Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 5, 2014 10:44:10 GMT -5

Well how about that, even with velocity dropping.... But, but, but, the guy who invest in gold and silver that won't face up to wxyz and frankq told me velocity is dropping and the economy was getting weaker!! Almost like someone around here knows what he is talking about or something!  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 9, 2014 20:31:08 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 9, 2014 20:47:17 GMT -5

1 year chart for the dollar ! It's all good bro ham. It's the The American Renaissance . You do have to click on the one year not just one day. Forward looking guys. www.bloomberg.com/quote/DXY:CUR |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 9, 2014 22:10:32 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 11, 2014 5:14:06 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 11, 2014 5:16:07 GMT -5

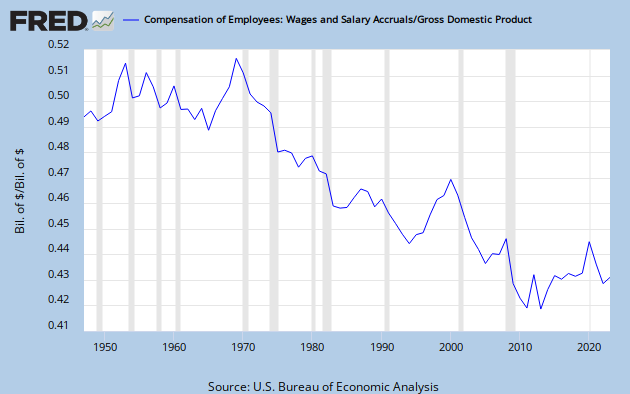

Yes I see what you mean about no correlation between declining household income and money velocity.

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 11, 2014 5:27:57 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 11, 2014 5:28:23 GMT -5

Nice look at your American Renaissance ,

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 11, 2014 10:04:37 GMT -5

Actually damn, that would be cherry picking a segment in time to try and prove your point. But we all know that's your guys MO. This is what you originally posted...  Which doesn't correlate with this...  Also, the Renaissance began in 2009-2010. It will take decades to undo what has gone on since the 60's. Don't worry, I get you're upset that you have been listening to someone who has been consistently wrong and has been doing nothing but spreading FUD. It's all good, I don't hold it against ya.  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 11, 2014 13:49:50 GMT -5

Lol cherry picking data? The data is what it is, facts.

I see you state the renaissance started in 2009? What a coincidence that's when QE to infinity started.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 11, 2014 15:43:54 GMT -5

Facts that contradict the facts you posted before. In other words, you are misrepresenting the facts to try and prove a point. Aka, cherry picking. More like it started when the trends from the remade in the USA and the uptick in the oil and gas production charts above started happening. Aka, the reason that the FRB is tapering. You know, another thing you guys got wrong.  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 12, 2014 4:43:09 GMT -5

More like your a fish and I set the hook!

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 12, 2014 10:39:28 GMT -5

No DNA, you really didn't. You're misrepresenting data because you have no idea what you are talking about. Or if you like, you went to cast your line and the hook got stuck in your ear. Honesty, the self centered point of view is getting old. We get it, there has been no recovery for you. The funny part in all of this is that the bad GDP report got you all riled up. Which is actually another point to your cherry picking, as long as the data coming out supports your outlook, it's true. If it goes against what you think, the government is lying.  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on May 12, 2014 13:57:13 GMT -5

Take it up with bloomberg and the federal reserve , the information is theirs.

show me one sentence that says I've said " the government lies".

Just like you to make shit up when you don't like what you see. Your bottle is getting smaller, 45 billion a month . What a joke.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on May 12, 2014 14:43:03 GMT -5

Again, it's how you are presenting it. You are contradicting yourself. All you have been saying through this thread is that there is no recovery, and no I'm not making anything up. In fact, I back up everything I say and lots of things a couple of us talk about happen. All you keep saying is there is no recovery, post a chart, are disproven, then start trying to attack. QE infinity, what a joke!  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 5, 2014 0:33:02 GMT -5

Again, not making a single thing up. Velocity at an all time low while US services hit a nine month high, manufacturing holding steady, and housing picking up after a cold winter. Welcome to the new age.  However, I am still bearish on the market and the global economy. Why? Margin Debt has Fallen for Two Months Now!  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 23, 2014 11:45:35 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jun 27, 2014 12:45:22 GMT -5

|

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jun 27, 2014 12:52:34 GMT -5

I thought you knew the difference between monetary and fiscal policy ? |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jun 28, 2014 7:24:41 GMT -5

What happened to the final " nail " in the velocity of money argument ? Seems you were wrong .... Again.

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 28, 2014 11:09:38 GMT -5

April, May, and June is Q1  Again, not making a single thing up. Velocity at an all time low while US services hit a nine month high, manufacturing holding steady, and housing picking up after a cold winter. Welcome to the new age.  However, I am still bearish on the market and the global economy. Why? Margin Debt has Fallen for Two Months Now!  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jun 29, 2014 16:26:12 GMT -5

April, May, and June is Q1  Again, not making a single thing up. Velocity at an all time low while US services hit a nine month high, manufacturing holding steady, and housing picking up after a cold winter. Welcome to the new age.  However, I am still bearish on the market and the global economy. Why? Margin Debt has Fallen for Two Months Now!  The fed does revise its numbers as well. Just like GDP revised down . Q1  Yep! 2014:Q1: 1.533 < see that number ? Lol 2013:Q4: 1.564 2013:Q3: 1.572 2013:Q2: 1.572 2013:Q1: 1.578 |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jun 29, 2014 17:29:07 GMT -5

Again, not making a single thing up. Velocity at an all time low while US services hit a nine month high, manufacturing holding steady, and housing picking up after a cold winter. Welcome to the new age.  However, I am still bearish on the market and the global economy. Why? Margin Debt has Fallen for Two Months Now!  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 3, 2014 10:04:47 GMT -5

Manufacturing holding steady, hiring up, housing recovery still on track, exports up, oil production strong; all while velocity is at an all time low. Do you see why the final nail is in this argument yet damn?  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 26, 2014 21:30:03 GMT -5

|

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 30, 2014 10:33:45 GMT -5

|

|

usaone

Senior Member

Joined: Dec 21, 2010 9:10:23 GMT -5

Posts: 3,429

|

Post by usaone on Jul 30, 2014 12:52:03 GMT -5

4% GDP  |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jul 30, 2014 13:43:42 GMT -5

4% GDP  No doubt revised up to 6% ! Lol If we come out at end of year 2%, count our blessings. "Wednesday’s report, which also included revised GDP figures going back to 1999, showed the economy grew at a faster rate in the last half of 2103 than initially reported." Revised numbers all the way back to 1999 this kind of stuff should even bother you optimist. www.nydailynews.com/news/national/u-s-economy-sizzling-summer-article-1.1885847 |

|

damnotagain

Well-Known Member

Joined: Oct 19, 2012 21:18:44 GMT -5

Posts: 1,211

|

Post by damnotagain on Jul 30, 2014 19:11:48 GMT -5

They must use different math to get to the velocity of money? Oops GDP revised up and money velocity revised down? 2014:Q2: 1.531 2014:Q1: 1.534 2013:Q4: 1.563 2013:Q3: 1.569 2013:Q2: 1.568 research.stlouisfed.org/fred2/series/M2VThe only thing up is the number of illegal aliens coming across the boarder .  |

|

Aman A.K.A. Ahamburger

Senior Associate

Viva La Revolucion!

Joined: Dec 20, 2010 22:22:04 GMT -5

Posts: 12,758

|

Post by Aman A.K.A. Ahamburger on Jul 30, 2014 22:56:26 GMT -5

I will repost the OP for you damnot, minus the comments on personal finance so the conversation stays on point. As an aside, the GDP revision going back to 1999 has to do with how they are calculating sectors like movies. Since you seem to be missing how velocity works damnnot, jar, or whoever you are, I will start a new thread on it. From investopedia... Definition of 'Velocity Of Money' The rate at which money is exchanged from one transaction to another, and how much a unit of currency is used in a given period of time. Velocity of money is usually measured as a ratio of GNP to a country's total supply of money. Velocity is important for measuring the rate at which money in circulation is used for purchasing goods and services. This helps investors gauge how robust the economy is, and is a key input in the determination of an economy's inflation calculation. Economies that exhibit a higher velocity of money relative to others tend to be further along in the business cycle and should have a higher rate of inflation, all things held constant.... Definition of 'Multiplier Effect' The expansion of a country's money supply that results from banks being able to lend. The size of the multiplier effect depends on the percentage of deposits that banks are required to hold as reserves. In other words, it is money used to create more money and is calculated by dividing total bank deposits by the reserve requirement. Investopedia explains 'Multiplier Effect' The multiplier effect depends on the set reserve requirement. So, to calculate the impact of the multiplier effect on the money supply, we start with the amount banks initially take in through deposits and divide this by the reserve ratio. If, for example, the reserve requirement is 20%, for every $100 a customer deposits into a bank, $20 must be kept in reserve. However, the remaining $80 can be loaned out to other bank customers. This $80 is then deposited by these customers into another bank, which in turn must also keep 20%, or $16, in reserve but can lend out the remaining $64. This cycle continues - as more people deposit money and more banks continue lending it - until finally the $100 initially deposited creates a total of $500 ($100 / 0.2) in deposits. This creation of deposits is the multiplier effect. The higher the reserve requirement, the tighter the money supply, which results in a lower multiplier effect for every dollar deposited. The lower the reserve requirement, the larger the money supply, which means more money is being created for every dollar deposited..... So, in laymen's terms.... The banks aren't lending and lots of houses that are being bought, are cash deals on FORECLOSURES. The velocity isn't picking up because the money supply is growing very fast, and the economy is growing very slow. This is again because of too much debt and not enough savings.. The irony in this topic is that you doomers where crying hyperinflation a couple years back, and the velocity of money says,THERE IS NO INFLATION!!!    Do you understand damnnot? |

|