flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 7, 2013 15:34:19 GMT -5

The lags in monetary flows (representing our means-of-payment money times its transactions rate-of-turnover), have been mathematical constants for the last 100 years.

Rates-of-change (roc’s) in the proxy for real-output bottomed in Oct (a seasonal inflection point) and are set to rebound over and above the typical seasonal pattern. The first quarter of 2014 should show continued strength.

The declining roc’s in the proxy for inflation is due to bottom this month or next (gas prices reflect this continued deceleration).

Nominal-gDp growth in 2014 will thus be bolstered by both components (the proxy for real-output & the proxy for the inflation indices).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 11, 2013 12:32:46 GMT -5

Anticipating the music to stop will reverse QE's "churn". Reserve velocity will decline. But if "specials" are released, then rates could soften.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 11, 2013 12:37:55 GMT -5

Presumably, deposit credits (QE) are used to chase "riskier assets", e.g., stocks. And since for every buyer of stocks there is a seller, debits to brokerage accounts are eventually recycled as credits to the ultimate seller's bank accounts in the speculative chain.

I.e., the FRB-NY’s "trading desk” deposit credits are cashed, converted, & then the proceeds are returned to the commercial banking system (replenishing excess reserves), thereby leaving the total volume of IBDDs (interbank demand deposits) unchanged.

But as this demonstrates, wealth effect’s foray (via asset swaps), ultimately depends on reserve velocity (the spending of new & existing IBDDs, i.e., unless new money & credit is created thru record margin debt, etc.).

I.e., it's not based on levels, it's based on the simultaneous conversion (netting) of funds over the length of quantitative easing (a series of speculators paying successively higher prices). I.e., it seems that reserve velocity depends on the buyer always being able to convert his holdings, at ever higher prices, at some future date |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 23, 2013 12:46:57 GMT -5

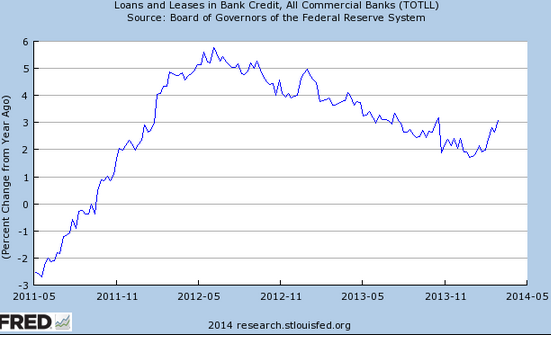

This is both a major economic reporting error as well as a major economic analytical error: Zerohedge, like most other professionals, continues to display a sub-group - loans & leases ($ 7,352b), not total CB credit which includes securities ($10,063b). And then again, CB credit on the FRED database (TOTBKCR) is also a sub-group. See: A Record $2 Trillion In Deposits Over Loans - The Fed's Indirect Market Propping Pathway Exposed www.zerohedge.com/news/2012-12-26/record-2-trillion-deposits-over-loans-feds-indirect-market-propping-pathway-exposedThe point being is that the DIDMCA provided the legal basis for the CUs & MSBs & S&Ls (thrifts) to literally become commercial banks (money creating depository institutions). The Federal Reserve Bank of St. Louis & the Board of Governors of the Federal Reserve System treats the CU's, & MSB's, & S&L's liabilities one way (adds them to the money supply classifications, M1 & M2, e.g., "Savings Deposits at Thrift Institutions" (SVGTI) are included in M2), but doesn't include their liabilities with CB credit. I.e., total loans & investments (CB assets) should be approximately equal to total CB deposits or liabilities (like between Sept 66 & Dec 1969, when the FOMC first began including a bank credit proviso clause in its directive). |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 26, 2013 15:44:36 GMT -5

By 1980 there were only 6 MSBs that could create new money. And the Fed's technical staff treated some IBDDs as money in for example, their H.6 release (where the MSBs were classified as intermediaries), and as correspondent balances on other publications (excess reserves).

Today, there are not 5,844 commercial banks as the FRB_STL's data base reflects; rather there are another 1,271 S&Ls, 7,094 CUs, & 361 MSBs which are also technically, commercial banks (with the capacity to create new money).

I.e., the 1980 DIDMCA legislation gave these institutions the power to create new money when they permitted the new instrumentality of negotiable order of withdrawals -NOW & automatic transfer services -ATS, accounts.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 27, 2013 11:17:27 GMT -5

There's no support after this seasonal rally, look out below! |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 27, 2013 17:42:16 GMT -5

Total increase in the volume of securities held outright on the Fed's balance sheet: H.4.1 since Oct 6, 2008 = $3,270,714 trillion dollars. Note this increase in SOMA securities is related to quantitative easing or the purchase of Treasury & MBS securities (or the reinvestment of maturing securities), by the FRB_NY's "trading desk" (our Central Bank).

Total increase in bank accounts included in M1 & M2 (less currency) since Oct 6, 2008 = $2,334,700 trillion dollars.

So bank money, relative to POMOs, grew by only .71 percent of all open market operations of the buying type. Whereas prior to Oct 3, 2008, any one dollar increase in excess reserve balances (due to POMOs) resulted in the multiplier (required reserves) expanding CB credit by 208 times.

See: bit.ly/yUdRIZ

Quantitative Easing and Money Growth:

Potential for Higher Inflation?

Daniel L. Thornton

Commercial bank credit (all loans + investments), increased by $1,074 trillion dollars during roughly the same period (from 7/30/2008 until 12/18/13). I.e., lending/investing by the CBs involves the creation of new money somewhere in the commercial banking system.

The cash-drain factor during this period = $381.7b The other principal drain on bank deposits during this period was from the increase in bank capital accounts (roughly $312b).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 27, 2013 17:54:49 GMT -5

2013-01 ,,,,, 0.169

2013-02 ,,,,, 0.154

2013-03 ,,,,, 0.156

2013-04 ,,,,, 0.15

2013-05 ,,,,, 0.136

2013-06 ,,,,, 0.073

2013-07 ,,,,, 0.088

2013-08 ,,,,, 0.072

2013-09 ,,,,, 0.075

2013-10 ,,,,, 0.018

2013-11 ,,,,, 0.068

2013-12 ,,,,, 0.092 rebound's over early unless Vt offsets the decline in M

2014-01 ,,,,, 0.066

2014-02 ,,,,, 0.041

2014-03 ,,,,, 0.065

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 28, 2013 11:58:34 GMT -5

Then when you subtract the money created by the CBs you get 39 percent on the dollar. I.e., out of every dollar of assets purchased by the FRB_NY's "trading desk", only 39 cents on the dollar could possibly have ended up as new money.

POMOs between the Reserve Bank (FRB-NY - our Central Bank) & the non-bank public (the only way new money could be created by the Reserve Bank:

......................... Reserve Banks

[+] U.S. Obligations...... [+] Demand deposits (banks)

........................ Commercial Banks

[+] Reserves................. [+] Demand deposits

It is assumed that the seller of the security received a deposit credit (after the seller cashes his check from the Reserve Bank).

The excess reserves of the CB typically increase less than total reserves, since the expansion of Reserve Bank credit causes an equal increase in the CB's deposit liabilities (i.e., depending upon the deposit classification, this may or may not increase the CB's required reserves - if it is "e-bound").

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Dec 28, 2013 12:58:25 GMT -5

Open market operations of the buying type only decrease or suppress short-term interest rates whenever the rate-of-change in money flows isn't on the upswing (the 24 month proxy for inflation). This is largely a reflection of inflation expectations (the expectation that price level will chronically increase injects an “inflation premium” into the yield curve). Paul Volcker’s experiment (using Paul Meek’s antiquated 1974 operating procedures), represents a spectacular example of this phenomenon. But the Fed's "open market power" has been emasculated. QE or POMOs (under the payment of interest on excess reserve balances), resulted in, at the very most, only 39 cents of every dollar of assets purchased by the FRB_NY’s “trading desk” being converted into new money. Prior to Oct 3, 2008, the expansion coefficient was 208 dollars of loans and investments for every dollar of assets purchased by the FRB_NY (the multiplier equals the base, i.e., required reserves, divided by commercial bank credit). To say the remuneration rate is a credit control device is an understatement. See: bit.ly/yUdRIZQuantitative Easing and Money Growth: Potential for Higher Inflation? Senior Economist: Daniel L. Thornton FRB_STL |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 7, 2014 17:01:21 GMT -5

In Praise of Art Laffer..."Usually when you find the model this far off, you’ve probably got something wrong with the model, not that the world has changed,” he said. “Inflation does not appear to be monetary base driven,” he said. krugman.blogs.nytimes.com/2014/01/03/in-praise-of-art-laffer/Friedman's "MB" has never been a base for the expansion of new money & credit. Just because the cash-drain factor (K-ratio), was relatively constant historically doesn't imply that currency had an expansion coefficient. In fact, any increase in currency held by the non-bank public was contractionary - unless (as was typical), it was offset by concurrent infusions of Reserve Bank credit. Currency ($1,166.10 trillion) held by the non-bank public is .31 percent of the "MB" ($3,730,532 trillion). Excess reserves ($2,428,716 trillion) are .65 percent of the "MB". Both are contractionary monetary components. That's why gold's falling and the U.S. exchange rate has been rising. |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 11, 2014 12:19:07 GMT -5

I am not an economist & don't necessarily give this enough thought, but prior to Oct 6, 2008, injections of excess reserves (via open market operations of the buying type), by the FRB-NY's "trading desk" resulted in an immediate response from commercial banking mangers to minimize their new, costless, non-earning assets (i.e., clearing balances and/or warehouse money). Obviously, any reduction in the remuneration rate would have to be orchestrated gradually.

In other words, the policy induced, yield curve inversion (at the short-end segment of the money market), would have to be gradually narrowed (assuming that: the shorter the duration of the Fed's preferential interest rate differential - then the greater the volume of wholesale funding that would be offered in the loan-funds market - in the proverbial borrow short, to lend long, business model).

The actual objective is to force savings to "leak out", or to provide an outlet for savings (incentivize savings to be matched with non-inflationary investment). This would also steepen the yield curve & thereby increase net interest rate margins (increasing both the CB's & NB's profits, as well as benefiting the overall economy by boosting real-gDp & increasing job growth).

The argument that by reversing this bad policy, it would set off a scramble for high quality assets (gov't securities), that would in turn, cause short-term interest rates to turn negative is problematic. Policy reversal would end up creating a balancing act for the Fed, i.e., between generating new inflation expectations (inflation is the largest factor determining the substantial substitutability of short dated vs. long dated interest rate levels), and the demand for the fiscal policy induced, “safe asset's shortage”.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jan 15, 2014 2:18:26 GMT -5

Then when you subtract the money created by the CBs you get 39 percent on the dollar. I.e., out of every dollar of assets purchased by the FRB_NY's "trading desk", only 39 cents on the dollar could possibly have ended up as new money. But the Fed's "open market power" has been emasculated. QE or POMOs (under the payment of interest on excess reserve balances), resulted in, at the very most, only 39 cents of every dollar of assets purchased by the FRB_NY’s “trading desk” being converted into new money. Prior to Oct 3, 2008, the expansion coefficient was 208 dollars of loans and investments for every dollar of assets purchased by the FRB_NY (the multiplier equals the base, i.e., required reserves, divided by commercial bank credit). To say the remuneration rate is a credit control device is an understatement. First, great thread flow! Above, exactly what we have Ben arguing about for the last year or so, lol...  A hole started to open in the fincial system in 2007 because of MBS, CDOs, CDSs, and tons of consumer credit in the form of houses maxed out for various reasons. That hole was plugged and the water has been slowly returning to the well. Bank earnings once again are confirming this. There have also been reports of MBSs becoming investment options once again. Once consumers money is flowing in that direction, M2 will start to expand at a faster rate.  |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 17, 2014 16:53:36 GMT -5

2014 looks like a good year. No major dislocations upward or downward:

2013-10 ,,,,,,, 0.02 ,,,,,,, 0.26

2013-11 ,,,,,,, 0.07 ,,,,,,, 0.29

2013-12 ,,,,,,, 0.10 ,,,,,,, 0.25

2014-01 ,,,,,,, 0.12 ,,,,,,, 0.30 temporary top (buy the seasonal dip)

2014-02 ,,,,,,, 0.09 ,,,,,,, 0.34

2014-03 ,,,,,,, 0.12 ,,,,,,, 0.29

2014-04 ,,,,,,, 0.11 ,,,,,,, 0.28

2014-05 ,,,,,,, 0.09 ,,,,,,, 0.32

See: Michael Ivanovitch | President, MSI Global

"The reason is that the bank lending to households – 41 percent of total consumer lending – has begun to take off after a long period of puzzling doldrums. It is currently growing at an annual rate of nearly 6 percent. ADDING TO THAT a 9 percent growth of NONBANK LENDING to consumers, the total consumer credit is soaring at an annual rate of 7.3 percent"

As the ratio of NB to CB lending increases, it signifies that Vt is increasing.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 18, 2014 16:43:18 GMT -5

soberlook.com/2014/01/how-bank-reserves-make-gap-between.htmlSomeone might actually catch up: Sober Look ________________________________________ How bank reserves make the gap between deposits and loans disappear Posted: 17 Jan 2014 02:06 PM PST Earlier this week, CNN Money ran a story on JPMorgan's quarterly results. Instead of focusing on the earnings, the author's (Stephen Gandel) discussed the fact that JPMorgan's loan-to-deposit ratio (LTD) hit a new low. FORTUNE: - The nation's largest banks are healthier than they have been in years. Someone, apparently, forgot to tell their loan officers. JPMorgan Chase reported its 2013 profits on Tuesday. The news was mostly good -- bottom line: $18 billion -- but there was one significant black spot, not just for the bank, but for the economy in general. A key lending metric, the ratio of the bank's loans-to-deposits, hit a new low. In 2013, JPMorgan on average lent out just 57% of its deposits. That's down from 61% a year ago and the lowest that ratio has been in at least a decade. Back in 2004, JPMorgan's loan-to-deposit percentage was as high as 88%. While JPMorgan's LTD is particularly low, the bank is by no means unique. As discussed earlier (see post), LTD in the US is at the lows not seen in decades. On an absolute basis the gap between deposits and loans is now at some $2.4 trillion and growing. This divergence seems completely unique to the post-financial crisis environment. Red = loans and leases, Blue = deposits (all commercial banks) As the CNN story suggests, there are a few possible explanations for this trend. Here are four of them. 1. Demand for credit remains weak due to economic uncertainty, large amounts of cash on corporate balance sheets, jittery labor markets, poor wage growth expectations, general unease with taking on debt, etc. 2. Regulatory uncertainty and tighter (and to some extent unknown) capital requirements are preventing banks from extending more credit. 3. Exceptionally low rates make some forms of lending unprofitable. 4. Banks are running unusually large excess reserve positions with the Fed that are "crowding out" lending. These reserves are effectively "loans" to the Fed paying 25bp, funded with bank deposits that pay near zero, creating riskless profits with zero regulatory capital requirement. There are arguments to be made for all four. The last one however is particularly intriguing because the $2.4 trillion gap between deposits and loans is a familiar number. The excess reserves in the banking system is now ... also around $2.4 trillion.

The chart below adds bank reserves held with the Fed to loans and leases - and the gap "disappears" (here we use total reserves vs. just the excess reserves, but the difference is not material to this trend.) Red = loans and leases + bank reserves, Blue = deposits (all commercial banks) Coincidence? Perhaps. But if there is any validity to the explanation #4 above, it would suggest that QE, which is directly responsible for the $2.4 trillion in excess reserves, was not helpful (and possibly harmful) to credit growth in the US.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jan 24, 2014 23:50:56 GMT -5

You monetary guys are so funny. You have to take off the 20/20 rear view glasses.  For instance, 5 years on from the worst financial crisis the USA has experienced since the Depression of the 1930's, there are still 15 states where deeply underwater foreclosures reign.. (Good thing investing in US real estate has become a hot market again, eh?) I have seen both you, Flow and BiMetal,(nothing but respect for the both of you) post time and again that the 2.4 Trillion that the banks are holding onto didn't make it into the economy because of the interest on extra reserves. My questions are, after the crash who would have got that money? They same people that have spent the last 3 years buying up properties, kash? Did it really not end up in the economy, or did it just not end up in the economy right away? Maybe it needed to be in reserve because it was helping to plug the massive hole that was complex financial products backed by housing? I mean, there was talk a few weeks back about how MBS are back as investment. You see, now that Ben B. has helped return some sort of stability to the US housing market after the disaster of '08, tapering can begin regardless of the credit squeeze in China. How? The FRB can eliminate the money paid on excess reserves and that 2.4 trillion the banks are holding can start flowing into the economy, slow and steady. They can modify loan requirements and millions of qualified buys that are having a hard time getting a mortgage under these really right conditions will now be home owners. We are talking a 2.4 trillion dollar stimulus package that actually goes directly into the economy and there will be a multiplier effect on that, right? China, Canada, and a handful of other places made it through the '08 finical crisis, there is no reason to think that with the solid foundation building in the USA, that it won't make it through another Asian one. Slow growth is better than no growth.   |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 27, 2014 13:09:14 GMT -5

As Greenspan pontificated in “The Map & the Territory”: “The laws of physics…once identified, rarely have to be revised”:

Rates-of-change (roc’s) in monetary flows (our means-of-payment money times its transactions rate-of-turnover), equal roc’s in all transactions in Irving Fisher’s “equation of exchange”: (MVt=PT). Roc’s in nominal-gDp are a proxy for all transactions.

The lags for monetary flows (MVt), i.e. the proxies for (1) real-growth, & for (2) inflation indices (for the last 100 years), have been mathematical constants. However, the FED's target (interest rates), is indirect, varies widely over time, & in magnitude. And stocks just sold off this January because the roc in MVt fell. This is inviolate & sacrosanct.

The remuneration rate is a credit control device. Why do you think the pundits say it will be raised to check inflation?

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Jan 27, 2014 13:11:41 GMT -5

All the boom/busts following the Great Depression were caused by monetary policy blunders. There are no exceptions.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jan 30, 2014 21:36:30 GMT -5

I'm not 100% sure why the pundits are saying it will be raised to check inflation, but I'm guessing it's because inflation will make things cost more. It would also be why rates are never constant? I agree that monetary blunders cause every boom and bust. As they say, it takes two to tango.   |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Feb 3, 2014 23:51:46 GMT -5

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Feb 7, 2014 18:34:31 GMT -5

Stocks are going up for a reason - the roc in MVt is now rising at a fast clip. Reserve simplification probably screwed things up (either penalty free bands disrupted the seasonals, weather created a latent demand, or the Fed's lost control by targeting interest rates).

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Feb 8, 2014 12:21:57 GMT -5

Keynes' liquidity preference curve (demand for money), is a false doctrine. There's a difference between the supply of money & the supply of loan-funds (between credit creators & credit transmitters). If the Fed raises the remuneration rate on excess reserve balances, it absorbs the non-bank's wholesale funding in their borrow short to lend long business model (inducing dis-intermediation among the NBs, & reducing or even contracting lending). And these unspent savings (savings impounded within the CBs), are a leakage in Keynesian National Income Accounting.

Monetary policy hasn't offset the decline in NB lending. And consumers haven't recovered from the economic collapse. Unfortunately, the correct solution is politically unacceptable.

Both (1) real-output & (2) inflation are now increasing (i.e., aggregate demand):

.........................

2013-10 ,,,,, 0.02 ,,,,, 0.26

2013-11 ,,,,, 0.07 ,,,,, 0.29

2013-12 ,,,,, 0.10 ,,,,, 0.25

2014-01 ,,,,, 0.16 ,,,,, 0.34

2014-02 ,,,,, 0.19 ,,,,, 0.46

2014-03 ,,,,, 0.22 ,,,,, 0.40

The rebound coming out of the 4th qtr has been accelerating. That's the reason why stocks have abruptly risen in the last 2 trading sessions.

The only tool at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be controlled is legal reserves. However, the Fed is bent on eliminating reserve requirements (see FSRRA of 2006: "the Board--as authorized by the act--could consider reducing or even eliminating reserve requirements, thereby reducing a regulatory burden for all depository institutions"). The money supply can never be managed by any attempt to control the cost of credit.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Feb 22, 2014 12:03:28 GMT -5

The Fed should be more concerned about deflation instead of potential inflation:

Release Date: February 21, 2014

For immediate release

The Federal Reserve plans to conduct a series of seven-day term deposit operations in March under the Term Deposit Facility (TDF) as part of the ongoing program of small-value offerings announced on September 8, 2010. These small-value operations are designed to ensure the operational readiness of the TDF and to provide eligible institutions with an opportunity to gain familiarity with term deposit procedures. The development of the TDF and the ongoing small-value TDF operations are a matter of prudent planning and have no implications for the near-term conduct of monetary policy.

The Federal Reserve plans to conduct four operations of seven-day term deposits in March with the individual operations held on March 3, March 10, March 17, and March 24. The first three operations will offer fixed-rate deposits with the rate set in advance at 26 basis points, as in previous TDF operations. The last operation will employ a floating-rate format, with the rate set equal to the sum of the interest rate paid on excess reserves (currently 25 basis points) plus a fixed spread of 1 basis point, resulting in an effective rate of 26 basis points.

Further details for each of the weekly operations will be announced nearer to the time of each operation, and additional information, including the steps that institutions must complete to be eligible to participate in term deposit operations are available at www.frbservices.org/centralbank/term_deposit_facility.html.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 17, 2014 16:33:06 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Mar 17, 2014 23:18:14 GMT -5

You gotta post the chart flow!   |

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 18, 2014 10:40:41 GMT -5

Mr. Market got scared last week - not. Stocks fluctuate as money flows fluctuate. Money flows oscillate as payments (bank debits), oscillate. This week's data will confirm the large delta.

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 19, 2014 17:20:02 GMT -5

|

|

tyfighter3

Well-Known Member

Joined: Dec 20, 2010 13:01:17 GMT -5

Posts: 1,806

|

Post by tyfighter3 on Mar 19, 2014 22:01:10 GMT -5

Flow5, would the 2.4 trillion that the Banks our still holding is because it really doesn't exist anymore because the Banks didn't write it off but still on the Books? I'm not up on this kind of stuff so don't laugh at me too much. LOL

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 21, 2014 17:34:29 GMT -5

Don't understand your question. Are you asking why the CBs continue to hold excess reserve balances?

|

|

flow5

Well-Known Member

Joined: Dec 20, 2010 21:18:02 GMT -5

Posts: 1,778

|

Post by flow5 on Mar 21, 2014 17:39:47 GMT -5

Rates-of-change in monetary flows (our means-of-payment money times its transactions rate-of-turnover), are on the upswing (See: Dr. Leland J. Pritchard, Ph.D., economics, Chicago 1933).

In contradistinction to Nobel Laureate Dr. Milton Friedman, the distributed lag effects for money flows (MVt) are not “long & variable”. The lags for MVt have been mathematical constants for the last 100 years. This is inviolate & sacrosanct.

Roc’s in MVt depend upon transaction based accounts 30 days prior. See: bit.ly/yUdRIZ

Daniel L. Thornton’s “Quantitative Easing and Money Growth: Potential for Higher Inflation?”

Both short-term & long-term roc’s in money flows are now accelerating. That’s why the FOMC is now tapering (when they should be tightening).

-----------------------------------------------------------------------------------------------

Parse DT, proxy for real-output, proxy for inflation:

2012-11 ,,,,, 0.11 ,,,,, 0.55

2012-12 ,,,,, 0.15 ,,,,, 0.51

2013-01 ,,,,, 0.17 ,,,,, 0.59

2013-02 ,,,,, 0.15 ,,,,, 0.60

2013-03 ,,,,, 0.16 ,,,,, 0.49

2013-04 ,,,,, 0.15 ,,,,, 0.50

2013-05 ,,,,, 0.14 ,,,,, 0.54

2013-06 ,,,,, 0.07 ,,,,, 0.48

2013-07 ,,,,, 0.09 ,,,,, 0.40

2013-08 ,,,,, 0.07 ,,,,, 0.28

2013-09 ,,,,, 0.08 ,,,,, 0.28

2013-10 ,,,,, 0.02 ,,,,, 0.26

2013-11 ,,,,, 0.07 ,,,,, 0.29

2013-12 ,,,,, 0.10 ,,,,, 0.25

2014-01 ,,,,, 0.16 ,,,,, 0.34

2014-02 ,,,,, 0.13 ,,,,, 0.38

2014-03 ,,,,, 0.15 ,,,,, 0.33 ---------------------------------------------------

Note that oil/gas spiked last Feb.

Note that economic activity bottomed in Oct. & inflation has also bottomed.

|

|