Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 5:57:24 GMT -5

The latest: Data on housing starts and building permits gets as bad as bad as it's ever been.

VirgilBot TP v0.01 Started Thread Port on 12/24/2010

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 5:58:40 GMT -5

Virgil SyonidMessage #1 - 07/08/09 06:04 PMWelcome to Green Shoots Corner Where bullish investors can justify their faith in the imminent recovery of the US economy by posting about the green shoots (now sprouting up everywhere) they happen across in their daily browsing. Why look. Here's one now: [ finance.yahoo.com/news/US-credit-card-defaults-rise-rb-15527409.html?sec=topStories&pos=1&asset=&ccode=] U.S. credit card defaults rise to record in May  U.S. credit card defaults rose to record highs in May, with a steep deterioration of Bank of America Corp's (NYSE:[finance.yahoo.com/q;_ylt=AiQIOqp1Yb.Tr6QdUralHPL9ba9_?s=bac] BAC - [finance.yahoo.com/q/h;_ylt=Ap7LAo54nXe6dNoyiHxX1vv9ba9_?s=bac] News) lending portfolio, in another sign that consumers remain under severe stress. And look, over there: [ www.reuters.com/article/domesticNews/idUSTRE5670KD20090708] U.S. apartment vacancies near historic high: report  The vacancy rate for U.S. apartments reached its highest level in more than 20 years in the second quarter and could soon exceed record highs if the recession persists, real estate research firm Reis Inc said. Why, it's an unemployment green shoot: [ www.cbsnews.com/stories/2009/06/19/business/main5097357.shtml] Unemployment Hits Record Highs In 8 States  The unemployment rate in the West jumped over 10 percent last month, the first time that regional threshold has been broken in about 25 years. On the state level, eight set record-highs, and only two - Nebraska and Vermont - did not report increases. And... is that?... No! It couldn't be... [ www.ritholtz.com/blog/2009/06/continuing-claims-exhaustion-rate/] Continuing Claims “Exhaustion Rate” Spikes  Last week, we saw Continuing Claims decrease · proof, said the green shooters, of the imminent economic recovery. Only, not so much. Those of you (who can still afford the luxury of) a trusty Bloomberg will note the ·exhaustion rate· for jobless benefits - EXHTRATE · reveals that people are not leaving the pool of continuing unemployment claims because they are getting new jobs; Rather, they are leaving because they have exhausted their benefits. The latest data for EXHTRATE is [ ows.doleta.gov/unemploy/5159report.asp] here.  Thought weeding out all the corruption at the Fed (thereby impeding their ability to print the nation into oblivion) was a terrible idea? Here's another green shoot just for you: [ www.reddit.com/r/Libertarian/comments/8yzdk/democrats_use_procedural_tactic_to_block_progress/] Democrats use procedural tactic to block progress of the "Audit the Federal Reserve" Bill in the Senate  And let's not forget those green shoots in the housing markets: [ www.latimes.com/business/la-fi-foreclosure4-2009jul04,0,5145254.story] Another wave of foreclosures is poised to strike  Mortgage defaults have surged to record levels amid rising unemployment and falling home prices. Lenders are expected to move quickly to clear up backlogs as moratoriums on foreclosures expire. Yes. So many green shoots. So little time. There's a little something for everyone. Share yours, and let the shoots shine upon us all! ( Apologies for a JP-esqe rant, but this is just getting ridiculous...)

neohguyMessage #2 - 07/08/09 06:35 PMHow does the Vancouver bud crop look this year?

Virgil SyonidMessage #3 - 07/08/09 06:55 PMHow does the Vancouver bud crop look this year? I don't know. But somebody must be making money somewhere. [ www.byebyeblighty.com/1/canadian-average-house-price-reaches-record-high/] Canadian Average House Price Reaches Record High  Since our employment numbers are dropping, maybe there's a hidden "Grow-Op Jumbo Prime" mortgage market keeping the whole thing afloat.

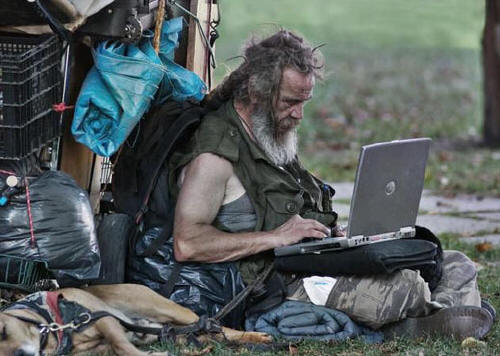

flag_usaMessage #4 - 07/08/09 07:03 PM

neohguyMessage #5 - 07/08/09 07:13 PMI heard that Hawaii has a record low occupancy rate for hotels. Vancouver must be doing something right because it is getting favorable press here in spite of the weak dollar and strong Canadian loonie. www.webehigh.com/city/detail.php?CITYID=2024 following article about Hawaii occupancy: www.mercurynews.com/travel/ci_12769218 Hawaii hotel occupancy drops to record low The Associated Press Posted: 07/07/2009 11:09:11 AM PDT Updated: 07/07/2009 11:13:11 AM PDT

outaheresoonMessage #6 - 07/08/09 07:13 PMIs that brown stuff I see around the base of those green shoots government BS?

Virgil SyonidMessage #7 - 07/08/09 07:35 PMneoh, here's our Canadian 'green shoot'. [ news.sympatico.msn.ctv.ca/abc/home/contentposting.aspx?isfa=1&feedname=CTV-TOPSTORIES_V3&showbyline=True&date=true&newsitemid=CTVNews%2f20090708%2fPBO_report_090708] Deficit predicted to hit $155.9B over next 5 years Good news is that the Central Bank and Parliament here don't seem to have quite the same schism with reality as the White House and US Treasury. Even Flaherty has enough tact to admit that the recession won't be over by August and that 'green shoots' are a fiction. The 'good news', if you can call it that, is that the waves of pessimism are driving down the value of the dollar more into the territory where our exporters would like it. Is that brown stuff I see around the base of those green shoots government BS? It's Weed-n-Fed.

PL1968Message #8 - 07/08/09 07:44 PMBut hey the market manipulators have brought the stock market from the brink right around the 3:00 hour. You can set your watch to it.

neohguyMessage #9 - 07/08/09 07:49 PMGood news is that the Central Bank and Parliament here don't seem to have quite the same schism with reality as the White House and US Treasury. Yea, O&G said that the European and Asian banks were more transparent than the US banks also. I wish that news would make the news in the US. For a land that has the right of freedom of the press, well, the press does not say much about anything worthwhile. The US newscasters do have the best hair stylists in the world though!

PL1968Message #10 - 07/08/09 07:54 PMThey're too busy scrambling outside Michael Jackson's funeral so they can get a good shot at all the celebs entering. Its a lot of work.

mlsjapan07Message #11 - 07/08/09 09:31 PMThe US newscasters do have the best hair stylists in the world though! neohguy, I think you mean news ACTORS.  LOL.

Virgil SyonidMessage #12 - 07/08/09 09:51 PMThe US newscasters do have the best hair stylists in the world though! Demand for Brylcreem is soaring! Another green shoot!  My favourite critique of the MSM has long-since been this original from [ sendables.jibjab.com/originals/what_we_call_the_news] Jib-Jab.

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 5:59:45 GMT -5

darvey76Message #13 - 07/08/09 09:57 PMSpeaking of green shoots, I've got a whole lot of them in my back yard,time to mow,got to go.

Falling Sky - NotMessage #14 - 07/08/09 10:28 PMAfter much thought I've got a green shoot - This is the mildest Depression we have experienced in about 80 years!

itstippyMessage #15 - 07/08/09 11:44 PMGiant SUV's are no longer status symbols, fingernail and tanning salons are going broke for lack of customers, weddings are less ostentatious. Everywhere you look, conspicuous consumption is out and value is in. Will this new attitude stimulate an economic recovery in 2nd half of 2009? Nope. It is, however, a fragile green shoot toward a sustainable, quality lifestyle in the good ol' USA. "A stitch in time saves nine" (routine maintenance avoids costly repair) and "A penny saved is a penny earned" (don't blow your paycheck on overpriced crap) were once considered sage advice and bedrocks of American economics. Folks are starting to appreciate their "Benjamins" again. That has to be good. "Large streams from little fountains flow, Tall oaks from little acorns grow." (not a Benjamin, but germane).

Virgil SyonidMessage #16 - 07/09/09 02:50 AMThis is the mildest Depression we have experienced in about 80 years! We hope.  Giant SUV's are no longer status symbols, fingernail and tanning salons are going broke for lack of customers, weddings are less ostentatious. Giant SUV's, tanning salons, manicures, fancy weddings, new drapes, new fridge, new lawnmower, weekly "night out", minor repair work on the car, A/C repairs, organic foods, high-speed internet, new workboots, high-quality meat, long distance plan, major repair work on the car, monthly "night out", breads/cereals, dental insurance, fridge repairs, mid-speed internet, cosmetics, fuel, car insurance, winter coat, mid-quality meat, fruits/vegetables, any internet, semi-annual "night out", books, phone plan, tools, mortgage payments, bus pass, workclothes, low-quality meat, cheap bicycle, electricity, low-quality meat, toiletries, clothes, shelter, food, water, air, McDonalds. On the destite-o-meter, most people are still pretty high on the scale.

ungenteelMessage #18 - 07/09/09 03:50 AMor ... perhaps one could say, consumer goods, made offshore and a service economy ... do not make for a sustainable economy it appears we need to manufacture, construct, plant and mine to have an economic future

Take it AgainMessage #20 - 07/09/09 04:38 AMWell, I see all the green shoots are just the DAISIES pushing up over the grave plot  !

neohguyMessage #21 - 07/13/09 08:09 PMFinally. The bank problems are behind us.

Virgil SyonidMessage #22 - 07/13/09 08:23 PMFinally. The bank problems are behind us. Duff's article about the program trade reporting made me sick. Good night, America.

Virgil SyonidMessage #23 - 07/13/09 11:30 PMMore blazing green shoots from [ www.silverbearcafe.com/private/07.09/hell.html] The Silver Bear Cafe : What else would you call non-financial growth in the early nineties, which averaged $565 billion annually that peaked at $3.545 trillion in 2007? Does that sound like monetary sanity? This was the massive system of credit that inflated asset prices, incomes, corporate profits and government revenues. This caused the wild orgy of consumption, services, including de-industrialization and massive imports spawned by free trade, globalization, offshorting and outsourcing. Those horrendous events will take decades to reverse. Who can call prudent or reasonable the creation of those combined Treasury, GSE and MBS obligations surging $1.949 trillion, or 15.3% in 2008 to $14.709 trillion? This is called Ponzi finance dynamics. The word is bubble and that bubble is still being sustained. How does Sir Alan justify Total Mortgage Debt growth from the 90s averaging $269 billion to $1 trillion by 2003 and $1.390 trillion in 2006? ABC, asset backed securities, went from $200 billion in 2003 and beyond $800 billion in 2006. MBS doubled in four years to $4.5 trillion by the end of 2007. That was the bad news; unfortunately there is worse news on the way. Today's credit crisis finance bubble will make the residential and commercial bubble look like a joke. Multiply by 5 or 10. Who knows where this can end up? The bomb is in the air and hasn't even hit yet. The quality of Treasury, GSE (Fannie Mae and Freddie Mac), CDO and ABS falls every day. The debt is massive and it is not producing real economic wealth creation. This is a tremendous drag on the system. Wage increases are miniscule, inflation grows as purchasing power falls as does general confidence. There is major misallocation of assets and a maladjusted economic structure that can only end in dire inflationary consequences. The private creation of real jobs has generated about 100,000 jobs a year and the public sector more than double that, or 240,000 a year. Most jobs created over the past ten years have been low paying. 290,000 have been created in healthcare, 157,000 in food and drinking establishments and 139,000 in government education. Declining jobs, free trade, globalization, offshoring and outsourcing, have decimated living standards and have caused a massive transfer of wealth to BRICs; OPEC and slave labor countries that cheapen their currencies by manipulating them and by subsidizing their industries. In just the first quarter GDP fell 5.5% due to a decline in inventories and trade. The 37.3% decline in business investment and inventories was a record. The greatest decline since 1947 when records began. The 38.8% decline in homebuilding is the largest contraction since 1980. And excellent article, with a good summary of all the wonderful 'green shoot' statistics to date. If you're still not convinced, he takes a shot at Goldman. Incidentally, Chapman is bullish on Canadian Treasuries, which I think is premature. If the US goes to pot, so do we, stable banking system or no.

DuffminsterMessage #24 - 07/14/09 12:18 AM'Green Shoots' of Recovery? Don't Fall for the Media's Economic Triumphalism

[www.alternet.org/workplace/140758/%27green_shoots%27_of_recovery_don%27t_fall_for_the_media%27s_economic_triumphalism/] www.alternet.org/workplace/140758/%27green_shoots%27_of_recovery_don%27t_fall_for_the_med27s_economic_triumphwithout letting the taxpayers off the hook for future losses) in order to escape limits on executive pay and other watery "conditions" attached to the public's largesse (Goldman Sachs' research department has been out front in shaping the green shoots narrative). The Obama administration is fending off conservative charges that his stimulus package -- of which only a small fraction has actually been spent in the four short months since Congress approved it -- is a failure. The Fed and other institutions are anxious about foreign investors' perceptions of the U.S. economy's overall health, and economic reporters and pundits are loath to admit that they've been sleeping with the fetid corpse of a dead economic paradigm known as Reaganomics. [/Color][/blockquote] Moreover, much of the business establishment has an interest in heading off any attempt to fundamentally transform the economy. After all, when things go south in the 21st century, the big fish are protected -- they get a bailout. So we need to ask not only if a recovery is really over the horizon, but also what it might look like. Structural Imbalances Remain Consumer spending in the U.S. accounts for not only about 70 percent of American economic activity, but also about a sixth of the planet's. Gallup [www.gallup.com/poll/120866/Weekly-Economic-Wrap-Spending-Continues-to-Wither.aspx?CSTS=alert] notes that consumer confidence is edging up -- thanks in part, no doubt, to all the talk of green shoots -- but (self-reported) consumer spending has plummeted by a whopping 41 percent compared to the same time last year. This is the [www.alternet.org/workplace/101869/if_we_get_through_this_crisis,_we%27ll_face_another_in_5_to_10_years_--_here%27s_why/] culmination of a long-term problem. Most people's wages have not been stagnant in recent years-- it's worse than that. For more than three decades the real incomes of all but those in the top 10 percent of the economic pile have actually declined. We kept up our lifestyles, though -- first through massive numbers of women joining the workforce, and later by running deep into debt. That central economic disconnect has only [www.washingtonpost.com/wp-dyn/content/article/2009/05/02/AR2009050202207.html?hpid=topnews] accelerated with the recession.

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:00:37 GMT -5

DuffminsterMessage #25 - 07/14/09 03:27 PMGovernment Golden Goose Good For Goldman Sachs Profits

www.cnbc.com/id/31904153

Though it may now be debatable that what·s good for General Motors [data.cnbc.com/quotes/GLMOP] [GLMOP 23.3181 --- UNCH (0)  ] is good for America, it·s even more of a stretch to suggest that what·s good for Goldman Sachs [data.cnbc.com/quotes/] [ Loading... () ] is good for America, it·s even more of a stretch to suggest that what·s good for Goldman Sachs [data.cnbc.com/quotes/] [ Loading... ()  ] is good for America and represents some economic barometer. ] is good for America and represents some economic barometer.

If anything, [www.cnbc.com/id/31894821/] Goldman’s handsome profits are a barometer of the government·s bailout of the financial system, from the straight-up handout mechanism called TARP to the Federal Reserve·s less direct, but probably more beneficent, policy of rock bottom interest rates and other favorable lending facilities.

The massive stock market rally from April to June and the fixed income bonanza triggered by a flight to safety no doubt helped. Goldman·s profits are good for Goldman and perhaps a few other financial institutions, whose stock prices may benefit from the collateral impact. [www.cnbc.com/id/31894821/] Goldman Profits In Detail Borrowing money from Uncle Sam for virtually nothing and then loaning it at a 300-400-basis-point margin should be profitable. Of course, with weak loan demand and tightened borrowing standards, Goldman is hardly throwing money at the crowd, although it is turning away people at the door. This is not government aid that has to be paid back. It is a gift that keeps giving. Imagine if GM was able to that, if the federal government essentially subsidized its production cost and thus fattened its profit margin.

Goldman·s far profits are more likely to gush up to senior management than trickle down to business and consumers, who are still feeling the crunch. If Uncle Sam helped facilitate a huge reduction in the rate of my mortgage or home equity loan, I·d have a lot more cash on hand. In the current environment, thought, that does not mean I would go on a spending binge or spread it around. Financial firms can also count on more support in the months ahead, as they collect billions in fees from the government·s massive foreclosure mitigation program, as they restructure mortgages. The big four banks (JPMorgan Chase[data.cnbc.com/quotes/JPM] [JPM 34.83  0.12 (+0.35%) 0.12 (+0.35%)  ] , Citigroup [data.cnbc.com/quotes/C] [C 2.85 ] , Citigroup [data.cnbc.com/quotes/C] [C 2.85  0.07 (+2.52%) 0.07 (+2.52%)  ] , Wells Fargo [data.cnbc.com/quotes/WFC] [WFC 24.40 ] , Wells Fargo [data.cnbc.com/quotes/WFC] [WFC 24.40  -0.40 (-1.61%) -0.40 (-1.61%)  ] , Bank of America [data.cnbc.com/quotes/bac] [BAC 12.94 ] , Bank of America [data.cnbc.com/quotes/bac] [BAC 12.94  -0.05 (-0.38%) -0.05 (-0.38%)  ] ) control more than half of all loans being serviced. Some three to four million million loans could fall under the Obama administration·s Making Home Affordable program. ] ) control more than half of all loans being serviced. Some three to four million million loans could fall under the Obama administration·s Making Home Affordable program. At best, Goldman·s profits may be a very, early leading indicator of some bottoming of the economy, but if the company isn·t doing well after all of the support-direct and indirect·we should be worried.

Just enter your preferred display name belowMessage #26 - 07/14/09 04:00 PMthings are continuing to get worse at an even faster pace now. the end is here folks. the world will no longer build valuable things for us and expect us to pay for them with useless dollars. the free ride our service economy has gotten off the labor of others is over. it's time we went back to work and built things of value. It's sad that our soldiers defending our country in Iraq and Afganistan are only making like $40,000 a year and the Wall Street bankers who stole our 401K pension plan money are not in jail and are still making on average over $500,000 a year. What a totally corrupt country we have become.

neohguyMessage #27 - 07/17/09 04:17 PMThis is good news. Michigans unemployment rate is only 15.2%. It was as high as 16.9% in 1982. news.moneycentral.msn.com/provider/providerarticle.aspx?feed=AP&date=20090717&id=10153739 ... The rate in Michigan surpassed 15 percent, the first time any state hit that mark since 1984....Home to America's struggling auto makers, Michigan has been clobbered by lost factory jobs. Its jobless rate of 15.2 percent in June was the highest in the U.S... While Michigan's rate was the highest in the U.S. in June, the record-high for the state was 16.9 percent in November 1982.

angelqueekMessage #28 - 07/17/09 05:06 PMSome people are so lacking in conscience that they think it is a good thing to profit off others' misfortunes. Glad I'm not them when karma comes to call.

jma23Message #29 - 07/17/09 06:20 PMJust got appraisel notices for 6 empty lots I own in a subdivision showing their value increasing over 150% since 2007 There are 3 foreclosure signs and two for sale signs within line of sight of those lots and nothing has been bought or sold there since 2004 , The answer from the county appraiser was similar lots in the county will sell for that much. When I asked where in the county, they weren't sure. Looks like my lawyer will be getting more work again. It's either pay him or higher taxes it's getting harder to win these days.

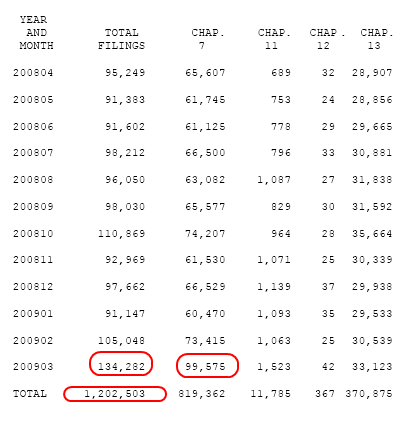

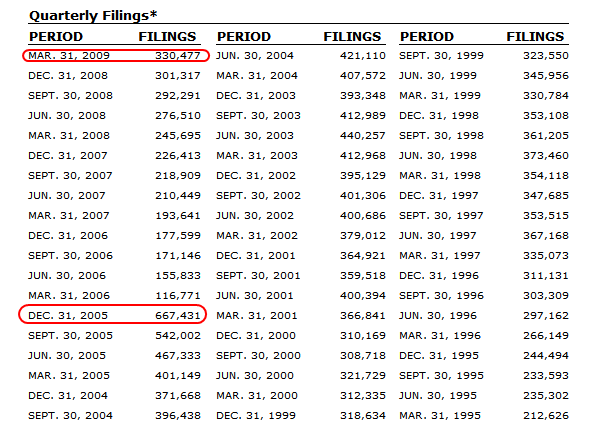

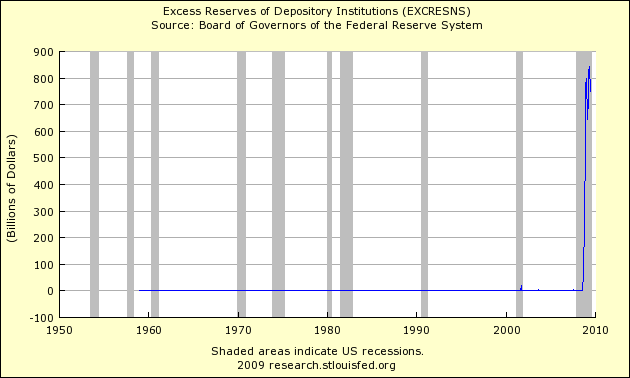

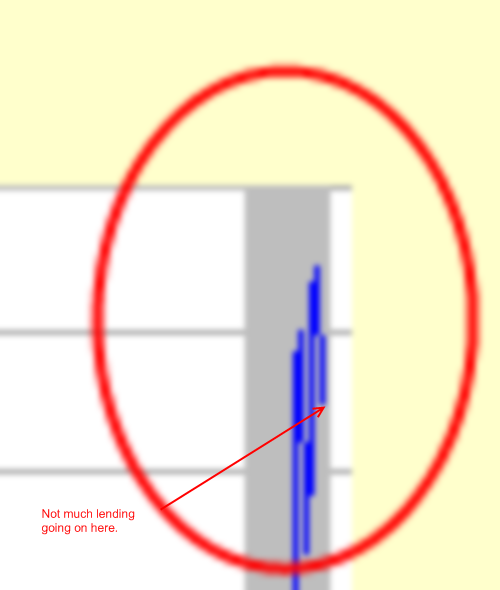

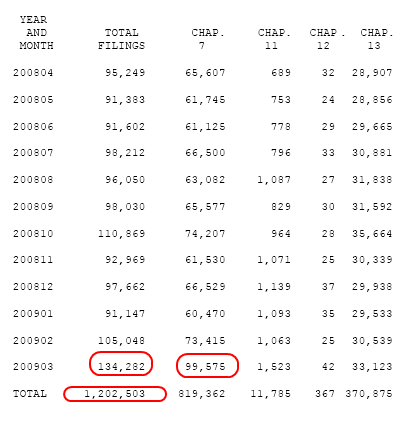

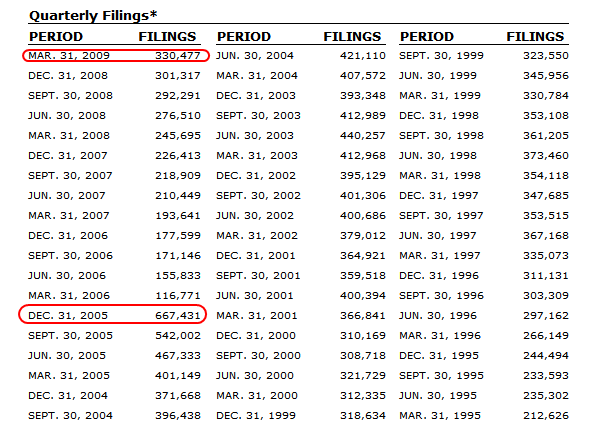

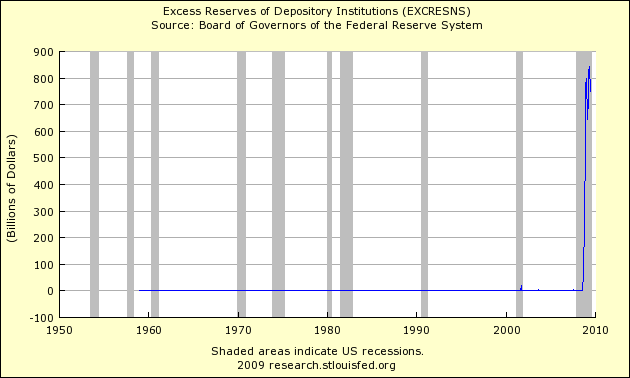

DuffminsterMessage #30 - 07/17/09 08:26 PMjma23, That sucks! Forgive the childish language but I think I know a little about how you might feel. I just found out that because I don't use my credit card enough Bank of America just cut my credit line in half even though I have perfect FICO and almost no debt. I"m changing bankers. In the mean time. Bankruptcy Filings up 33 Percent over a 12-month Period: Total 12-month Total of Bankruptcy Filings 1.2 Million. In last Report, Filings up 27 Percent in one month. www.mybudget360.com/bankruptcy-filings-up-33-percent-over-a-12-month-period-total-12-month-total-of-bankruptcy-filings-12-million-in-last-report-filings-up-27-percent-in-one-month/ Bankruptcy filings are soaring in the United States. In the last data point, we had 134,282 bankruptcy filings for the month of March 2009. Bankruptcy data usually lags 3 or 4 months but the trend is ominous. For the last 12 months some 1.2 million bankruptcy filings have occurred. Much of this is linked to the [ www.mybudget360.com/the-second-derivative-employment-and-the-mounting-job-losses-measuring-the-velocity-of-job-cuts-in-the-current-recession/] 26,000,000 unemployed or underemployed Americans being unable to pay their bills or even service their debt. What is more telling is the amount of Chapter 7 bankruptcies occurring since these are straight liquidations and not like a Chapter 13 restructuring. Let us examine the most recent data for bankruptcies that highlight this troubling trend: [www.mybudget360.com/wp-content/uploads/2009/07/bankruptcy.png]  What you·ll notice is a significant spike in the March data point. This monthly jump was enormous. This was the largest number of quarterly bankruptcy filings since December of 2005 when many were rushing to beat the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Yet even with the law making it harder for people to file bankruptcy, most are being [ www.mybudget360.com/the-new-american-austerity-getting-by-with-less-debt-and-less-money-in-what-sectors-are-americans-spending-less-money/] forced into austerity and it is hard to squeeze anything further out of a turnip. What this tells us is that for average Americans there is still a significantly large amount of pain in the real economy. The [ www.mybudget360.com/the-second-derivative-employment-and-the-mounting-job-losses-measuring-the-velocity-of-job-cuts-in-the-current-recession/] unemployment rate is understated by the 9.5 percent headline number. Below is data showing quarterly bankruptcy filings: [www.mybudget360.com/wp-content/uploads/2009/07/filings-by-quarter.png]  It is interesting to note, that even during the supposedly boom times of this decade, there were more people filing bankruptcy than during the bust since the recession started in December of 2007. The new bankruptcy legislation is designed to make it much harder for borrowers to file but ironically, during this same time banks have been having nearly unlimited borrowing power from the [ www.mybudget360.com/us-treasury-and-fed-determined-to-destroy-dollar-and-force-savers-to-spend-investing-in-a-government-hoping-for-a-us-dollar-collapse/] U.S. Treasury and Federal Reserve. As I discussed in a [ www.mybudget360.com/sl-crisis-part-two-are-we-repeating-mistakes-from-the-sl-crisis-accounting-sleight-of-hand-and-mortgage-fraud/] previous article the Federal Reserve will protect banks before it seeks to protect consumers. The major sticking points of the 2005 legislation requires means tests, higher filing fees, mandatory credit counseling, and other obstacles preventing people from filing bankruptcy. If you put enough hurdles, you will see a decline. But let us flip the tables for a second. Imagine if we required this from banks that we have been bailing out. Have we had them go through ·credit counseling· or have we required them to go through means tests? If anything, they have been given the money simply because they demanded it. For the consumer bankruptcy is the last option but for banks, the only option is a taxpayer funded bailout. But as the times have gotten tougher in this recession, there really isn·t much a bank can do when someone has lost their job and is unable to pay their bills. By any standard, someone who has no money will fall below the median household income for that state. [ www.mybudget360.com/how-much-does-the-average-american-make-breaking-down-the-us-household-income-numbers/] The average American household brings in roughly $46,000 to $50,000 per year so there isn·t much room to maneuver. With credit drying up, this was virtually the last lifeline. And banks refuse to lend because now after a decade of lax lending they are now verifying basic levels of capital and collateral: [www.mybudget360.com/wp-content/uploads/2009/07/excess-reserves.png]  [www.mybudget360.com/wp-content/uploads/2009/07/lending.png] [www.mybudget360.com/wp-content/uploads/2009/07/lending.png]  Banks are holding tight to the funds because they want to avoid their own bankruptcy. Consumers are left to their own devices. As the year goes on, we can expect surging levels of bankruptcy creating further writedowns for banks. A $50,000 credit card debt that once was an asset for a bank can quickly t

Stay PutMessage #32 - 07/17/09 10:22 PMD son met ruff, other than attacking decoy, do you actually have any contribution to add to any string? Let me make it easier for you. Do you have any position that you stand for, that you can supply supporting data, other than attacking decoy that is? Grow up. You disagree with him. We get it. Now move on and tell us what you think about the market or the economy and why you think that way.

randy47Message #33 - 07/17/09 11:03 PMThe green shoots you are seeing is your money flying out the window!!

DuffminsterMessage #34 - 07/17/09 11:11 PMSomehow this green shoot was obfuscated by the D son met ruff post and so I'm putting it back in part: Bankruptcy Filings up 33 Percent over a 12-month Period: Total 12-month Total of Bankruptcy Filings 1.2 Million. In last Report, Filings up 27 Percent in one month. www.mybudget360.com/bankruptcy-filings-up-33-percent-over-a-12-month-period-total-12-month-total-of-bankruptcy-filings-12-million-in-last-report-filings-up-27-percent-in-one-month/ Bankruptcy filings are soaring in the United States. In the last data point, we had 134,282 bankruptcy filings for the month of March 2009. Bankruptcy data usually lags 3 or 4 months but the trend is ominous. For the last 12 months some 1.2 million bankruptcy filings have occurred. Much of this is linked to the [ www.mybudget360.com/the-second-derivative-employment-and-the-mounting-job-losses-measuring-the-velocity-of-job-cuts-in-the-current-recession/] 26,000,000 unemployed or underemployed Americans being unable to pay their bills or even service their debt. What is more telling is the amount of Chapter 7 bankruptcies occurring since these are straight liquidations and not like a Chapter 13 restructuring. Let us examine the most recent data for bankruptcies that highlight this troubling trend: [www.mybudget360.com/wp-content/uploads/2009/07/bankruptcy.png]  What you·ll notice is a significant spike in the March data point. This monthly jump was enormous. This was the largest number of quarterly bankruptcy filings since December of 2005 when many were rushing to beat the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Yet even with the law making it harder for people to file bankruptcy, most are being [ www.mybudget360.com/the-new-american-austerity-getting-by-with-less-debt-and-less-money-in-what-sectors-are-americans-spending-less-money/] forced into austerity and it is hard to squeeze anything further out of a turnip. What this tells us is that for average Americans there is still a significantly large amount of pain in the real economy. The [ www.mybudget360.com/the-second-derivative-employment-and-the-mounting-job-losses-measuring-the-velocity-of-job-cuts-in-the-current-recession/] unemployment rate is understated by the 9.5 percent headline number. Below is data showing quarterly bankruptcy filings: [www.mybudget360.com/wp-content/uploads/2009/07/filings-by-quarter.png]  It is interesting to note, that even during the supposedly boom times of this decade, there were more people filing bankruptcy than during the bust since the recession started in December of 2007. The new bankruptcy legislation is designed to make it much harder for borrowers to file but ironically, during this same time banks have been having nearly unlimited borrowing power from the [ www.mybudget360.com/us-treasury-and-fed-determined-to-destroy-dollar-and-force-savers-to-spend-investing-in-a-government-hoping-for-a-us-dollar-collapse/] U.S. Treasury and Federal Reserve. As I discussed in a [ www.mybudget360.com/sl-crisis-part-two-are-we-repeating-mistakes-from-the-sl-crisis-accounting-sleight-of-hand-and-mortgage-fraud/] previous article the Federal Reserve will protect banks before it seeks to protect consumers. The major sticking points of the 2005 legislation requires means tests, higher filing fees, mandatory credit counseling, and other obstacles preventing people from filing bankruptcy. If you put enough hurdles, you will see a decline. But let us flip the tables for a second. Imagine if we required this from banks that we have been bailing out. Have we had them go through ·credit counseling· or have we required them to go through means tests? If anything, they have been given the money simply because they demanded it. For the consumer bankruptcy is the last option but for banks, the only option is a taxpayer funded bailout. But as the times have gotten tougher in this recession, there really isn·t much a bank can do when someone has lost their job and is unable to pay their bills. By any standard, someone who has no money will fall below the median household income for that state. [ www.mybudget360.com/how-much-does-the-average-american-make-breaking-down-the-us-household-income-numbers/] The average American household brings in roughly $46,000 to $50,000 per year so there isn·t much room to maneuver. With credit drying up, this was virtually the last lifeline. And banks refuse to lend because now after a decade of lax lending they are now verifying basic levels of capital and collateral: [www.mybudget360.com/wp-content/uploads/2009/07/excess-reserves.png]  [www.mybudget360.com/wp-content/uploads/2009/07/lending.png] [www.mybudget360.com/wp-content/uploads/2009/07/lending.png]  Banks are holding tight to the funds because they want to avoid their own bankruptcy. Consumers are left to their own devices. As the year goes on, we can expect surging levels of bankruptcy creating further writedowns for banks. A $50,000 credit card debt that once was an asset for a bank can quickly t

schrizoMessage #36 - 07/18/09 01:33 AMGreen shoots believers read post "Cash 4 clunkers leaves GM in the dust".

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:03:32 GMT -5

BeerfanMessage #37 - 07/19/09 02:41 PMneohguy said: How does the Vancouver bud crop look this year? Like crap as usual. Come to California where we can do it in nature!

neohguyMessage #38 - 07/19/09 07:10 PMI've always advocated that we should buy products produced in this country first.

ComoKateMessage #39 - 07/20/09 03:52 AM"Attack" is such an ugly word. Wouldn't you agree. Now if on the other hand I called someone, oh let's say, "sleazy, white trash, **** dumpster mother", I can see how that might be construed as an "attack". Or if I called someone a "white trash mother". Once again I can see how the word "attack" could be used. But you know, I really didn't call Decoy 409 any names.

I believe it's called "trash talk" or "smack talk" and neither one is appreciated here. It never fails to amaze me how rude people can be when hidden by the anonymity of an internet alias verses a real name. Internet trolls, pimple-faced 14 year olds, people with personality disorders and their like are all on equal footing when posting anonymously. I am so sorry if I left the wrong impression. Oh, I think you have given us quite an accurate impression. Apparently I have been under the wrong impression about this "Message Board". I thought this was suppose to be about "Market Talk". It turns out this "Message Board" is about almost anything but "Market Talk". Of course I could go on but then I would just be contributing to the fact that this has nothing to do with "Market Talk". Isn't that the irony to this whole thing? Oh, let's not forget your other inquiry. I think the market will go up and it will go down. And I base that on history. Oh look, the Dow is up 30 some points. Now there's some "Market Talk". The financial market is in a shambles as is the rest of our economy. People are hurting, outraged, venting, and sometimes even offering helpful suggestions as to how to prevent another crisis of this kind from repeating. Even the "experts" are lacking any concrete answers, and many of those "experts" were involved in creating our crisis...I'd rather read what my fellow posters here have to say at this point. Markets are driven by the irrational acts, fears and hopes of people. Getting a pulse on those can be an invaluable resource to those who want to take a chance on the crap shoot we call the stock market. Yes, the market can go up again. It went up again after the crash of 1929, though it took 26 years to get back to the level it had previously enjoyed. I'm sure those people who were 65-70+ years old in 1929 didn't mind waiting....

DuffminsterMessage #40 - 07/20/09 06:13 PMWell, "economists" now believe that the recession is already over. Another green shoot, leading economist from the "whatever the government reports is true" school of economics say recession is already over. Talk about MOPE (management of economic perspective economics): Recession in U.S. May Have Already Ended, Leading Index Shows www.bloomberg.com/apps/news?pid=20601087&sid=aMKZYfjyvGek July 20 (Bloomberg) -- Components of the index of leading economic indicators are signaling the worst U.S. recession in five decades may be over now, not three to six months from now. Less-known elements of the [www.conference-board.org/] Conference Board·s report, including ratios and diffusion indexes, bolster the view the contraction has ended. The leading index, a gauge of the economic outlook over the next two quarters, rose 0.7 percent in June, a third consecutive gain, the New York-based research group said today. ·The process of coming out of the recession, although still fragile, may be starting,· Ataman Ozyildirim, a Conference Board economist that tracks the business cycle, said in an interview. ·If it continues in this way, the NBER committee will look back and tell us the recession ended.· A committee of the [wwwdev.nber.org/cycles/cyclesmain.html] National Bureau of Economic Research, a private group in Cambridge, Massachusetts, is the accepted arbiter of when recessions begin and end. The group announced in July 2003 that the last recession had ended in November 2001, indicating their deliberations take time. Several requirements within the Conference Board·s report that economists say need to be fulfilled before a contraction is officially considered over were checked off the list in June. Those were: three straight gains in the [www.bloomberg.com/apps/quote?ticker=RTCL%3AIND] ratio of coincident-to-lagging indicators, three months of 50-plus readings in the diffusion index, three consecutive gains in the leading index and an annualized reading over that period in excess of 10 percent. Annual Rate The leading index was up 12.8 percent at an annual rate over the last three months, today·s report showed. It was the best performance since January 2002, two months after the last recession ended. ·This is the third straight month of a gain in leaders and suggests that, along with other economic evidence, the U.S. recession might have ended· in the second quarter, [search.bloomberg.com/search?q=Kenneth+Kim&site=wnews&client=wnews&proxystylesheet=wnews&output=xml_no_dtd&ie=UTF-8&oe=UTF-8&filter=p&getfields=wnnis&sort=date:D:S:d1] Kenneth Kim, an economist at Stone & McCarthy Research Associates in Princeton, New Jersey, wrote in a note to clients. The Conference Board·s index of coincident indicators, a gauge of current economic activity, dropped 0.2 percent after decreasing 0.3 percent the prior month. The NBER cycle-dating committee follows measures in this index to help time downturns. The index tracks payrolls, incomes, sales and production. The diffusion index shows the breadth of gains in the leading index, with figures over 50 showing the majority of components rising. The index registered a reading of 70 in June for a third consecutive month, today·s report showed. Financial Gauges Earlier this year, only the financial components of the leading index -- including money supply and the difference in interest rates between the benchmark 10-year Treasury note and the overnight rate banks charge to borrow from each other --were rising. The increase in the diffusion index shows other measures are also now increasing. ·We now have positive moves in the indicators of the real side of the economy,· such as decreasing jobless claims and increasing building permits, the Conference Board·s Ozyildirim said. While the timeframe can vary between three and nine months, on average the leading index reaches a bottom about five to seven months before the end of a recession, Ozyildirim said. ·The ·all clear· is not quite there, but you are beginning to see the kind of sequence unfolding that will get us there,· he said, referring to the end of the recession.

Virgil SyonidMessage #41 - 07/20/09 06:32 PMRecession in U.S. May Have Already Ended, Leading Index Shows Good catch on the latest green shoot, Duff.   By now it should be clear to all that the recession is over. Clearly so. The cynics get hung up on the fact that it's one of those unusual recoveries where states are going bankrupt, businesses are going bankrupt, economic output continues to drop, jobs continue to haemorrhage away, home prices continue to fall, corporate headquarters move out-of-country, every subjective growth indicator is negative, and P/E ratios soar into the stratosphere. A few more solid weeks of gains on the S&P, and even the cynics will have to admit the recession is over.

neohguyMessage #43 - 07/20/09 08:13 PMtoo high too quick. something tells me that this is not a good thing.

ComoKateMessage #44 - 07/20/09 10:14 PMNow would this be a fair quote? " The ultra rich have no patriotism; they look for profits by investing in countries outside the borders of where they live, caring little for the human suffering and carnage they create in their wake." Or this? " It is quite possible that bio-terrorism may be at work in some of the "epidemics" we are exposed to." Or, "So what do we do with the vast amounts of people in the middle and lower end of the "Bell Curve" ? " These are things that you have stated but there is nothing that can stop you from deleting the original post. D-son, I would have no reason to delete my posts except for horrific spelling errors and poor typing skills. I'm not ashamed of the opinions I hold and I'm sure that some will agree/disagree with them. If you want to quote me out of context, that is your option, but anyone truly interested in the entire line of thought can easily look up my posts and make their own judgment as to the validity of my opinions. I have tremendous compassion for those born with mental/physical disabilities and feel that those of us born with a higher intelligence, higher social status, or both, have an obligation to help them. As far as my quotes being "fair"; I call em' like I see em'.

neohguyMessage #45 - 07/21/09 12:32 PMI would have no reason to delete my posts except for horrific spelling errors and poor typing skills. I agree. There seems to be a higher than normal amount of posters that are either deleting their posts or editing them (and not showing they were edited) when they are called on something. For the most part they seem to be the types that have an agenda to promote and intend to do it dishonestly if necessary. Anyway, back to the topic: news.moneycentral.msn.com/ticker/article.aspx?Feed=OBR&Date=20090721&ID=10160336&Symbol=CAT Caterpillar posts stronger-than-expected earnings July 21, 2009 7:56 AM ET

The company, the world's largest maker of mining and construction vehicles, reported a second-quarter net profit of $371 million, or 60 cents a share, compared with $1.11 billion, or $1.74 a share, last year.

Sales and revenue fell 41 percent to $7.98 billion....

I have not seen the "details" yet about cat. Another company I watch: news.moneycentral.msn.com/provider/providerarticle.aspx?feed=AP&date=20090721&id=10160103 United Technologies 2Q profit falls 24 percentJuly 21, 2009 8:14 AM ET ....Struggling airlines have ordered fewer engines made by United Technologies' Pratt & Whitney division and weak construction continues to hurt demand for its Carrier climate control systems and Otis elevators.... ...."The year-over-year rate of decline in orders across the business appears to have stabilized, although orders remain lower than previously anticipated," CEO Louis Chenevert said in a statement.... Maybe not a green shoot but perhaps the massive bleeding is slowing? temporary? permanent?

ungenteelMessage #46 - 07/21/09 02:29 PMreal green shoots??? www.minyanville.com/articles/CAT/index/a/23648

Virgil SyonidMessage #47 - 07/21/09 03:09 PMneoh and ungenteel, the news on CAT seems to be a genuine "green shoot". Go figure. Keep in mind that the revenue was almost halved. The Minyanville article puts the optimism into perspective.

neohguyMessage #48 - 07/21/09 03:29 PMWell Mr. Practical from ungeteel's article is a party pooper: But what if those revenues don't grow? That would be because this is no normal recession. Perhaps the country has been running well ahead of our capacity to produce and our actual wealth for some time, because we have been able to borrow and spend money so easily. Maybe we've borrowed our standard of living from the future -- from our children

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:04:24 GMT -5

ungenteelMessage #49 - 07/21/09 03:36 PM Well Mr. Practical from ungeteel's article is a party pooper: Exactly ... here is more from the article ... the paragraph previous to the one posted ... to bad it was classified as spam The market (i.e. everyone) has determined this to be a normal, albeit extended recession. If companies are cutting costs, both they and the market anticipate a recovery in revenues. Thus stocks like CAT (almost every company has made or beat earnings by cutting costs) are being rewarded for potentially much better earnings in the future, all predicated on a return to normalcy.

neohguyMessage #50 - 07/22/09 01:47 PMI guess if folks are buying iphones, which I consider discretionary, then perhaps things are improving somewhat.: news.moneycentral.msn.com/provider/providerarticle.aspx?feed=OBR&date=20090721&id=10158829 Apple smashes profit forecasts, iPhone shines July 21, 2009 8:30 PM ET ...The company continued to defy the global recession with a solid 13 percent jump in fiscal third-quarter net profit. It sold more than seven times as many iPhones -- 5.2 million units of its latest signature device -- as the year-ago period.....

neohguyMessage #52 - 07/22/09 02:00 PMmessage 51 deleted by me

marshallcrazyMessage #53 - 07/22/09 04:29 PMRegarding the current earnings season, everyone has to remember a few things (one of which has been mentioned in other threads on this board from time to time): 1. Analysts have greatly lowered estimates, thus it's easy to beat those lowered estimates. 2. So far, there have been better than 70% "surprises", some to the upside, some to the downside. See lowered expectations in item 1. above. 3. With only a handful of exceptions (10 give or take?), all of the upside surprises have been with regard to profitability. 4. Revenues, on the other hand, have consistently missed (fallen short) of what were already lowered expectations. Further, even when these companies have "beat" the lowered expectations, revenues and profits across the board (with the exception of Boeing, Apple, and maybe a couple of others) have fallen off the cliff compared to last year's 2nd quarter. 5. When you add all of this up, it means that these businesses are not only not performing well, the upside surprises are due to severe cost cutting otherwise known as "productivity gains" in the green shoot camp. Translation; businesses are not hiring, in fact they are adding to the numbers of previously announced layoffs. They are not investing in capital expenditures, building of inventories, etc. None of that is good for the economy, and none of that will lead to an economic recovery, in fact it will deepen and prolong whatever stage of the recession we're in. That's the reality, folks.

Virgil SyonidMessage #54 - 07/22/09 04:55 PMmarshall, the revenues were a big spot of contention in my mind too. 41% drop here. 53% drop there. Still, in the end, revenues minus costs is what matters to the short-term stock value. Incidentally, business revenues aren't the only revenues dropping. [ www.usatoday.com/money/perfi/taxes/2009-05-26-irs-tax-revenue-down_N.htm] IRS tax revenue falls along with taxpayers' income They're quoting a drop of 34%. Another green shoot.

neohguyMessage #55 - 07/22/09 05:49 PMFrom the tax revenue article that Virgil posted (last paragraph): "The American consumer led us out of previous recessions with some semblance of gusto," Lonski says. "They're too old to do it now." I have seen an almost 180 degree turn among people my age concerning their spending habits. Even the frivolous ones now think excessive spending for unnecessary items is not "cool". I don't know of any people my age that are purchasing iphones (but that might be my perception). I wonder if anyone will figure out that an economy based on irresponsible spending and abuse of debt might not be a good idea?

RemathMessage #56 - 07/22/09 07:09 PMThe White House thinks that tax revenue will increase in 2011, thanks in part to the stimulus package, says the report from AIER, an independent economic research institute. But it warns, "Even if that does happen, the administration also projects that government spending will be so much higher each year that large deficits will continue, and the national debt held by the public will double over the next 10 years." I find this odd. A "stimulus package" means somethng that has to be paid for in taxes. So we issued debt to ourselves and will pay it back in taxes. So does the white house see an increase in tax revenues due to new taxes that will have to be levied to pay for the "stimulus package". or Does the White House see an increase in tax revenues by the jobs created from the money we borrowed from ourselves to employ ourselves untill the "stimulus package" runs out of money. Maybe I'm not understanding it all. Could someone explain to me please how a job created by the government and paid for by the government increases tax revenues and not deficits? isn't it correct to say that every government employee is technically a deficit and not an asset (tax speaking I mean).

Virgil SyonidMessage #57 - 07/22/09 08:50 PM" We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle." - Winston Churchill Remath, the theory (at least to the Keynesians) is that spending money in a period of economic contraction will increase real wealth. The theory holds that taxes should be increased and the funds used to pay workers to build infrastructure, create new industries, produce useful goods and generally create real wealth. In future years, this new wealth will decrease the rate at which productive output must be taxed. The old 'spend money to make money' saw. The reality, of course, is that the cost of the stimulus seldom (if ever) brings about a commensurate increase in real wealth. In the exceptional event that it does, governments are rarely amenable to cutting taxes when productivity is restored, which belies the motivation for the stimulus. Unfortunately, whole schools of economists worship Keynes and Friedman as demigods, oft citing Roosevelt's "New Deal" as the 'cure' to the 1930's depression despite volumes of evidence to the contrary. They also seem to forget that the time-adjusted cost for the New Deal was between 350-500 billion dollars over the four years it was implemented. With 23 trillion on the Fed's books and the national debt climbing by a trillion per quarter, the 'New Deal' roughly equates to what was spent in the first 16 days of the current crisis. The current push for a new stimulus are the cries of a man lost in a wide desert. The OTC derivatives mess continues to unwind and fresh capital is needed to plug the bottomless hole created by the insolvent 'banks'. Jobs continue to haemhorrage, businesses continue to fail, and since the government has no way of stopping it, they instead busy themselves trying to manage the perception of the crisis (as Duffminster's many articles have followed) as well as making sweeping promises to spend more money, which conveniently provides the illusion that they have some idea of what they're doing. Bigger problems, such as the Social Security, Medicaid, Medicare $60 trillion bankruptcy, they ignore entirely. Just ask the former comptroller of the GAO. In time, they hope that the theories of their demigods will honour their directionless spending--the vain belief that man can indeed pull himself out of a well by his bootstraps. Stay sane. - Virgil [Edit: '23' trillion on the Fed's books, referring to Neil Barofsky's report. Had '43' on the mind for some reason.]

DuffminsterMessage #58 - 07/23/09 01:10 AMI believe the only way to really resolve the problem is to put whatever stimulus money we are going to spend into long range renewable energy. If energy approaches zero in cost over time then productivity will approach infinity and if the government, social and infrastructural systems are properly designed, it means potentially every person can live with prosperity. I guess getting the government, social and infrastructural architecture right is the hard part even if building out large scale solar plants is very costly up front. None the less, I don't think monetary policy can ever fully resolve the problems on its own. Just meandering thoughts. Probably at least a fallacy or two but I welcome a response. Oh by the way Virgil, is this place here, you know Green Shoots corner, is it like Green Acres? "Green acres is the place to be. Farm livin' is the life for me. Land spreadin' out so far and wide. Keep Manhattan, just give me that countryside. New York is where I'd rather stay. I get allergic smelling hay. I just adore a penthouse view. Dah-ling I love you but give me Park Avenue. ...The chores. ...The stores. ...Fresh air. ...Times Square You are my wife. Good bye, city life. Green Acres we are there." I suggest we have a contest to re-write the Green Acres them song to make it suitable for Green Shoots Corner.

mlsjapan07Message #60 - 07/23/09 02:08 AMSoup Czar.....is that anything like the Soup Nazi? NO SOUP FOR YOU!

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:05:17 GMT -5

ComoKateMessage #61 - 07/23/09 02:21 AMMaybe I'm not understanding it all. Could someone explain to me please how a job created by the government and paid for by the government increases tax revenues and not deficits? isn't it correct to say that every government employee is technically a deficit and not an asset (tax speaking I mean). How about this one; the county I reside in ( Ramsey), in Minnesota, has off-shored some telephone,computer and information assistance jobs in their Social Services department to India. That's right tax- payer dollarsin the form of payrolls, flowing out of the country. No stimulus to local economies, let alone the national one. Unbelievable but, sadly, true.

Virgil SyonidMessage #62 - 07/23/09 03:14 AM*lol* @ djrick I see a future for you in the White House.

mlsjapan07Message #63 - 07/23/09 06:22 AMDuffminster!!!  (Just kidding.) I have had that song in my head for 5 hours! So, here you go:  To the tune of Green Acres. Ahem. Green Shoots Corner is the place to be, Market bitchin· is the life for me, Lies spreadin· out so far and wide, Keep the ·Change,· and let me off this ride. In denial is where I·d rather stay, I am allergic to the truth, okay? Madoff might have lost his penthouse view, Wall Street I love you so give me my cut, too. .·The crimes! .·Good times! ·.The fraud! ·.Applaud! I came, I saw, Good bye, Rule of Law·. Green Shoots Corner we are there.

neohguyMessage #64 - 07/23/09 11:41 AMI've heard that the Sports Illustrated app swimsuit issue is to be released. I have not seen it yet so I don't know if this would be a green shoot. From Investopedia: [ www.investopedia.com/terms/s/sportsillustratedindicator.asp] www.investopedia.com/terms/s/sportsillustratedindhttp://www.investopedia.com/terms/s/skirtlengththeory.asp The idea behind this theory is that shorter skirts tend to appear in times when general [www.investopedia.com/terms/s/skirtlengththeory.asp#] consumer confidence and excitement is high, meaning the markets are bullish. In contrast, the theory says long skirts are worn more in times of fear and general gloom, indicating that things are bearish. and excitement is high, meaning the markets are bullish. In contrast, the theory says long skirts are worn more in times of fear and general gloom, indicating that things are bearish.

Although some [www.investopedia.com/terms/s/skirtlengththeory.asp#] investors may secretly believe in such a theory, serious analysts and investors - instead of examining skirt length to make investment decisions - insist on focusing on market fundamentals and data.

1939sMessage #65 - 07/23/09 11:55 AMOMG ... M.A.S.H. *** has been lying to us for all those years of re-runs !! Suicide is painless  For the government it surely is as is evident from their actions (or hmmm ... their inactions) but for everyone else  ? Talk about a chicken strutting around with it's head cut off  Come to think of it the "disjoined head" approach has great practical value since it can stay where only customs officials dare to look while the rest of the "body" can get on with business without having to deal with the encumbrance of a brain

Cmdr. CodyMessage #66 - 07/23/09 02:51 PMFord beats expectations The automaker burns through less cash, expects operating profit in 2011. Posted by [boards.msn.com/profile.aspx?userid=2841185&forumid=18] Elizabeth Strott on Thursday, July 23, 2009 8:56 AM Ford Motor ([moneycentral.msn.com/detail/stock_quote?symbol=f] F), the only U.S. automaker not to undergo bankruptcy proceedings, seems to be doing just fine. Ford this morning reported an unexpected second-quarter profit of $2.8 billion, due to accounting gains related to its debt reduction. In March, Ford swapped stock and cash to reduce its loan and bond debt by $7.7 billion. The company has cut its debt by $10.1 billion for 2009. Excluding items, including the debt reduction, Ford said it would have posted an operating loss of $638 million, or 21 cents a share, which was better than the loss of 63 cents per share last year and the consensus estimate of an operating loss of 48 cents per share. Shares of Ford rose 64 cents, or 10%, to $7.02 on the news. "(CEO Alan) Mulally's largely achieved all of the benefits that Chrysler and GM received in bankruptcy without a bankruptcy," John Wolkonowicz, an IHS Global Insight analyst, told Bloomberg News. "He has truly streamlined that company, and it will be competitive with the formerly bankrupt companies." Ford's auto operations burned through $1 billion in the period, which was an improvement from the $3.7 billion it burned through in the first quarter of 2009. Ford said it expects to return to an operating profit in 2011, and it expects to continue gaining market share in both the United States and Europe this year. Through the first half of 2009, Ford accounted for 16.1% of U.S. auto sales, up from 15.5% last year. In June, sales of U.S. vehicles dropped 33% for Ford, which was better than the 40% decline at General Motors and the 46% plunge at Chrysler. For green shoots lovers: Isn't Ford's 2nd quarter a wonderful green shoot? Bottom line is that they had an operating loss of 21 cents a share versus the Street expectation of a 48 cent loss. There are, in fact, many green shoots as most companies reporting earnings are beating Street expectations. Or are Street expectations so low that beating them is a foregone conclusion? As usual, I am confused. Or am I?

DuffminsterMessage #67 - 07/23/09 03:05 PMmlsjapan, I think we have the ingredients of a sit com here. Green shoots corners is the place to be.

Virgil SyonidMessage #68 - 07/23/09 04:17 PMmlsjapan FTW.  Oy. A green shoots day it is. Unemployment didn't rise by quite as many tens of thousands as the 'analysts' had predicted, Ford only posted a modest loss (even provided its two major competitors are now bankrupt), repo homes are selling like hotcakes... and at the price of hotcakes. 3M is making a mint off of 'Swine Flu' masks. And profits in virtually every other Dow component have only dropped by a mere 30-50%--proving that a moving train does need time to fully come to rest.  No jobs, who cares?, Goodbye, market bears·. Green Shoots Corner we are there. [Edit: I should note that the rate of new unemployment didn't increase by untold thousands. But of course the increase in the initial claims rate is the second time derivative of actual unemployment. Hence, we are celebrating the fact that the losses aren't accelerating as quickly as the analysts expected. A few months from now, we'll be cheering the fact that (although job losses continue to accelerate) the rate of increase in the rate of acceleration in the unemployment rate wasn't as high as analysts had predicted. Hence, we pass the 'third derivative' unemployment test and the Dow will break 10,000.]

Cmdr. CodyMessage #69 - 07/23/09 05:03 PMCalculus knowledge is apparently needed to understand the basis of market movement as Virgil has so eloquently described. Off to the Rathskeller!

outoftheworldMessage #70 - 07/23/09 05:17 PMWOW! Profits are flooding Wall Street. HOW? Triggered by Massive Corporate Layoffs and much lower than expected earnings estimates by a consensus of idiots so called experts. WHERE's THE REAL GROWTH? Instead of cutting salaries across the board to maintain employment at ease, they throw out a bunch of employees on the streets. This is the Wall Street you want to invest in? Get ready for the next BULL MARKET CRASH...IT WILL COME UNEXPECTEDLY. Your rotten eggs disguised as green shoots are stinking up WALL STREET.

DuffminsterMessage #71 - 07/23/09 06:35 PMThe Other Plunge Protection Team: 122,017 December SPY $95 Puts To me this looks like another orchestrated breakout based on another round of MOPE with the slight increase in existing home sales being used as the Perceptual pivot catalyst. The false break out appears to be operative in the S&Ps with the euro doing what it is in massive trading blocks in the spider puts... It appears that some entity flushed all the stops of the old yearly highs to get an even better price on puts. Its amazing what you can do with the right inside information. Is this high frequency trading or something else? www.zerohedge.com/article/other-plunge-protection-team-122017-december-spy-95-puts Not much commentary needed. Last night open interest was 28,197. Volume so far: 122,018. 122,000 lots = 12,200,000 shares - at around $95 each - that is a $1,159,000,000 notional trade [www.zerohedge.com/sites/default/files/images/SPY%20Dec%2095%20Puts.jpg]  [www.zerohedge.com/sites/default/files/images/SPY%2095%20Puts%20chart.jpg]

schrizoMessage #72 - 07/23/09 07:18 PMI know there is a lot of pessimism in here. But, these markets are moving on the daily news. Consider that Fords news was not bad today and that they are selling a lot of cars this month and next from the Cash for Clunkers incentives. What does that mean for next quarter?? I think higher prices for their stock. One day at a time now. You may want to be short this market for long term, but given what I have said to be true, you could make some money being in the right place now.

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:06:09 GMT -5

DuffminsterMessage #73 - 07/23/09 07:52 PMThe Cash for Clunkers program is highly inefficient and will just crank up the debt meter even more and relative to any small bump in GDP we get the increased weight of the tax payer burden generated in yet more borrowed money is laughable. Short term gain will cause long term pain. A bump in the economy is not the substance of a real recovery in my opinion. The weight of debt grows more onerous by the minute.

DuffminsterMessage #74 - 07/23/09 11:50 PMWow, this Green Corners Acres song is not easy. In keeping with spirit of trial and error, I'm putting up my rough draft and welcome edits and editions. In the spirit of high hopes and green shoots: Green Shoots Corner is the Place to be, Managed Markets are the trade for me, Corruption spreading out far and wide, Keep Manhattan, just trade the PPT New York is where I'd rather stay, I get the allergic when I have to pay. I just adore a spun financial view. Dah-ling I love you but we're the chosen few. The Fed. In the Red. Fresh Spin. You win. You are my TALF, Good bye toxic debt. Green Shoots Corner, are we there yet?

New Liberals of the purple sageMessage #75 - 07/24/09 12:06 AMI'm putting up my rough draft and welcome edits and editions. perfect just the way it is!

DuffminsterMessage #76 - 07/24/09 12:12 AM[ www.lemetropolecafe.com/Pfv1.cfm?pfvID=7919&SearchParam=adrian%20douglas] THE GREEN SHOOTS OF HYPERINFLATION By Adrian Douglas One of the hardest things to do as an analyst is to keep an open mind. The S&P 500 topped out in October 2007 at about 1565. Since then it has had a series of five dramatic bear market declines and also five quite impressive bear market rallies. It is very easy to develop Pavlov dog response. Over 20 months we have seen the market fall and rise, fall and rise, fall and rise, fall and rise, fall and rise·so what will it do next? If you answered ·fall· you are probably wrong! Until recently I was thinking that the economy is bad and getting so much worse that the stock market MUST continue to fall. It would defy logic for it to do anything else·.or would it? Imagine if the US Government were to announce tomorrow that they are replacing the existing dollar (USD) with a ·New Dollar· (NUSD) where 1 USD= 2 NUSD and if currently the S&P500 is trading at 900 then what would the S&P500 be tomorrow? It would be 1800. So with out any improvement in the economy the stock market would double. Of course with such an announcement spelling out to everyone what was transpiring no one would be fooled into thinking that this was a big bull market move, but merely the result od devaluation. But now consider what happens if instead of making any announcements the government just surreptitiously, over a few months, doubled the money supply. If the usual manipulation of BLS statistics of CPI and PPI continues then this inflation would be masked and the resulting debasement of the dollar would manifest itself, among other things, as at least a doubling of the nominal value of the stock market. Because this is done without many people realizing what is going on the rise in the stock market would be heralded as a turn in economic fortune and the ·green shoots· of recovery when it is really the green shoots of hyperinflation! If you think that people are not that stupid to fall for it then ask yourself how in the presence of the biggest monetary debauchery ever in the United States history the current chatter is whether we can avoid deflation! The most ridiculous argument is that the average American is so tapped out he can·t borrow anymore so the money supply can·t grow. This totally ignores the multi-trillion dollar expenditure of the US government which is multiples of its tax revenue and is being funded by money that is created by the Federal Reserve. The US Government can spend into existence as much money as it desires to create. For the critics who say that M3 is not yet reflecting the monetary debauchery I would remind them that inflation is relatively more money chasing relatively fewer goods and services. So a contraction of things to spend money on with even a static money supply will lead to an increase in the general price level. The economy is contracting so the supply of things to spend money on is contracting. More importantly, though, the massive derivatives market is largely ignored in discussions of inflation. A 600 trillion dollar market can not be ignored in a 60 Trillion dollar global economy! The derivatives market essentially was a tool of the US government to suppress interest rates and commodity prices. It is now contracting rapidly so clearly the opposite effect must happen that interest rates and commodity prices will rise. I will discuss this in detail in an upcoming article. The stock market during the infamous Weimar Republic hyperinflation delivered stellar nominal gains as has the stock market of Zimbabwe in the most recent example of hyperinflation.

Figure 1 Comparison of inverted USDX, Commodity Index (CCI) and S&P500 In figure 1 the USDX is displayed in red. It is on an inverted scale such that when the curve rises the USDX is actually falling and vice versa. The blue curve is the Continuous Commodity Index (CCI) and in green the S&P500. It can be seen that in general the trends in commodities and the S&P500 can be correlated exactly with dollar strength or weakness. The only exception is indicated by the blue

mlsjapan07Message #77 - 07/24/09 12:31 AMVirgil, Duff, Great lyrics!

schrizoMessage #78 - 07/24/09 03:42 AM From Jon Markman "A Barclays Capital study has determined that if the clunker transactions happened at expected rates, which are fairly modest because of restrictions on the type of clunkers that would qualify, they would add to quarterly sales at an annualized rate of up to 1.5 million vehicles. ISI Group ran the numbers and discovered that the last time vehicle production jumped by anything close to that amount, real GDP surged 11.6% in a single three-month span. That was the first quarter of 1971, after an autoworkers strike. Autos make up a smaller share of GDP today, to be sure, but you can see that the scale could be impressive. Adjusting the data, ISI economists believe the cash-for-clunkers program could cause automakers to boost production enough this summer to generate positive GDP growth of 2% and 3% in the second and third quarters." So what I hear you saying Duff is we should pay down our debt rather than creating more of it. The way I see this is the government is going to spend tax dollars to either enrich the wealthy or throw a bone to the little man. That is what's happening here with the CARS program. Same with first time homeowners and the 8k rebate. The common man can afford a newer ,more efficient car with a little help from Uncle Sam. The renter can get into a home and put down roots with a boost from Sam. We have been throwing a lot of tax money into the military and into other pork why not give some to the citizens. Yes there will be a price to pay just as there is when having a war but somehow it gets paid and life goes on. I am trying to see the benefit to moving some important inventory and it is happening. You may argue about what's good for the future and what's most important. Global warming?? Fair trade?? Money backed by gold?? But at the end of the day we only have today and if we give a few cars away maybe that's better than building a bridge to nowhere. I'm just saying that at least these programs lean toward reducing excess inventory which could lead to more production and isn't that what we all want?? People working. I am sure there are better ideas. Lets hear them.

High Net WorthMessage #79 - 07/24/09 05:59 AMA new green shoot. The largest bank failure of 2009 awaits. $1.7 Billion in write-down's for it's Mortgage Backed Securities. galvestondailynews.com/story.lasso?ewcd=fc5c8b06544f473e

neohguyMessage #80 - 07/24/09 11:41 AMschrizo makes some good points in post #78 about auto incentives. Europe has been doing this for quite awhile: www.usatoday.com/money/autos/2009-02-22-european-car-incentives_N.htm European officials go wild with new car incentives for buyers Updated 2/23/2009 10 ....Europe seems to be going quite mad, launching schemes to help," says Nigel Griffiths, chief auto economist in consultant IHS Global Insight's London office. "Very good job; very fast. All done independently in the past six or seven weeks."

IHS says the sweeteners will "put a floor under the European market" some 500,000 car sales higher than without the discounts, for an estimated 11.7 million instead of 11.2 million this year in Western Europe.....

A more recent article: [ uk.reuters.com/article/idUKTRE56E1EA20090715?pageNumber=2&virtualBrandChannel=11595] uk.reuters.com/article/idUKTRE56E1EA2009071RENA.PA) chief executive Carlos Ghosn said last week that 2010 would be as hard as 2009 for the industry, and that the end of scrapping schemes could be difficult.[/Color][/blockquote]

schrizoMessage #81 - 07/24/09 03:05 PMIts not that I am happy with our governments debt spending. In my personal life I have taken on little debt but for a house payment. So I am a conservative with regards to spending more than I have and I think our leaders should do the same. But, as my religious grandma would say,"(on the sabbath) when the ox falls in the pit you have to pull it out." We are trying to pull the ox out of the pit with this spending. Perhaps a better way to get people back to work would be to directly subsidize employment by giving money to companies that increase their job force rather than just keep sending welfare checks to the unemployed individual. Perhaps paying people to pick up all the crap that has been dumped along our rivers and highways would be a start. Surely there has to be better ideas than sending welfare checks to the unemployed so they can feel depressed and unwanted. Lets get them doing something that will keep us "leaning" toward a cleaner, brighter future and at the same time give people a reason to get up in the morning. Depression is more than an economic nightmare, it is a life destroying event easily brought on by a total lack of hope. Lets create some hope.

DuffminsterMessage #82 - 07/24/09 03:34 PMschrizo, So what I hear you saying Duff is we should pay down our debt rather than creating more of it. The way I see this is the government is going to spend tax dollars to either enrich the wealthy or throw a bone to the little man. That is what's happening here with the CARS program. Same with first time homeowners and the 8k rebate. The common man can afford a newer ,more efficient car with a little help from Uncle Sam. The renter can get into a home and put down roots with a boost from Sam. We have been throwing a lot of tax money into the military and into other pork why not give some to the citizens. Yes there will be a price to pay just as there is when having a war but somehow it gets paid and life goes on. I am trying to see the benefit to moving some important inventory and it is happening. You may argue about what's good for the future and what's most important. Global warming?? Fair trade?? Money backed by gold?? But at the end of the day we only have today and if we give a few cars away maybe that's better than building a bridge to nowhere. I'm just saying that at least these programs lean toward reducing excess inventory which could lead to more production and isn't that what we all want?? People working. I am sure there are better ideas. Lets hear them. Stimulus with highest net ROI both in terms of long term ROI to the nation as a whole and job creation needs to be the criteria. Too big too fail is just a front for Fascism. The trillions of dollars used to bail out banks could have been used to make direct loans to business and people but more importantly it could have been used to do some serious infrastructure in terms of long term sustainable energy development rather than the piddling numbers put at it. The US needs much more ambitious goals for energy independence as it has the highest ROI for both the citizens and the business of the nation. While sustainable long term power costs a lot up front to build and implement, if done right, it re-trains millions of workers, and after a period of lets say 15 years, begins to generate nearly free energy after the initial capital costs are paid down. As the cost of energy approaches zero, productivity approaches infinity and thus it is possible for there to be prosperity for the masses, enabling a very stable society, markets a win/win for everyone on Earth, including the environment and the other creatures that live here. What the US policy makers lack is long term strategic vision and political will. The latter is partially because of the many layers of illness within the political system. So perhaps the biggest area in which reform is needed remains in campaign finance and ensuring there is a paper trail for voting.

outoftheworldMessage #83 - 07/24/09 04:19 PMA great product sells itself with minimal advertising. Is Wall Street DESPERATELY BEGGING people to invest in stocks? SUMMER RALLY their CRYING, SUMMER RALLY. WALL STREET IS NOT GIVING UP THEIR BOGUS ADVERTISING which HAS NO FOUNDATION. MOST ARE A BUNCH OF DUMB DOGS OUT TO STEAL YOUR VERY LAST BONE.

Virgil SyonidMessage #84 - 07/24/09 04:23 PMPerhaps paying people to pick up all the crap that has been dumped along our rivers and highways would be a start. Surely there has to be better ideas than sending welfare checks to the unemployed so they can feel depressed and unwanted. This was the mentality through most of history, even back to biblical times. Alas, a hue and cry arose from the social engineers, who claimed it was inhumane. What about the addicted? What about the chronically unemployable? Or those with serious physical impediments? What if the unemployed in one area happened to all be of a particular race or visible minority? Then such work would not only be 'humiliating', it would be 'racist'. 'No', they clucked, shaking their sage heads, 'our society has progressed far beyond these barbaric practices.' Better to hand out cheques free of conditions, avoiding the slightest risk of transgressing the most sacrosanct virtue of all: political correctness. " Much of the social history of the Western world over the past three decades has involved replacing what worked with what sounded good. In area after area - crime, education, housing, race relations - the situation has gotten worse after the bright new theories were put into operation. The amazing thing is that this history of failure and disaster has neither discouraged the social engineers nor discredited them." - Thomas Sowell

|

|

Virgil Showlion

Distinguished Associate

Moderator

[b]leones potest resistere[/b]

Joined: Dec 20, 2010 15:19:33 GMT -5

Posts: 27,448

|

Post by Virgil Showlion on Dec 24, 2010 6:07:02 GMT -5

ASKMessage #86 - 07/24/09 05:11 PMGreen shoots corner is the place to be  Our balance sheets you do not need to see Tax dollars coming in from far and wide For wall street bonuses and not the countryside New York is where our dollars stay In the markets is where you need to play Don't worry about the American dream Just keep contributing to our ponzi scheme AAA No way We're broke No joke Here comes the recovery It's just for banksters Not for you and me