2014 9:54:57 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 27, 2014 10:18:06 GMT -5

I fix financial in the post above. Sorry about that... Yes exactly, it could have all been avoided, but here's the problem, Clinton decided that everyone should own a home. So when you tell everyone that its their right to own a home, they get a whipped up and think they "deserve" a home. I also agree that since 9/11 it has been one crap storm after another, it's hard for a business to make a long term choice when short term problems keep popping up. The next is of course going to make things mostly moot.   |

|

bimetalaupt

Senior Member

Joined: Oct 9, 2011 20:29:23 GMT -5

Posts: 2,325

|

Post by bimetalaupt on Apr 2, 2014 0:20:31 GMT -5

Ben B, destroyed the savings and investment cycle? Or did investment banks and consumers already do a good job of that themselves?  A+++,This chart. USA ism not the saving nation it used to be during WWII or after. Current Saving rate from FRED. 4.3% for Feb 2014 not great but better then 1.4 % for 2005!

<iframe src="//research.stlouisfed.org/d2/graph/graph-landing.php?g=vkN" scrolling="no" frameborder="0" style="overflow:hidden; width:670px; height:475px;" allowTransparency="true"></iframe>

<iframe src="//research.stlouisfed.org/fred2/graph/graph-landing.php?g=vkN" scrolling="no" frameborder="0" style="overflow:hidden; width:670px; height:475px;" allowTransparency="true"></iframe>

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 2, 2014 0:30:31 GMT -5

B,   It sure isn't. I would say that chart is a reflection of kids not listening to the advice of their parents. Yes, I also think things are changing for the better, but we are talking about a generational shift here... Also, this is some of that money flowing in the right direction... You gotta post the chart flow!   I guess I'm having a hard time understanding what people think should be happening right now, a boom?? I just don't get it?? Call me confused,   |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Apr 2, 2014 1:34:44 GMT -5

A+++,This chart. USA ism not the saving nation it used to be during WWII or after. Current Saving rate from FRED. 4.3% for Feb 2014 not great but better then 1.4 % for 2005! Reading when I should be sleeping, but I had to share this. Don't feel bad, look at the crap that people in Canada will be in once the next cycle kicks in... The charts!  Canada's Getting Richer. Most Canadians Aren't. Canada's Getting Richer. Most Canadians Aren't. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Apr 3, 2014 11:27:38 GMT -5

Keynes’ “optical illusion” today is much more obtuse than in yesteryears (the Gurley-Shaw thesis).

(1) The credit crisis of 1966 was induced by increases in Reg. Q ceilings for just the commercial banking sector (the only financial institutions that had ceilings). I.e., CB dis-intermediation was the result of the big money-center (NYC banks) not being able to roll-over their large CDs as they matured. This did not result in the CB system shrinking, but in the thrift’s size shrinking (the CBs just pay for what they already own).

(2)Then this was repeated as Reg. Q ceilings were phased out in the late 1980′s, early 1990′s, (which again induced dis-intermediation among just the non-banks – i.e., the 1990 S&L crisis where the FSLIC & RTC closed down 1/3 of all the S&L’s).

(3) The same error was repeated in Oct 2008, with the intro of the payment of interest on excess reserve balances at the CBs (in which Bankrupt you Bernanke destroyed the NBs).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Apr 3, 2014 11:32:43 GMT -5

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Apr 4, 2014 14:28:35 GMT -5

The latest release indicates that April 2014 will be a top in the stock market.

|

|