countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Oct 27, 2021 18:04:49 GMT -5

Don't you have to keep them for 5 years before you can cash them in if you need the money? It's been awhile since I've read up on them, I just know mine are earning well.

All of ours are way out of that period, they could b e cashed with no penalty. Good long term investments.

|

|

|

|

Post by minnesotapaintlady on Oct 27, 2021 19:20:22 GMT -5

Don't you have to keep them for 5 years before you can cash them in if you need the money? It's been awhile since I've read up on them, I just know mine are earning well. All of ours are way out of that period, they could b e cashed with no penalty. Good long term investments. 1 year. If you cash before 5 years you sacrifice 3 months earnings. |

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Oct 28, 2021 14:59:28 GMT -5

I had forgotten, need to reread this stuff.

|

|

Lizard Queen

Senior Associate

103/2024

Joined: Jan 17, 2011 22:19:13 GMT -5

Posts: 14,659

|

Post by Lizard Queen on Oct 31, 2021 6:54:25 GMT -5

|

|

plugginaway22

Well-Known Member

Joined: Jan 2, 2011 10:18:42 GMT -5

Posts: 1,661

|

Post by plugginaway22 on Oct 31, 2021 7:10:00 GMT -5

Wish the annual limits were higher! Need a reminder to purchase 20 more in Jan for DH and I.

|

|

|

|

Post by minnesotapaintlady on Oct 31, 2021 8:53:56 GMT -5

Ha! The writer of that article needs to go read the Wiki too. Most of the Boglehead's (that hadn't already maxed them) rushed out to get theirs bought before Nov 1. |

|

Lizard Queen

Senior Associate

103/2024

Joined: Jan 17, 2011 22:19:13 GMT -5

Posts: 14,659

|

Post by Lizard Queen on Oct 31, 2021 9:36:31 GMT -5

Ha! The writer of that article needs to go read the Wiki too. Most of the Boglehead's (that hadn't already maxed them) rushed out to get theirs bought before Nov 1. Yeah, I don't know how that works. I don't really have extra room to tie up even more cash. Thinking this might be a good thing to start 5 years before retirement, though. So, how does that work again, getting it before the next hike? |

|

|

|

Post by minnesotapaintlady on Oct 31, 2021 10:09:04 GMT -5

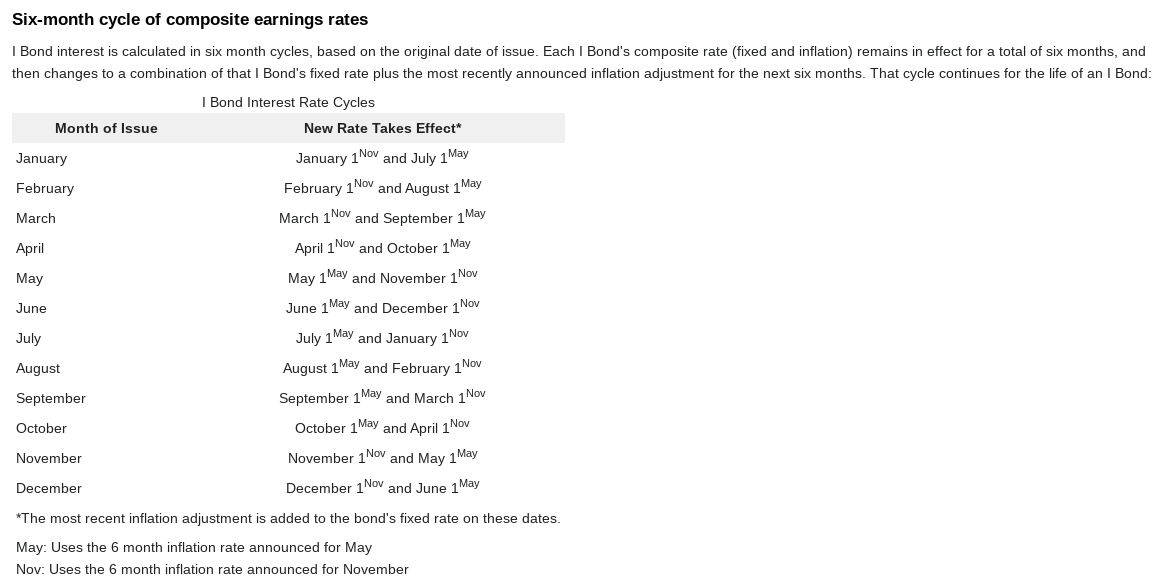

Ha! The writer of that article needs to go read the Wiki too. Most of the Boglehead's (that hadn't already maxed them) rushed out to get theirs bought before Nov 1. Yeah, I don't know how that works. I don't really have extra room to tie up even more cash. Thinking this might be a good thing to start 5 years before retirement, though. So, how does that work again, getting it before the next hike? There are two rates. The fixed rate and the inflationary rate and they are both announced on 6 month cycles in May and November. You get whatever the fixed rate is the month you purchase, but you CPI rate lags by up to 6 months, so someone buying in October gets the 3.54 and 6 months from now gets the new 7.12 rate, you're not missing out on the higher rate and if next May the rate is lower than 3.54 you came out ahead. If it's more than 3.54 you'll still get it, you're just lagging 6 months. The chart below shows when your rates changed based on the month you purchase. The month shown in the superscript is the CPI rate that you get, so buy in October, on October 1st you get the May CPI rate and starting April 1st you get the November CPI rate. Now, if the FIXED rate goes up in November you would have been better off buying in November, but it's been 0% for quite a while and that is not expected to change. Unfortunately, they don't announce that ahead of time like the CPI rate.   |

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Oct 31, 2021 10:17:39 GMT -5

I am not thrilled with long term, the ones I bought had a good fixed CPI rate plus the inflation rate. How in the world can they say 0 CPI?

But we are thinking of buying $20k this year and $20k for next year to at least earn something on our cash sitting here. Can't buy for DD unless we put it in her trust.

|

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Oct 31, 2021 10:17:55 GMT -5

Duplicate.

|

|

|

|

Post by minnesotapaintlady on Oct 31, 2021 10:30:34 GMT -5

I am not thrilled with long term, the ones I bought had a good fixed CPI rate plus the inflation rate. How in the world can they say 0 CPI? The CPI rate is the inflationary rate. The FIXED rate is at 0%. |

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Oct 31, 2021 14:10:54 GMT -5

Damn MPL, I am slipping, I haven't reread my stuff and I've been wrong several times here. Thanks for being up on it.

Yes, I know the fixed rate is well fixed, LOL! And mine are a % some 3% which really helps them earn. Looks like the only money now is coming from CPI, consumer price index.

Duh, feel like a dummy today, sigh.

|

|

Tiny

Senior Associate

Joined: Dec 29, 2010 21:22:34 GMT -5

Posts: 13,508

|

Post by Tiny on Nov 1, 2021 10:32:28 GMT -5

It looks like the Fixed Rate remains at 0.00% for bonds purchased on or after Nov 1, 2021. This is the rate the Bond will carry for the entire time you own it. It looks like the Variable Rate is 7.12%. On the plus side - having moved some of my EF 'cash' to I-bonds wasn't such a bad idea... I'm getting way more than the .5% I would have gotten on the $$ if I moved it to Ally - and it's getting way more than if I had left the money in CDs (getting way less than .5%). I can easily live with not needing the money for 12 months (I still have some EF 'cash') and I can deal with the loss of 3 months of income if I need to cash the bonds soon after 12 months. So at this point my decision to buy I-Bonds (in June/July and the Sept/Oct) isn't looking so bad. And moving some additional EF cash to I-Bonds in Jan/Feb as some other low interest CDs come due - isn't looking like a bad plan either. Googly-moogly - even my older bonds (I have a bout 2000 in $50 and $100 bonds purchased from 2005 thru 2008 or so) will also take advantage of the higher right (at some point). I'm guessing this is why long term I-Bond holders are swooning at the higher interest rate right now - ALL of the bonds they have purchase in the past will eventually get the 7.12% rate goodness. As an aside (I think it's FOMO): Kind of wish I had kept with the monthly purchase of a I-Bond that I started back in 2005 - I stopped the monthly purchase when the Great Recession started - as I was worried about my job and thought I should "conserve cash" - I was using "fun money" to buy that monthly $50 bond... once the "danger/fear" had past I never started up the monthly purchase... On the other hand - I didn't really have a lot of money to put towards I-Bonds - I was too busy chasing the ever increasing contribution limits on my 401K/Roth/HSA... Which were better places to put any "extra savings" I had. I need more income.  As another aside - I'm not sure how good it is to 'celebrate' this - as it means other bigger parts of our financial holdings might not be doing so well....  |

|

trimatty471

Established Member

Joined: Dec 21, 2010 3:59:02 GMT -5

Posts: 490

|

Post by trimatty471 on Dec 21, 2021 9:43:56 GMT -5

I'm pissed being limited to ONE only one I bond. Yeah, I noticed that 'complication' when I purchased the first 1K I bond. It didn't give me any options (like the ability to do 2 $500 bonds). Kind of sucks that if you want to use some of the bond money - you have to cash out the whole big lump sum bond... I'm not able to do a big lump sum I bond purchase - so mine will be in smaller denominations (1K, 2K, 2K and then maybe a 5K one...) because I will buy them on different days. So, I think I will have some flexibility with "cashing" them out if I need some of the $$ in the next year or within 5 years. I can see where this might be an issue with having one's EF in large denomination I bonds - and having a smaller amount emergency. I'm using this for EF "overflow" so I don't ever expect to need this money in a suitcase at midnight on Friday. I'm thinking that the people who are using the 10K as part of their retirement income might be willing to pull the whole 10K at once when it's needed. And so a single 10K I bond isn't such a big deal. |

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Dec 22, 2021 0:54:08 GMT -5

I have some earning, 7. 8.16 and 9% this 6 months, makes me wish I had a lot more, they have more than doubled.

|

|

jerseygirl

Junior Associate

Joined: May 13, 2018 7:43:08 GMT -5

Posts: 5,393

|

Post by jerseygirl on Dec 22, 2021 17:59:38 GMT -5

That said, I have about $2100 in I-bonds. There is no particular strategy behind buying them. They are just one more savings vehicle. I do claim the interest every year on my income taxes so that it won't be one more thing that my kids will have to pay taxes on if I don't outlive my money. Are one of your kids listed on the bonds as beneficiaries? Mom's got way more than that. (Though, I don't know how much). They are all in her and dad's name. If she doesn't put my name on them (or someone else's name who might be dealing with the estate), a lawyer will need to be hired to get all of that straightened out. My mom had I bonds without a named beneficiary. I was executor for her will and just needed to fill out some forms. I also had to send a statement that I was executor. Took a few months only |

|

countrygirl2

Senior Associate

Joined: Dec 7, 2016 15:45:05 GMT -5

Posts: 17,636

|

Post by countrygirl2 on Dec 23, 2021 11:19:45 GMT -5

My husband is on some and our son is on others, need to review them.

|

|

Rukh O'Rorke

Senior Associate

Joined: Jul 4, 2016 13:31:15 GMT -5

Posts: 10,339

|

Post by Rukh O'Rorke on Dec 23, 2021 20:07:42 GMT -5

Ha! The writer of that article needs to go read the Wiki too. Most of the Boglehead's (that hadn't already maxed them) rushed out to get theirs bought before Nov 1. I waited for Nov to make a big one, smaller ones in october. In december now, the October purchase still at 3.54% and nov at 7.12%. So....  |

|

|

|

Post by minnesotapaintlady on Dec 23, 2021 20:35:07 GMT -5

Ha! The writer of that article needs to go read the Wiki too. Most of the Boglehead's (that hadn't already maxed them) rushed out to get theirs bought before Nov 1. I waited for Nov to make a big one, smaller ones in october. In december now, the October purchase still at 3.54% and nov at 7.12%. So....  Yes, that's my point. You'll still get the 7.12% rate on the October ones when it changes in May, in addition to the 3.54% for 6 months, which is still pretty good for a guaranteed rate these days. If May is lower than 3.54 you come out ahead, if it's higher, you'll still get that higher rate, only with a 6 month lag. |

|

Rukh O'Rorke

Senior Associate

Joined: Jul 4, 2016 13:31:15 GMT -5

Posts: 10,339

|

Post by Rukh O'Rorke on Dec 23, 2021 21:01:58 GMT -5

I waited for Nov to make a big one, smaller ones in october. In december now, the October purchase still at 3.54% and nov at 7.12%. So....  Yes, that's my point. You'll still get the 7.12% rate on the October ones when it changes in May, in addition to the 3.54% for 6 months, which is still pretty good for a guaranteed rate these days. If May is lower than 3.54 you come out ahead, if it's higher, you'll still get that higher rate, only with a 6 month lag. why wait on a lag? |

|

|

|

Post by minnesotapaintlady on Dec 23, 2021 21:14:42 GMT -5

Yes, that's my point. You'll still get the 7.12% rate on the October ones when it changes in May, in addition to the 3.54% for 6 months, which is still pretty good for a guaranteed rate these days. If May is lower than 3.54 you come out ahead, if it's higher, you'll still get that higher rate, only with a 6 month lag. why wait on a lag? Why gamble that May is going to be higher than 3.54 when you don't have to? |

|

Rukh O'Rorke

Senior Associate

Joined: Jul 4, 2016 13:31:15 GMT -5

Posts: 10,339

|

Post by Rukh O'Rorke on Dec 24, 2021 20:29:48 GMT -5

Why gamble that May is going to be higher than 3.54 when you don't have to? Oh! It’s on, lady! We’ll talk in may! |

|

|

|

Post by minnesotapaintlady on Dec 24, 2021 23:55:08 GMT -5

Why gamble that May is going to be higher than 3.54 when you don't have to? Oh! It’s on, lady! We’ll talk in may! I guess I'm looking at this differently. I plan on keeping the bonds at least until retirement in 6 years and 3.54 is high compared to the inflation rates from the past 14 years. 7.12 3.54 1.68 1.06 2.02 1.40 2.32 2.22 2.48 1.96 2.76 0.16 1.54 0.00 1.48 1.84 1.18 1.18 1.76 2.20 3.06 4.60 0.74 1.54 3.06 0.00 4.92 4.84 I figure they're pretty much guaranteed to drop down to the typical 1-2% before that...for sure below 3.54. Now, if you're just buying for the short-term like to cash in at the one year mark I can see waiting for the 7.12 and gambling on May still being high. |

|

seriousthistime

Junior Associate

Joined: Dec 22, 2010 20:27:07 GMT -5

Posts: 5,173

|

Post by seriousthistime on Dec 25, 2021 11:03:59 GMT -5

Earlier this month I made my first I bond purchase, and will make another one in 2022.

I figure getting some interest from the I bonds is better than getting 0.5% on my money market account. TreasuryDirect says I am getting 7.12% on the bond even though I bought after November 1.

I guess you can buy an extra $5k in bonds if you do it with your income tax refund. I will owe on taxes for this year, so I'm thinking of making a large estimated tax payment in January, enough to pay the taxes due and get $5K back to buy more I bonds.

Bad idea? Good idea?

|

|

djAdvocate

Member Emeritus

only posting when the mood strikes me.

Joined: Jun 21, 2011 12:33:54 GMT -5

Posts: 76,708  Mini-Profile Background: {"image":"","color":"000307"}

Mini-Profile Background: {"image":"","color":"000307"}

|

Post by djAdvocate on Dec 26, 2021 1:10:14 GMT -5

interesting investment. how does it compare to the TIP ETF?

|

|

|

|

Post by minnesotapaintlady on Dec 27, 2021 14:00:51 GMT -5

Be aware, you don't get to choose the denomination for paper bonds. If you do the full 5k, you will receive 6 x $50, 1 x $200, 1 x $500, and 4 x $1000. And because it is the IRS, each of those 12 bonds are mailed separately! That's ridiculous. Then if you want to change them to electronic you have to go through the hassle of mailing them all back. |

|

azucena

Junior Associate

Joined: Jan 17, 2011 13:23:14 GMT -5

Posts: 5,941

|

Post by azucena on Dec 29, 2021 9:27:33 GMT -5

I'm up to 100k in liquid savings that is sitting earning nothing but gives me great peace of mind. Any drawback to rolling some of it into I-bonds? I've been following along and know that if I withdraw it early there is a slight interest penalty. I also saw the max per person but could fund some in my name and DHs for 2021 and right away in 2022. Thinking it would be nice to have half earning more.

|

|

|

|

Post by minnesotapaintlady on Dec 29, 2021 9:53:55 GMT -5

I'm up to 100k in liquid savings that is sitting earning nothing but gives me great peace of mind. Any drawback to rolling some of it into I-bonds? I've been following along and know that if I withdraw it early there is a slight interest penalty. I also saw the max per person but could fund some in my name and DHs for 2021 and right away in 2022. Thinking it would be nice to have half earning more. Mainly just the one year lock. You cannot access it at all before that. Although if you put some in now at the end of December, you get credit for the entire month, so really it's more like 11 months.

The Treasury Direct site kind of sucks a little too, but other than that, I would for sure move some of your cash making nothing if you don't need it in 2022.

|

|

Lizard Queen

Senior Associate

103/2024

Joined: Jan 17, 2011 22:19:13 GMT -5

Posts: 14,659

|

Post by Lizard Queen on Dec 29, 2021 12:02:33 GMT -5

I'm up to 100k in liquid savings that is sitting earning nothing but gives me great peace of mind. Any drawback to rolling some of it into I-bonds? I've been following along and know that if I withdraw it early there is a slight interest penalty. I also saw the max per person but could fund some in my name and DHs for 2021 and right away in 2022. Thinking it would be nice to have half earning more. What's that, $20k now, and $20k next week? Still leaves you $60. I say do it. |

|

azucena

Junior Associate

Joined: Jan 17, 2011 13:23:14 GMT -5

Posts: 5,941

|

Post by azucena on Dec 29, 2021 12:54:25 GMT -5

yes, that's my plan. Need to run it by DH first but he'll follow my lead.

|

|